Venture Financing Channels

Before starting a new business, entrepreneurs seek different resources. Funding is the most important one. Here we discuss how to generate funds to your startups.

Bank loans: Most commonly used sources of financing businesses. Bank offers various kinds of loans depending upon your business and startup.

Credit loan: Referstoloans issued by banks solely on the basis of trust in the creditworthiness of the borrower, and the borrower does not need to provide collateral to the bank.

Secured loan: Referstoloans issued with the guarantor's credit as a guarantee.

Discount loan: Referstothe loan method in which the borrower applies for discount to the bank with undue bills to finance funds when the borrower is in urgent need of funds.

Partnerfinancing: Partnership entrepreneurship not only raise funds effectively but also give full effort to the utilization and integration of various resources. This kind of financing opportunity reduces entrepreneurial risks.

Private capital: Money comes from individuals or groups of individuals that are not regulated by public exchange or government. The investment operation procedures of private capital are relatively simple, the financing speed is fast.

Business

incubators: Focus on high-tech sectors and

provide support for new business in various stages of development. The support

maybe in the form of financial or other administrative, logistic and technical

resources.

Internet financing: Internet funding platforms allow businesses to pool small investments from several investors instead of single investment sources. Crowdfunding is the best example of internet financing. If you fail to find venture capital funding or angel investor you can have this choice

Personal investment: You are the first investor when starting a business You can use your money or personal assets.

Family and friends: Youcan get money from your family, spouse, or friends. You can return to them after your business starts making profits

Venture Capital Financing

Venture capitalists are an outside group that takes ownership of the company in exchange for capital. The percentage of ownership to capital is negotiable and usually depends on the company’s valuation.

A high-risk and high-return investment, venture capitalists invest in startups in the form of equity participation. Venture capital favors high-tech startups.

The benefits of VCare not only financial.VC also helps you to create connections in the industry and acquire knowledge to direct your business.

Venture Capitalists expect a healthy return on their investment and always looking for technology-driven high growth potential startups.

Venture Capital Process

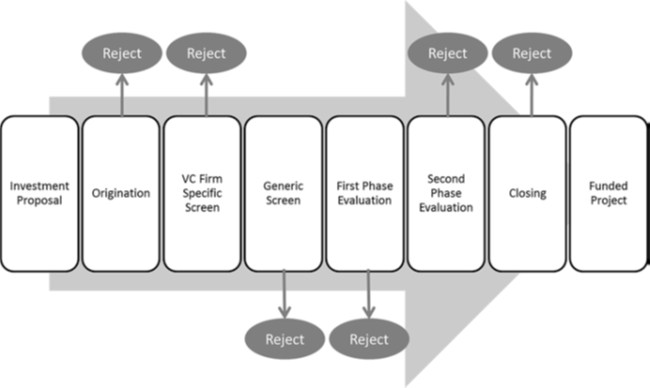

The process of venture capital financing can be categorized in several distinct stages. The dealing process of VC firms with an investment takes at least eight stages.

The venture capital process. (Source: Fried and Hisrich 1994)

Term Sheet

The term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. Once parties are agreed to invest in a startup the detailed term sheet is drawn up.

Term sheets are most often associated with startups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

All term sheets contain information on the assets, the initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information.

The essential element of structuring the venture capital deal is a “ term sheet”. The contents of term sheets can vary according to different types of deals. Main contents are:

Offering terms

Charter of shareholder rights

Stock purchase agreement

Investor rights agreement

Right of first refusal/co-sale agreement and voting agreement

Drag along with provisions

Other matters

Confidentiality and expiration

example of the term sheet

Venture capital funding – case Study SKYPE

Skype was started in 2002 as a VOIP service provider.

Founders -Nikolas Zennstrom and James Friss

2002: Angel round

$2M Investment

3 angels+ Tom Draper

Draper Investment Inc. (VC)

2004: VC round

$18M investment

Draper Fisher Jurvetson

Bessermer Venture Partners

Index Ventures

Mangrove Capital Partner

2006:

Sold to eBay for a whopping $2.6 Bn

Earliest investors saw huge return 350times of $2M

VC’s return 40 times on their investment of $18M