Chapter 9 The Influence of Monetary and Fiscal Policy on Aggregate Demand

LEARNING OBJECTIVES学习目标:

understand the concept of liquidity preference theory

explain the interest-rate effect by using liquidity preference theory

identify the AD shifts caused by monetary changes in iquidity preference theory

FOCUS AND DIFFICULTIES知识重难点:

Focus: The Theory of Liquidity Preference, how the interest rate adjusts to balance MS and MD, reexplain the interest rate effect by using the new theory

Difficulty: explain the effects of monetary changes on AD curve by using the liquidity preference theory, understand the application of the target interest rate in Fed policy

LECTURE VIDEO学习视频:

LEARNING OUTLINE学习大纲:

1. Aggregate Demand

The aggregate-demand curve is downward sloping for three reasons: The wealth effect, The interest-rate effect, The exchange-rate effect.

All three effects occur simultaneously, but are not of equal importance.

Because a household’s money holdings are a small part of total wealth, the wealth effect is relatively small.

Because imports and exports are a small fraction of U.S. GDP, the exchange-rate effect is also fairly small for the U.S. economy.

Thus, the most important reason for the downward-sloping aggregate-demand curve is the interest-rate effect.

2. The Theory of Liquidity Preference

In his classic book “The General Theory of Employment, Interest, and Money”, John Maynard Keynes proposed the Theory of Liquidity Preference to explain the determinants of an economy’s interest rate.

According to the Theory of Liquidity Preference, the interest rate adjusts to balance supply and demand for money.

In this theory, the interest rate refers to both the nominal interest rate and real interest rate, since the expected inflation is assumed to be constant.

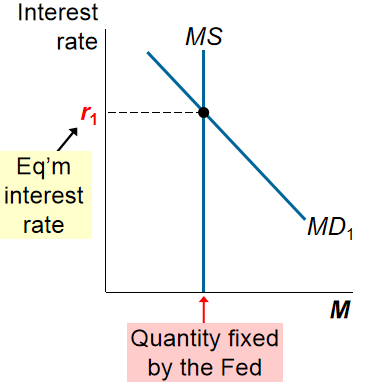

The money supply(MS) in the economy is assumed to be fixed by the central bank. Because the Fed can control the size of the money supply directly, the quantity of money supplied does not depend on any other economic variables, including the interest rate.

Money demand(MD) reflects how much wealth people want to hold in liquid form.

And, the quantity of money people demand depends on some variables, like real income, interest rate, and the price level.

All else being equal, as real income rises, people demand more money to buy more goods and services.

All else being equal, as the price level rise, the value of money declines, so people demand more money to buy a representative basket of goods and services.

People choose to hold money instead of other assets that offer higher return because money can be used to buy goods and services.

Money is the most liquid asset since money is the economy's medium of exchange.

For instance, Money is liquid but pays no interest while Bonds – pay interest but not as liquid.

So, the return on other assets (the interest rate) is the opportunity cost of holding money.

All else being equal, as the interest rate rises, namely the opportunity cost of holding money increases, the quantity of money demanded will fall.

Conversely, as the interest rate falls, the opportunity cost of holding money decreases, so the quantity of money demanded will rise.

Equilibrium In the Money Market

MS curve is vertical because the money supply dosen't depend on the interest rate.

MD curve is downward sloping because the quantity of money demanded increases as the interest rate falls.

As shown in the graph, there is the equilibrium interest rate where the quantity of money demanded and supplied are equal.

For example, if the interest rate is higher than the equilibrium interest rate, the quantity of money that people want to hold is less than the quantity that the central bank has supplied. Thus, people will try to get rid of the excess money supply by buying bonds or depositing in an interest-bearing bank account. This increases the funds available for lending, pushing interest rates down until back the equilibrium level.

Coversely, if the interest rate is lower than the equilibrium interest rate, the quantity of money that people want to hold is greater than the quantity that the Fed has supplied. Thus, people will try to acquire the additional money by selling bonds or withdrawing funds from a bank account. This decreases the funds available for lending, pulling interest rates up until back the equilibrium level.

Thus, the interest rate adjusts to bring money demand and money supply into balance.

3. How the Interest-Rate Effect Works

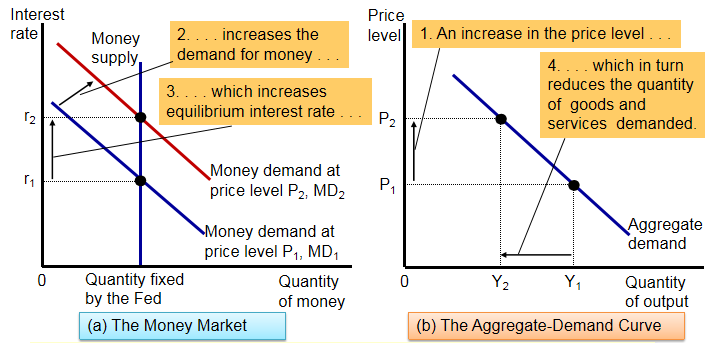

(1) When the price level increases, the quantity of money that people need to hold becomes larger.

(2) Thus, an increase in the price level leads to an increase in the demand for money, shifting the money demand curve to the right.

(3) For a fixed money supply, the interest rate must rise to balance the supply and demand for money.

(4) At a higher interest rate, the cost of borrowing and the return on saving both increases. Thus, consumers will choose to spend less and will be less likely to invest in new housing and firms will be less likely to borrow funds for new equipment or structures. In short, the investment spending and the quantity of goods and services purchased in the economy will fall.

This implies that as the price level increases, the interest rate rises and the quantity of goods and services demanded falls. This is Keynes’s interest-rate effect.

4. Monetary Policy Influences AD

A Monetary Injection and Aggregate Demand

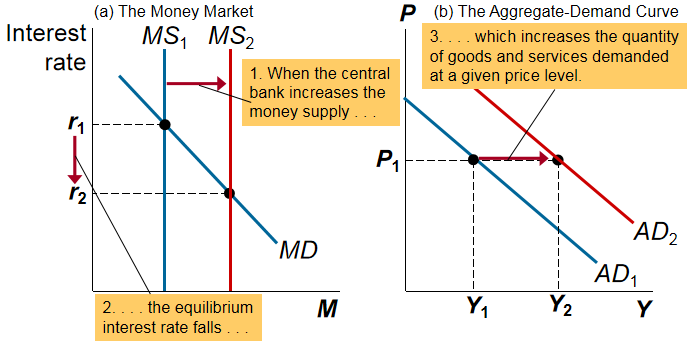

(1) If the central bank increases the supply of money, shifting the money supply curve to the right.

(2) The equilibrium interest rate will fall.

(3) The lower interest rate reduces the cost of borrowing and the return to saving. This encourages households to increase their consumption and desire to invest in new housing. Firms will also increase investment, building new factories and purchasing new equipment.

The quantity of goods and services demanded will rise at every price level, shifting the aggregate-demand curve to the right.

Thus, a monetary injection by the Fed increases the money supply, leading to a lower interest rate, and a larger quantity of goods and services demanded.

The Effects of Reducing the Money Supply

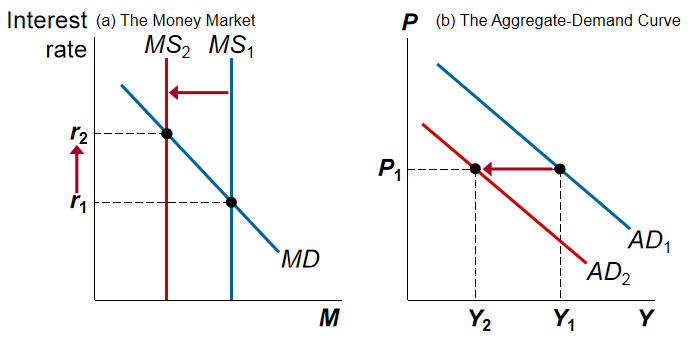

If the central bank reduces the money supply, shifting the MS curve to the left. The equilibrium interest rate rises, which indicates the cost of borrowing and the return to saving both increases.

So, households consume less and purchase fewer housing. Firms borrow less to finance their investment of capital goods.

As a result, the quantity of goods and services demanded at any given price level will decrease, shifting the AD curve to the left.

To conclude:

Expansionary Monetary Policy increases the money supply and lowers the interest rate. So, it increases the aggregate demand and shifts AD curve to the right.

Contractionary Monetary Policy decreases the money supply and raises the interest rate. So, it decreases the aggregate demand and shifts AD curve to the left.

5. The Role of Interest-Rate Targets in Fed Policy

In recent years, the Fed has conducted policy by setting a target for the federal funds rate (the interest rate that banks charge one another for short-term loans).

The target is reevaluated every six weeks when the Federal Open Market Committee meets.

The Fed has chosen to use this interest rate as a target in part because the money supply is difficult to measure with sufficient precision.

The theory of liquidity preference illustrates an important principle: Monetary policy can be described either in terms of the money supply or interest rate.

So, the use of interest-rate targets in Fed policy doesn't change our analysis of monetary policy.

In other words, when the Fed sets a target for the interest rate, it commits itself to changing the money supply to make the equilibrium in the money market hit that target.

For instance, When the Fed raises the target for the federal funds rate, the bond traders sell government bonds and this sale decreases the money supply and raises the equilibrium interest rate until hit the target. Similarly, when the Fed lowers the target, the bond traders buy government bonds and this puchase increases the money supply and reduces the equilibrium interest rate until hit the target.

So, lowering the target for the federal funds rate also is considered a way of expansionary monetary policy to stimulate the economic growth while raising the target is considered a way of contractionary monetary policy to chill down the economic growth.

6. Liquidity traps

As we have just seen, monetary policy works through interest rates. And, the Fed can lower the target interest rate to stimulate consumption, investment, so as to promote economic growth.

In the recession of 2008 and 2009, the federal funds rate fell to about zero.

Some economists describe this situation as a liquidity trap.

In a liquidity trap, interest rates have already fallen almost to zero, and since nominal interest rates cannot fall below zero, then expansionary monetary policy is no longer effective.

And, households and firms become extremely pessimistic about the economic propects, thus reducing consumption and investment sharply.

The nation's economy was in a severe depression with a low aggregate demand and high unemployment.

While, other economists argue that even in a liquidity trap, central banks still have additional tools to expand the economy.

In particular, the central bank could raise inflation expectations to make real interst rates negative, which would stimulate investment spending.

And, the Fed could also use other financial instruments in open market operations. For example, it could by mortgages and corporate debt and thereby lower the interest rates on these kinds of loans, just like what the Fed did during the recession of 2008 and 2009.

7. Interest Rates in the Long Run and the Short Run

In an earlier chapter, we said that the interest rate adjusts to balance the supply and demand for loanable funds.

In this chapter, we proposed that the interest rate adjusts to balance the supply and demand for money.

To understand how these two statements can both be true, we must discuss the difference between the short run and the long run.

In the long run, the economy’s level of output, the interest rate, and the price level are determined by the following manner:

a. Output is determined by the levels of resources and technology available.

b. For any given level of output, the interest rate adjusts to balance the supply and demand for loanable funds.

c. Given output and the interest rate, the price level adjusts to balance the supply and demand for money. Changes in the supply of money lead to proportionate changes in the price level.

In the short run, the economy’s level of output, the interest rate, and the price level are determined by the following manner:

a. The price level is stuck at some level (based on previously formed expectations) and is unresponsive to changes in economic conditions.

b. For any given price level, the interest rate adjusts to balance the supply and demand for money.

c. The interest rate that balances the money market influences the quantity of goods and services demanded and thus the level of output.

The two different theories of the interest rate are useful for different purposes.

When considering long-run determinants of interest rates, it is best to keep in mind the loanable funds theory which relates an economy's saving and investment.

When considering short-run determinants of interest rates, it is best to keep in mind the theory of liquidity preference which address the equilibrium in money market.