Chapter 7 Money Growth and Inflation

LEARNING OBJECTIVES学习目标:

understand the velocity of money and quantity equation

explain how the money suppy growth determines inflation rate and nominal interest rate

examine the costs of inflation

FOCUS AND DIFFICULTIES知识重难点:

Focus: quantity equation, fisher effect

Difficulty: costs of inflation, after-tax real interest rate, distribution wealth bewteen debotrs and creditors

LECTURE VIDEO学习视频:

LEARNING OUTLINE学习大纲:

1. Velocity and the Quantity Equation

Definition of velocity of money: the rate at which money changes hands.

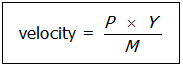

To calculate velocity, we divide nominal GDP by the quantity of money.

Velocity=nominal GDP/money supply

If P is the price level (the GDP deflator), Y is real GDP, and M is the quantity of money:

, Velocity can be understood as the number of transactions in which the average dollar is used.

, Velocity can be understood as the number of transactions in which the average dollar is used.

Rearranging, we get the quantity equation: MV=PY

Definition of quantity equation: the equation M × V = P × Y, which relates the quantity of money, the velocity of money, and the dollar value of the economy’s output of goods and services.

The quantity theory of money assumes the velocity is constant over time.

We can now explain how an increase in the quantity of money affects the price level using the quantity equation.

a. The velocity of money is relatively stable over time.

b. When the central bank changes the quantity of money (M ), it will proportionately change the nominal value of output (P × Y ).

c. The economy’s output of goods and services (Y ) is determined primarily by available resources and technology. Because money is neutral, changes in the money supply do not affect output.

d. This must mean that P increases proportionately with the change in M.

e. Thus, when the central bank increases the money supply growth rate, the result is a higher rate of inflation.

Conclusion:

The quantity of money available in the economy determines (the value of money) the price level.

Growth rate in money supply available determines the inflation rate.

2. Hyperinflation is generally defined as inflation that exceeds 50% per month.

Almost all hyperinflations follow the same pattern.

The government has a high level of spending and inadequate tax revenue to pay for its spending.

The government’s ability to borrow funds is limited.

As a result, it turns to printing money to pay for its spending.

The large increases in the money supply lead to large amounts of inflation.

The hyperinflation ends when the government cuts its spending and eliminates the need to create new money.

In addition to collect taxes and borrow by selling bonds, the government can pay for spending simply by printing the money it needs.

Printing money causes inflation which makes each dollar less valuable and the purchasing power decreases, the real income decreases, it seems like another tax on people who holds money.

Definition of inflation tax: the revenue the government raises by creating money.

3. The Fisher Effect

Recall that the real interest rate is equal to the nominal interest rate minus the inflation rate.

This, of course, means that: nominal interest rate=real interest rate-inflation rate.

The supply and demand for loanable funds determines the real interest rate.

Growth in the money supply determines the inflation rate.

In the long run, money is neutral, so a change in the money growth rate affects the inflation rate but not the real interest rate.

When the Fed increases the rate of growth of the money supply, in the long run, the inflation rate increases while real interest rate is unchanged.

This in turn will lead to an increase in the nominal interest rate.

In particular, nominal interest rate must adjust one for one to changes in the inflation rate, called Fisher effect.

To conclude, Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate would increase the inflation rate and the nominal interest rate by the same percentage.

Keep in mind that the analysis of the fisher effect holds in the long run but not need hold in the short run.

ACTIVE LEARNING:

Watching the following video to know more about the monetary system.

10-minute Crash Cource: the cause of Inflation