-

1.1出版说明

-

1.2前 言

-

1.3第一章 翻译的基础知识

-

1.3.1第一节 中外翻译简史

-

1.3.2第二节 翻译的概念与分类

-

1.3.3第三节 翻译的标准

-

1.3.4第四节 商务英语的翻译

-

1.3.5思考题

-

1.4第二章 商务英语翻译方法和技巧

-

1.4.1第一节 选词法

-

1.4.2第二节 增词法与减词法

-

1.4.3第三节 词类转换

-

1.4.4第四节 正说反译,反说正译法

-

1.4.5第五节 分译法与合译法

-

1.4.6第六节 数字和倍数的翻译

-

1.4.7第七节 定语从句的翻译:前置法、分句法和转换法

-

1.4.8第八节 长句的翻译:逆序法和顺序法

-

1.4.9第九节 被动语态的翻译

-

1.4.10翻译练习

-

1.5第三章 商务名片

-

1.5.1第一节 名片的构成

-

1.5.2第二节 机构、部门名称的翻译

-

1.5.3第三节 人名、职位的翻译

-

1.5.4第四节 地址的翻译

-

1.5.5翻译练习

-

1.6第四章 商号和公司简介的翻译

-

1.6.1第一节 商号的翻译

-

1.6.2第二节 企业简介的翻译

-

1.6.3第三节 公司简介常用表达

-

1.6.4翻译练习

-

1.7第五章 商标的翻译

-

1.7.1第一节 商标的概念与功能

-

1.7.2第二节 商标翻译的方法

-

1.7.3翻译练习

-

1.8第六章 商务信函

-

1.8.1第一节 商务信函简介

-

1.8.2第二节 英语商务信函的语言特点

-

1.8.3第三节 商务信函的翻译技巧

-

1.8.4翻译练习

-

1.9第七章 产品说明书

-

1.9.1第一节 产品说明书的概念和结构

-

1.9.2第二节 产品说明书的语言特点

-

1.9.3第三节 产品说明书的翻译

-

1.9.4翻译练习

-

1.10第八章 商务广告

-

1.10.1第一节 商务广告的构成

-

1.10.2第二节 商务广告的文体特征

-

1.10.3第三节 广告英语的翻译方法

-

1.10.4翻译练习

-

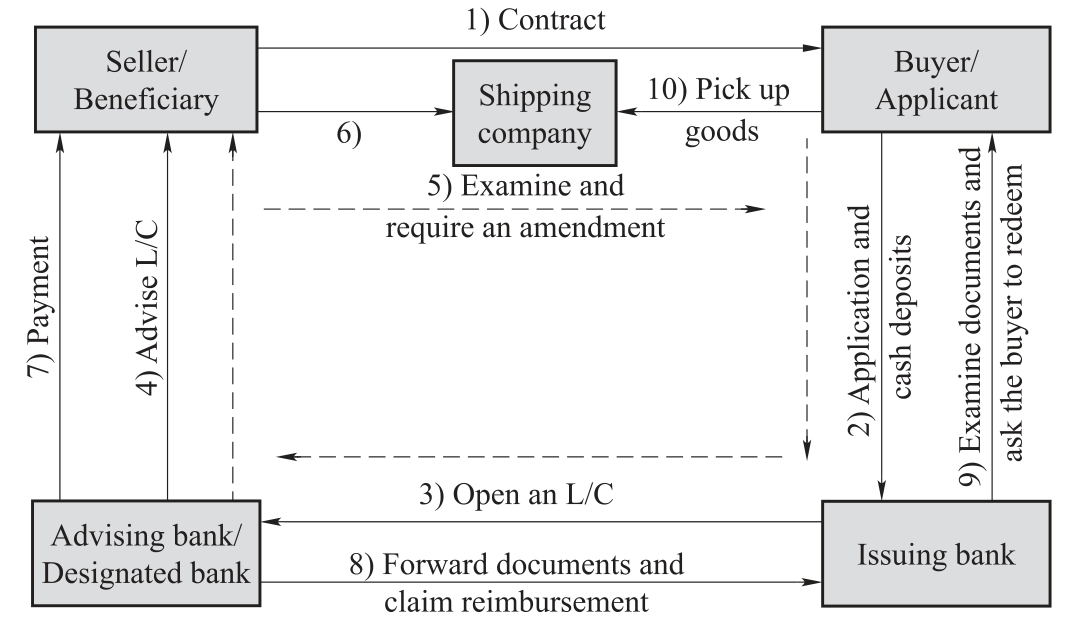

1.11第九章 信用证

-

1.11.1第一节 信用证的概念与分类

-

1.11.2第二节 信用证的语言特点及翻译

-

1.11.3翻译练习

-

1.12第十章 商务合同的翻译

-

1.12.1第一节 商务合同的基础知识

-

1.12.2第二节 商务合同的语言特点与翻译

-

1.12.3第三节 长句的翻译方法

-

1.12.4翻译练习

-

1.13附录一 常用商标术语

-

1.14附录二 2013年财富世界500强排行榜(企业名单)

-

1.15附录三 常用广告套语

-

1.16附录四 商务英语常用缩略语表

-

1.17参考文献

1

现代实用商务英语翻译