Chapter 6 The Monetary System

LECTURE VIDEO学习视频7:

Banks and Money Supply

Recall that Money supply is the quantity of money available in the economy, and consists of currency and deposits held by the nonbank public. (MS=C+D)

Since deposits are held in banks, the behavior of banks can influence the quantity of deposits in the economy and thereby the money supply.

CASE 1: No banking system

Example: Suppose that currency is the only form of money and the total amount of currency is $100.

Public holds the $100 as currency. Hence, MS=C+D=100+0=$100

CASE 2: 100% reserve banking system (r=100%)

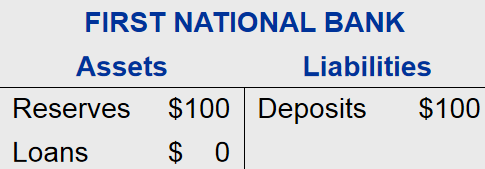

Now suppse that a bank called first national bank opens in the economy. Then, the public deposits the $100 at this bank.

Since the reserve ratio is 100%, the first national bank holds 100% of deposit as reserves thereby no loans made.

In this case, money supply =C+D=0+100=$100.

The money supply in this economy is unchanged by the creation of a bank.

Before the bank was created, the money supply consisted of $100 worth of currency.

Now, with the bank, the money supply consists of $100 worth of deposits.

This means that , if banks hold all deposits in reserves, banks do not influence the money supply.

CASE 3: Fractional reserve banking system

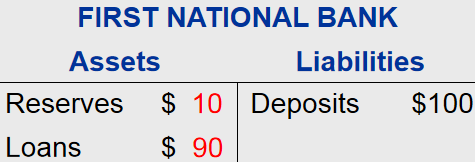

Suppose r=10% for all banks, and the public holds no currency.

After the public deposits $100 at the first national bank, the first national bank keeps 10% of deposits in reserves and loans 90% of deposit out.

Up to now, you will see that depositors still have $100 in deposits, while borrowers have $90 in currency. Therefore, so far, the money supply =C+D=$90 +$100=$190.

Before the bank made any loans, the money supply was equal to the $100 worth of deposits in case 2: 100% reserve banking system.

Now, after the loans, deposits are still equal to $100, but borrowers now also hold $90 worth of currency from the loans.

Thus, when banks hold only a fraction of deposits in reserve and loans out the remainder of deposits, banks create money.

However, loans from banks give the borrowers currency, and it also creates a corresponding laibility for those borrowers.

Thus, the money creation resulting from the loan-making creates new money and provides more liquidity(medium of exchange) in the economy, but the economy doesn't become weathier than before.

The creation of money doesn't stop with first national bank.

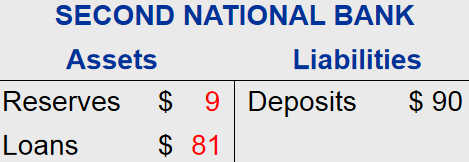

Suppose thant the borrower from first national bank uses the $90 to buy something from someone who then redeposits the $90 in second national bank.

At the second bank, deposit $90, keep 10% in reserves that is $9, loans 90% out that is $81.

The borrower from second bank uses $81 to buy things from someone who then deposits the $81 in third bank.

At the third bank, deposit $81, keep 10% in reserves that is $8.1, loans 90% out that is $72.9.

The borrower from third bank uses $72.9 to buy things from someone who then deposits the $72.9 in fourth bank,

At the fourth bank, deposit $72.9, 10% of deposits in reserves that is $7.29, loans 90% of deposit that is $65.61.

This process can continue forever. In theory, the process can continue for a long time until deposits are fractionally very small.

Each time that money is deposited and a bank loan is made, more money(derivative deposits) is created.

The total of deposits in the banking system is the sum of one geometric infinite sequence of numbers, and it approximately equals to $1000.

Assume that the public holds no currency, the money supply increased from $100 to $1000 after the establishment of 10% fractional reserve banking system.

Notice that if the commercial banks gain deposits of $100 and this leads to a final money supply of $1000, the money multiplier is 10.

Money multiplier refers to the amount of money the banking system generates with each dollar of initial deposit. The money multiplier(MM) equals 1/r.

The higher the reserve ratio, the less of each deposits banks loan out, the smaller the money multiplier, and the smaller the amount of money banks create.

The amount of money banks create depend on the reserve ratio (r).