Chapter 2 MEASURING THE COST OF LIVING

LECTURE VIDEO 学习视频2:

LEARNING OUTLINE学习大纲:

1. Definition of consumer price index (CPI): a measure of the overall cost of the goods and services bought by a typical consumer

2. How the Consumer Price Index Is Calculated

1) Fix the basket.

a) The Bureau of Labor Statistics uses surveys to determine a representative bundle of goods and services purchased by a typical consumer.

b) Example: 4 hot dogs and 2 hamburgers.

2) Find the prices.

a) Prices for each of the goods and services in the basket must be determined for each time period.

b) Example:

Year | Price of Hot Dogs | Price of Hamburgers |

2010 | $1 | $2 |

2011 | $2 | $3 |

2012 | $3 | $4 |

3) Compute the basket's cost.

a) By keeping the basket the same, only prices are being allowed to change. This allows us to isolate the effects of price changes over time.

b) Example:

Cost in 2010 = ($1 × 4) + ($2 × 2) = $8.

Cost in 2011 = ($2 × 4) + ($3 × 2) = $14.

Cost in 2012 = ($3 × 4) + ($4 × 2) = $20.

4) Choose a base year and compute the index.

a) The base year is the benchmark against which other years are compared.

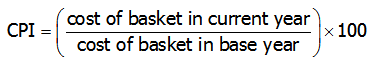

b) The formula for calculating the price index is:

c) Example (using 2010 as the base year):

CPI for 2010 = ($8)/($8) × 100 = 100.

CPI for 2011 = ($14)/($8) × 100 = 175.

CPI for 2012 = ($20)/($8) × 100 = 250.

5) Compute the inflation rate.

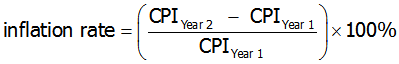

a) Definition of inflation rate: the percentage change in the price index from the preceding period.

b) The formula used to calculate the inflation rate is:

c) Example:

Inflation Rate for 2011 = (175 – 100)/100 × 100% = 75%.

Inflation Rate for 2012 = (250 – 175)/175 × 100% = 43%.

PRACTICE 习题2: