Chapter 4 Saving, Investment and Financial System

LECTURE VIDEO学习视频4:

LEARNING OUTLINE学习大纲:

1. The Market for Loanable Funds

Loanable funds refer to the total income that people decide to save and lend out, and to the amount that investors decide to borrow to finance new investments.

All savers deposit their saving in this market. All borrowers take out loans from this market.

In the market for loanable funds, The price of a loan is the interest rate, which is both the return to saving and the cost of borrowing.

The supply of loanable funds comes from saving.

Households with residual income because they spend less than they earn, namely savers, want to save and lend it out to earn interest.

Besides, public saving (T-G), if positive, adds to national saving and the supply of loanable funds; If negative, it reduces national saving and the supply of loanable funds.

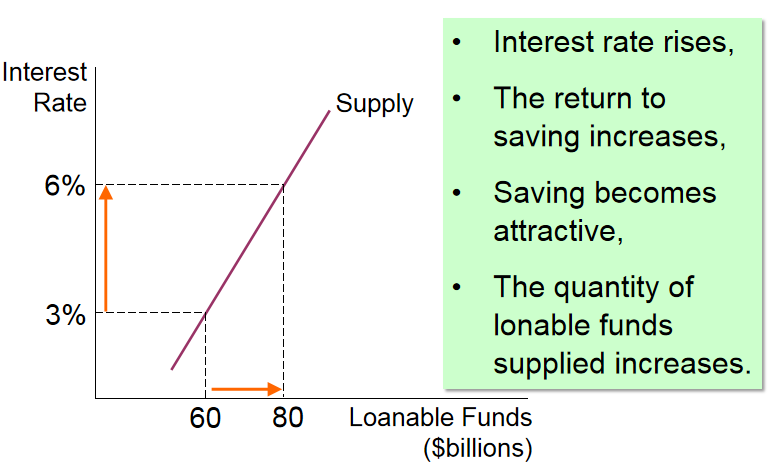

The Slope of the Supply Curve:

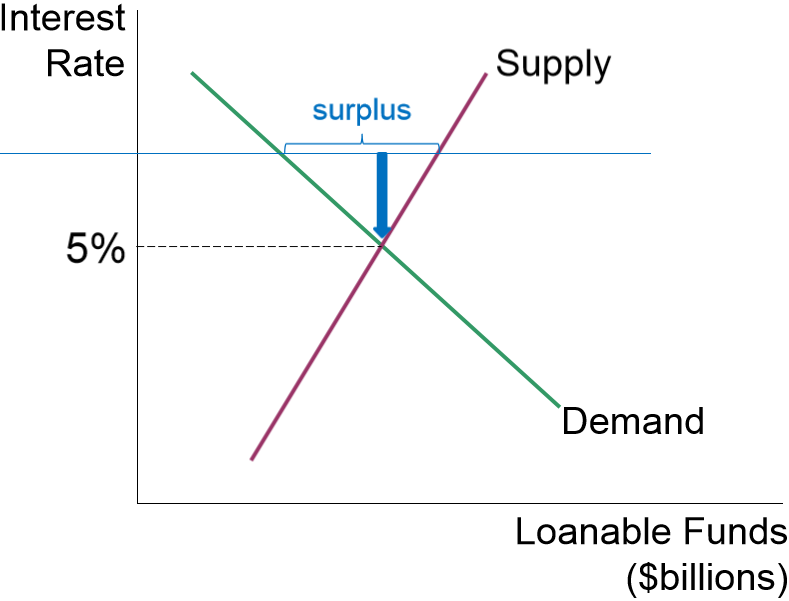

The supply curve of loanable funds is upward sloping. It indicates that as interest rate rises, the quantity of loanable funds supplied increases.

For the savers, the interest rate represents the return on their saving. A higher interest rate means an increase on the return to saving, which makes saving more attractive. Therefore, people are willing to supply a larger quantities of loanable funds in the market.

The demand for loanable funds comes from Investment (Borrowing):

Firms borrow the funds they need to pay for new equipment, factories, etc.

Households borrow the funds they need to purchase new houses.

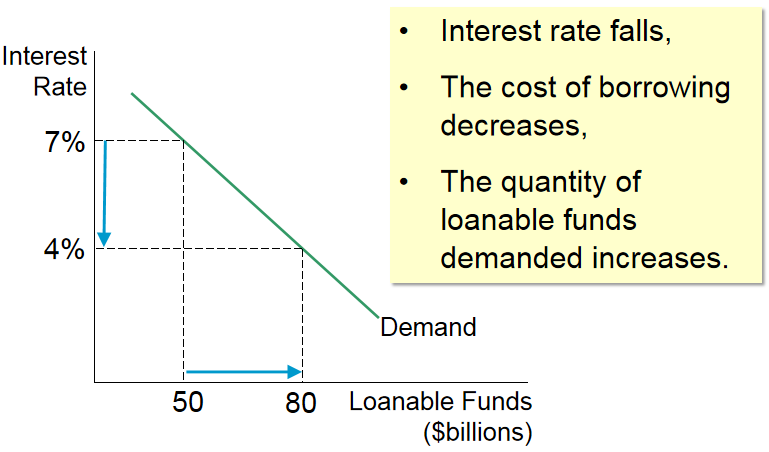

The Slope of the Demand Curve:

The demand curve for loanable funds is downward sloping. It means that as interest rate decreases, the quantity of loanable funds demanded increases.

For borrowers, the interest rate represents the cost of borrowing. A lower interest rate means the cost of borrowing decreases, which encourage borrowers to borrow more. Therefore, the quantity of loanable funds increases when the interest rate declines.

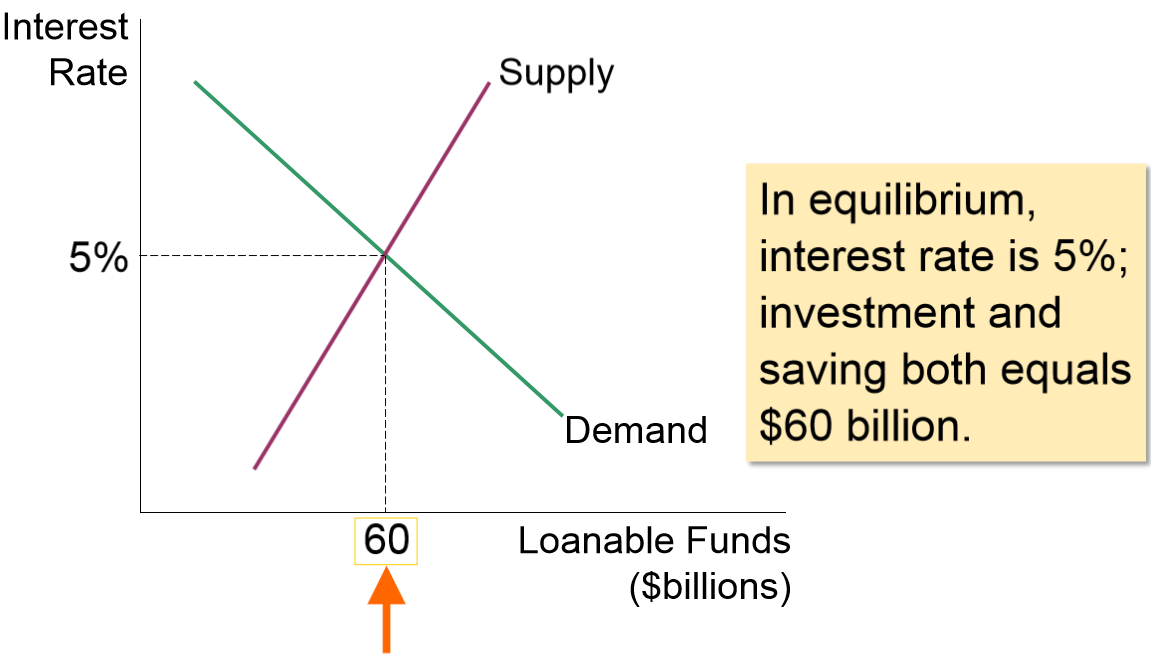

Equilibrium:

The supply of loanable funds comes from national saving including both private saving and public saving. The demand for loanable funds comes from firms and households that want to borrow for purposes of investment.

In the equilibrium shown, the interest rate is 5%, and the quantity demanded and the quantity supplied both equals $60 billion. Therefore, when the interest rate arrives at the equilibrium level, savings equals investment.

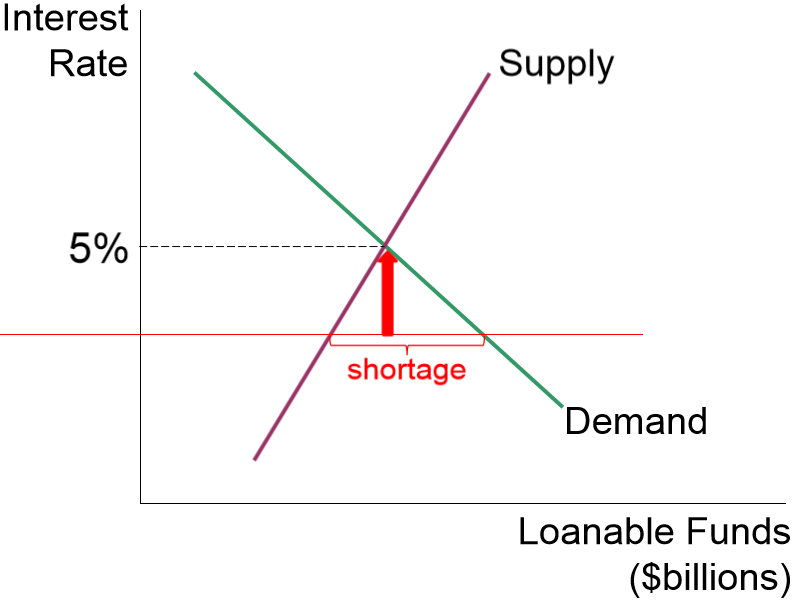

(1) If the interest rate were lower than the equilibrium level, the quantity of funds demanded would be greater than the quantity of funds supplied. The shortage of loanable funds would encourage lenders to raise the interest rate they charge. The rise in the interest rate would make borrowing more costly, and thus would reduce the demand for funds. The rise in the interest rate would also encourage households to save more, which would increase the supply of funds. This process would occur until equilibrium was achieved.

(2) If the interest rate were higher than equilibrium, there would be a surplus of funds. Lenders would compete for borrowers, driving the interest rate down until restore equilibrium.

Therefore, it is the interest rate in the economy that adjusts to balance the supply and demand for loanable funds. In other words, it coordinates the behavior of savers and the behavior of investors.

PRACTICE 习题4: