Chapter 7 Money Growth and Inflation

LEARNING OBJECTIVES学习目标:

understand the relation between the price level and the value of money

explain how an increase in money supply influence the price level and the value of money by a money supply-demand diagram

examine nominal variables and real variables as well as the monetary neutrality

FOCUS AND DIFFICULTIES知识重难点:

Focus: the value of money, money supply and money demand,

Difficulty: Classical Dichotomy and monetary neutrality, diagram analysis of monetary injection's effect on the price level

LECTURE VIDEO学习视频:

LEARNING OUTLINE学习大纲:

1. The Level of Prices and the Value of Money

When the price level rises, people have to pay more for the goods and services that they purchase.

A rise in the price level also means that the value of money is now lower because each dollar now buys a smaller quantity of goods and services.

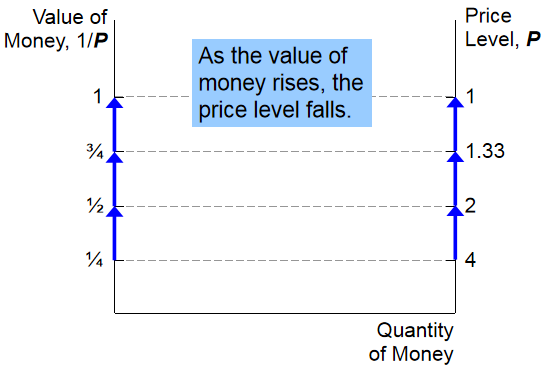

If P is the price level, then the quantity of goods and services that can be purchased with $1 is equal to 1/P, known as the value of money.

Suppose you live in a country with one good (ice cream cones).

When the price of an ice cream cone is $2, the value of a dollar is 1/2 cone.

When the price of an ice cream cone rises to $3, the value of a dollar is 1/3 cone.

Thus, inflation drives up prices, and drives down the value of money.

2. Quantity Theory of Money

Quantity Theory of Money is often called classical because it was developed by some of the earliest economic thinkers. Most economists today rely on this theory to explain the long-run determinants of the price level and the inflation rate.

Quantity theory of money is developed by 18th century philosopher David Hume, and advocated more recently by Nobel Prize Laureate Milton Friedman.

It states that the quantity of money determines the price level , the value of money and concludes that the money growth causes the inflation in the long run.

(1) Money Supply, Money Demand, and Monetary Equilibrium

The value of money is determined by the supply and demand for money.

For the most part, the supply of money is determined by the Fed.

This implies that the quantity of money supplied is fixed (until the Fed decides to change it).

Thus, the supply of money will be vertical (perfectly inelastic).

The demand for money reflects how much wealth people want to hold in liquid form.

Under what circumstances you would hold more money rather than bonds, stocks? Assume your real income unchanged.

Since real income determines the quantity of g&s people demand, people's shopping lists are unchanged. While, the price level (P) determines how many dollars will be needed to buy this quantity of g&s.

When the prices of goods and services rise, people need hold more money than before in order to pay for the shopping lists of goods and services.

When the return on bonds declines or there is a stock market crash, people will hold less financial securities and be incentive to hold more money in wallets.

Hence, a higher price level (and a lower value of money) leads to a higher quantity of money demanded.

(2) The Money Supply-Demand Diagram

The left vertical axis shows the value of money and the right vertical axis shows the price level. Notice that, a low price level is near the top and a high price level is near the bottom. It indicates that as the value of money rises, the price level falls.

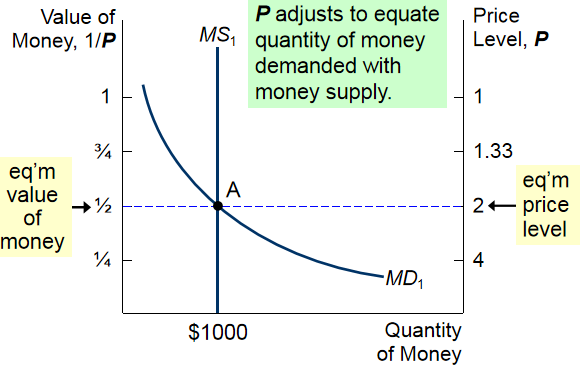

Since the Fed fixed the money supply, the MS curve is vertical regardless of the price level (P).

When the value of money declines (the price level rises), people will demand greater quantities of money. Thus, the MD curve is downward sloping.

MS and MD curves intersect at the equilibrium, where the quantity of money demanded equals the quantity of money supplied. And the equilibrium determines the value of money and the price level.

In the long run, the overall price level adjusts to the level at which the demand for money equals the supply of money.

a. If the price level is above the equilibrium level, people will want to hold more money than is available and prices will have to decline.

b. If the price level is below equilibrium, people will want to hold less money than that available and the price level will rise.

(3) The Effects of a Monetary Injection

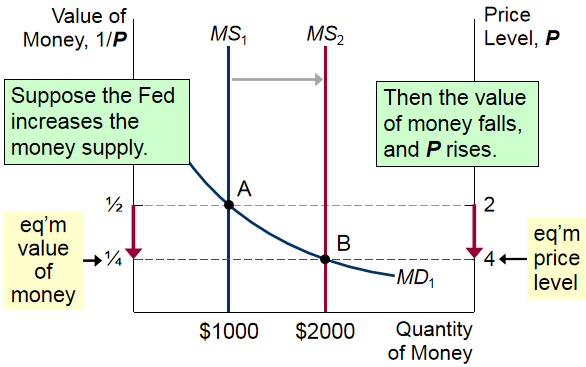

Assume that the economy starts with an equilibrium and now the Fed suddenly increases the supply of money.

The money supply curve shifts rightward from MS1 to MS2. The equilibrium moves from point A to point B. At new equilibrium B, the value of money decreases, while the price level rises.

Therefore, when an increase in money supply makes dollars more plentiful, the result is an increases in the price level that makes each dollar less valuable.

A Brief Look at the Adjustment Process

The immediate effect of an increase in the money supply is to create an excess supply of money.

People try to get rid of this excess supply in a variety of ways.

They may buy goods and services with the excess funds.

They may use these excess funds to make loans to others by buying bonds or depositing the money in a bank account. These loans will then be used to buy goods and services.

In either case, the increase in the money supply leads to an increase in the demand for goods and services.

Because the supply of goods and services has not changed, the result of an increase in the demand for goods and services will be higher prices.

3. The Classical Dichotomy and Monetary Neutrality

In the 18th century, David Hume and other economists wrote about the relationship between monetary changes and important macroeconomic variables such as production, employment, real wages, and real interest rates.

They suggested that economic variables should be divided into two groups: nominal variables and real variables.

Definition of nominal variables: variables measured in monetary units. (e.g., nominal GDP, dollar prices, nominal interest rate, nominal wage)

Definition of real variables: variables measured in physical units. (like real GDP, relative prices, real interest rate that is the rate at which the purchasing power of the deposit grows, and real wage that means the quantity of output workers can buy with their wage. )

Definition of classical dichotomy: the theoretical separation of nominal and real variables.

Prices in the economy are nominal (because they are quoted in units of money), but relative prices are real (because they are not measured in money terms).

Classical analysis suggested that different forces influence real and nominal variables. Changes in the money supply affect nominal variables but not real variables.

Definition of monetary neutrality: the proposition that changes in the money supply do not affect real variables.