2.Read the Big Four to Know Capital's Fate

By Paul Kennedy

US presidents,in confronting crises,have often let it be known that they are serious students of history and biography.George W.Bush,an unusually voracious late-night reader,devours books on the lives of Great Men,including his hero Winston Churchill,(who in turn liked to read about his illustrious ancestor,Marlborough).Barack Obama looks to biographies of Abraham Lincoln for inspiration.

Given the enormity of the banking,credit and trade crisis,might it be worth suggesting to Mr Obama and his fellow leaders that they study the writings of the greatest of the world's political economists,instead?After all,we may be in such a grim economic condition that the clever direction of budgets is a greater attribute of leadership than the stout direction of battleships.

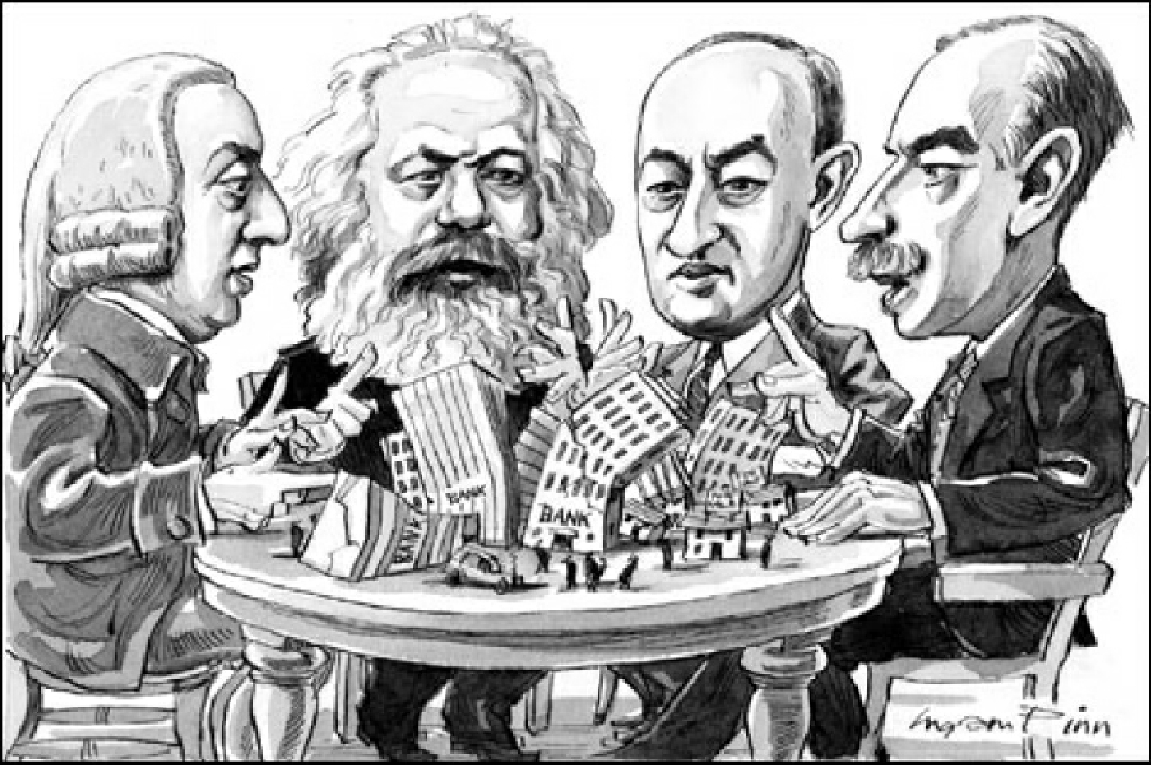

Since today's leaders cannot possibly read all the major works of political economy,let us help them by selecting four of the greatest names from Robert Heilbroner's classic collection The Worldly Philosophers:The Lives,Times,and Ideas of the Great Economic Thinkers:Adam Smith,the virtual founder of the discipline and early apostle of free trade;Karl Marx,that penetrating critic of the foibles of capitalism,and less reliable predictor of its“inevitable”collapse;Joseph Schumpeter,the brilliant and unorthodox Austrian who was certainly no foe of the capitalist system but warned of its inherent volatilities(its“perennial gale of creative destruction”);and that great brain,John Maynard Keynes,who spent the second half of his astonishing career seeking to find policies to rescue the same temperamental free-market order from crashing to the ground.

Perhaps the supremely gifted playwright Tom Stoppard could put those four savants on stage and offer an imaginary weekend-long quadrilateral discourse among them about the future of capitalism.Failing such a creative work,what might we imagine the four great political economists would say about our present economic crisis?

Smith,one imagines,would claim that he had never advocated total laissez faire,was appalled at how sub-prime loans to fiscally insecure people contradicted his devotion to moral economy,and was concerned at the deficit spending proposed by many governments.Marx would still be badly bruised by learning of Lenin and Stalin's perversion of his communistic theories,and by the post-1989 withering-away of most of the world's socialist economies;yet he might still feel pleasure at modern financial capitalism foundering on its contradictions.The austere Schumpeter,by contrast,might be lecturing us to swallow another decade of serious depression before a newer,leaner form of capitalism emerged again,though with lots of evidence of severe gale-damage(the end of the US car industry,the decline of the City of London,perhaps) in its wake.

And Keynes?My own guess is that he would not be very happy at today's state of affairs.He might(only might)regard it as fine that he was quoted or misquoted millions of times in today's media,but one suspects that he would be uneasy at parts of Mr Obama's deficit-spending scheme: at the US Treasury's proposal to allocate more money to buying bad debts and rescuing bad banks than investing in job creation;at a Washington spending spree that seems uncoordinated with those of Britain,Japan,China and the rest;and,most unsettling of all,at the fact that no one is asking who will purchase the$1,750bn of US Treasuries to be offered to the market this year—will it be the east Asian quartet,China,Japan and South Korea(all with their own catastrophic collapses in production),the uneasy Arab states(yes,but to perhaps one-tenth of what is needed),or the near-bankrupt European and South American states?Good luck!If that colossal amount of paper is bought this year,who will have ready funds to purchase the Treasury flotations of 2010,then 2011,as the US plunges into levels of indebtedness that could make PhilipⅡof Spain's record seem austere by Comparison?

In the larger sense,of course,all four of our philosophers would be correct.Capitalism—our ability to buy and sell,move money around as we wish,and to turn a profit by doing so—is in deep trouble.No doubt Smith,as he watches the collapse of Iceland and the Irish travails,is reconsidering his aphorism that little else is needed to create a prosperous state than“peace,easy taxes and tolerable administration of justice”—that did not work this time.By contrast,rumbles of satisfaction might be heard coming from Marx's grave in Highgate Cometery,causing excitement for the still-considerable numbers of Chinese visitors.Meanwhile,Schumpeter will have due cause to mutter:“This is not a surprise,really.”As for Keynes,we might imagine him sipping tea with Wittgenstein at Grantchester meadows,pursing his lips at the incapacity of merely normal human beings to get things right:at our tendency to excessive optimism,our blindness to the signs of economic over-heating,our proneness to panic—and our need,every so often,to turn to clever men like himself to put the shattered Humpty-Dumpty of international capitalism back together again.

All these political economists instinctively recognized that the triumph of free-market forces—with the consequent elimination of older social contracts,the downgrading of the state over the individual,the end of restraints upon usury—would not only bring greater wealth to many but could also produce significant,possibly unintended consequences that would ripple through entire societies.Laissez faire,laissez aller was not only a call to those chafing under medieval,hierarchical constraints;it was also a call to unbind Prometheus.Logically,it both freed you from the chains of a pre-market age,and freed you to the risks of financial and social disaster.In the place of Augustinian rules Come Bernie Madoff opportunities.

By the same instinctive reasoning,most sensible governments since Smith's time have taken precautions against citizens'totally unrestricted pursuit of private advantage.States have invoked the needs of national security(therefore you must protect certain industries,even if that is uneconomic),the desire for social stability(therefore do not allow 1 per cent of the population to own 99 per cent of its wealth and thus provoke civil riot),and the common sense of spending upon public goods(therefore invest in highways,schools and fire-brigades).In fact,with the exception of the few,all of today's many political economies lie along a recognizable spectrum of more-free-market versus less-free-market arrangements.

But what has happened over the past decade or more is that many governments let down their guard and allowed nimble,profit-seeking individuals,banks,insurance companies and hedge funds much greater scope to create new investment schemes,leverage more and more capital on the basis of increasingly thin real resources and widen dramatically the pool of gullible victims(silly,under-earning individuals,hopeful not-for-profits,Jewish charities,friends of a friend of an investment manager,the list is long),thereby creating our own era's spectacular equivalent of the South Sea Bubble.As in all such gigantic credit“busts”,many millions more people—the innocent as well as the foolish—will be hurt than the snake-oil salesmen and loan managers who perpetrated these so-called“wealth creation”schemes.

What,then,is capitalism's future?Our current,damaged system is not,despite Marx's hopes,to be replaced by a totally egalitarian,communist society.Our future political economy will probably not be one in which Smith or his present-day disciples could find much comfort:there will be a higher-than-welCome degree of government interference in“the market”,somewhat larger taxes and heavy public disapprobation of the profit principle in general.Schumpeter and Keynes,one suspects,will feel rather more at home with our new post-excess neocapitalist political economy.It will be a system where the animal spirits of the market will be closely watched(and tamed)by a variety of national and international zookeepers—a taming of which the great bulk of the spectators will heartily approve—but there will be no ritual murder of the free-enterprise principle,even if we have to plunge further into depression for the next years.Homo Economicus will take a horrible beating.But capitalism,in modified form,will not disappear.Like democracy,it has serious flaws—but,just as one find faults with democracy,the critics of capitalism will discover that all other systems are worse.Political economy tells us so.

The writer is professor of history and director of International Security Studies at Yale University,is the author/editor of 19 books,including The Rise and Fall of the Great Powers(Vintage).He is writing an operational history of the Second World War.

(From Financial Times,March 12,2009)

Questions for Discussion(问题讨论)

1.How different are the big four political economists picked by the writer?

2.What would Adam Smith say about today's economic situation?

3.What would Keynes say about today's economic situation?

4.What is meant by“a call to unbind Prometheus”?How does that relate to“Bernie Madoff opportunities”?

5.What purpose does it serve when Kennedy uses“PhilipⅡof Spain's record”in discussing America's further projected indebtedness?

Language Tips(阅读提示)

Robert Heilbroner:Robert Heilbroner(March 24,1919-January 4,2005)was an American economist and historian of economic thought.The author of some twenty books,Heilbroner was best known for The Worldly Philosophers(1953),a survey of the lives and contributions of famous economists,notably Adam Smith,Karl Marx,and John Maynard Keynes.

Creative destruction:The notion of creative destruction is found in the writings of Mikhail Bakunin(巴库宁),Friedrich Nietzsche(尼采),and in Werner Sombart's(桑巴特)War and Capitalism(1913,p.207),where he wrote:“again out of destruction a new spirit of creativity arises”.In Capitalism,Socialism and Democracy,the Austrian economist Joseph Schumpeter(熊彼特)popularized and used the term to describe theprocessoftransformationthataccompaniesradical innovation.In Schumpeter's vision of capitalism,innovative entry by entrepreneurs was the force that sustained long-term economic growth,even as it destroyed the value of established companies that enjoyed some degree of monopoly power.Also,the disruption and downfall that occurs to certain industries and people when a revolutionary new idea takes hold.Automobiles made blacksmiths obsolete.Big retail chains destroyed countless small businesses.Because of the Internet,the music,movie and publishing worlds have been seriously impacted,and many industries are expected to change dramatically in the future.(注意此词内含的paradox)

Tom Stoppard:Czech-born British playwright.After living in East Asia with his family during World WarⅡ,he moved to England and adopted his stepfather's surname.His first play,A Walk on the Water,was televised in 1963,and he won fame with the absurdist Rosencrantz and Guildenstern Are Dead(1966;film,1990).His later plays,marked by verbal brilliance,ingenious plotting,and a playful interest in pivotal historical moments,include Jumpers(1972),Every Good Boy Deserves Favour(1977;with music by André Previn),The Real Thing(1982),and Arcadia(1993).He has also written radio plays and screenplays for films such as Empire of the Sun(1987)and Shakespeare in Love(1998,Academy Award).Stoppard was knighted in 1997.

Moral economy:Moral economy is a phrase used in a number of contexts to describe the interplay between moral or Cultural beliefs and economic activities.A moral economy,in one interpretation,is an economy that is based on goodness,fairness,and justice.Such an economy is generally only stable in small,closely knit communities,where the principles of mutuality—i.e.“I'll scratch your back if you'll scratch mine”—operate to avoid the free rider problem.Where economic transactions arise between strangers who cannot be informally sanctioned by a social network,the free rider problem lacks a solution and a moral economy beComes harder to maintain.

Deficit spending:Deficit spending is the amount by which a government,private company,or individual's spending exceeds inCome over a particular period of time,also called simply“deficit,”or“budget deficit,”the opposite of budget surplus.The spending of public funds obtained by borrowing rather than by taxation.

Bad debt:坏账A debt that is not collectible and therefore worthless to the creditor.This occurs after all attempts are made to collect on the debt.Bad debt is usually a product of the debtor going into bankruptcy or where the additional cost of pursuing the debt is more than the amount the creditor could collect.This debt,once considered to be bad,will be written off by the company as an expense.

Treasuries:A United States Treasury security is a government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt.Treasury securities are the debt financing instruments of the United States Federal government,and they are often referred to simply as Treasuries.There are four types of marketable treasury securities:Treasury bills,Treasury notes,Treasury bonds,and Treasury Inflation Protected Securities(TIPS).There are several types of non-marketabletreasurysecuritiesincludingStateandLocal Government Series(SLGS).Government Account Series debt issued to government-managed trust funds,and savings bonds.All of the marketable Treasury securities are very liquid and are heavily traded on the secondary market.The non-marketable securities(such as savings bonds)are issued to subscribers and cannot be transferred through market sales.

PhilipⅡof Spain:Charles V,Philip's father,left Philip with a debt of about 36 million ducats and an annual deficit of 1 million ducats.Aside from reducing state revenues for overseas expeditions,the domestic policies of PhilipⅡfurther burdened Spain,and would,in the following century,contribute to its decline.

Ludwig Wittgenstein:路德维希·维特根斯坦(1889年4月26—1951年4月29日),出生于奥地利,后入英国籍。哲学家、数理逻辑学家。语言哲学的奠基人,20世纪最有影响的哲学家之一。Described by Bertrand Russell as“the most perfect example I have ever known of genius as traditionally conceived,passionate,profound,intense,and dominating”,Wittgenstein was regarded by many as the greatest philosopher of the 20th century.He was an Austrian-British philosopher whoworkedprimarilyinlogic,thephilosophyof mathematics,the philosophy of mind,and the philosophy of language.

Humpty Dumpty:An egg-shaped character in a nursery rhyme who fell off a wall and could not be put back together again(late 17th century).The text goes like this:Humpty Dumpty sat on a wall,/Humpty Dumpty had a great fall./All the king's horses,/And all the king's men,/Couldn't put Humpty together again.

Prometheus:普罗米修斯In Greek religion,one of the Titans and a god of fire.He was a master craftsman and a supreme trickster,and he was sometimes associated with the creation of humans.According to legend,Prometheus stole fire from the gods and gave it to humans.In vengeance,Zeus created Pandora,who married Prometheus's brother and set loose all the evils of the world.Another tale held that Zeus had Prometheus chained to a mountain and sent an eagle to devour his liver,which regenerated every night so that he could suffer the same torment the next day.

Bernard Madoff:伯纳德·麦道夫Bernard Madoff is an American former businessman and former non-executive chairman of the NASDAQ stock exchange who was convicted of operating a Ponzi scheme that has been called the largest investor fraud ever committed by a single person.On March 12,2009,Madoff pled guilty to an 11-count criminal complaint,admitting to defrauding thousands of investors.Federal prosecutors estimated client losses,which included fabricated gains,of almost$65 billion.He had been confined to his Manhattan penthouse apartment during the investigation,and was subsequently incarcerated after his guilty plea.There was no plea deal with prosecutors.He faces spending the rest of his life in prison,and up to$170 billion in restitution.

Hedge fund:对冲基金(也称避险基金或套利基金)意为“风险对冲过的基金”,起源于20世纪50年代初的美国。当时的操作宗旨在于利用期货、期权等金融衍生产品以及对相关联的不同股票进行实买空卖、风险对冲的操作技巧,在一定程度上可规避和化解投资风险。A hedge fund is an investment fund open to a limited range of investors that is permitted by regulators to undertake a wider range of investment and trading activities than other investment funds and pays a performance fee to its investment manager.Each fund has its own strategy which determines the type of investments and the methods of investment it undertakes.Hedge funds,as a class,invest in a broad range of investments including shares,debt,commodities and so forth.

Not-for-profit:Typeofincorporatedorganizationinwhichno stockholder or trustee shares in profits or losses and which usually exists to accomplish some charitable,humanitarian,or educational purpose; also called nonprofit.Such groups are exempt from corporate inCome taxes but are subject to other taxes on inCome-producing property or enterprises.Donations to these groups are usually tax deductible for the donor.Some examples arehospitals,colleges anduniversities,foundations,and such familiar groups as the Red Cross and Girl Scouts.

South Sea Bubble:One of the largest stock scams of all time.The U.K.-based South Sea Company's shares saw a huge appreciation based on rumor,speculation and false claims before plummeting and eventually becoming worthless.Thousands of people lost their life savings.The scam occurred in 1720,when South Sea's stock soared in the wake of speculation and greed surrounding the monopoly the South Sea Company was perceived to have in the shipping and trade industries,particularly in Mexico and parts of South America.With nothing to prevent it from doing otherwise,South Sea Company's management continued to issue shares in response to seemingly insatiable demand.As a result,the stock's price soared,defying all fundamental sense.Eventually,the truth was exposed:the company was making virtually no profit,and the share price plummeted when investors fled.In the post-Enron investing world,some have dubbed this scam the“Enron of England”.

Snake oil:Snake oil is a traditional Chinese medicine used to treat joint pain.However,the most common usage of the phrase is as a derogatory term for compounds offered as medicines which implies that they are fake,fraudulent,quackish,or ineffective.The expression is also applied metaphorically to any product with exaggerated marketing,but questionable or unverifiable quality or benefit.

Animal spirits:“Animal spirits”is the term John Maynard Keynes used in his 1936 book The General Theory of Employment,Interest and Money to describe the psychological forces that partly explain why the economy doesn't behave in the manner predicted by classical economics—a system of thought that expects economic actors to behave as unemotional rational beings,or emotion which influences human behavior and can be measured in terms of consumer confidence.Trust is also included or produced by“animal spirits”.

Cultural Notes(文化导读)

Political economy:Academic discipline that explores the relationship between individuals and society and between markets and the state,using methods drawn from economics,political science,and sociology.Political economy is thus concerned with how countries are managed,taking into account both political and economic factors.The field today encompasses several areas of inquiry,including the politics of economic relations,domestic political and economic issues,the comparative study of political and economic systems,and the study of international political economy.Political economy most commonly refers to interdisciplinary studies drawing upon economics,law,and political science in explaining how political institutions,the political environment,and the economic system—capitalist,socialist,mixed—influence each other.When narrowly construed,it refers to applied topics in economics implicating public policy,such as monopoly,market protection,government fiscal policy,and rent seeking.Economists and political scientists often associate the term with approaches using rational choice assumptions,especially game theory,in explaining phenomena beyond economics' standard remit,in which context the term“positive political economy”is common.政治经济学中的“政治的”(political)一词,源于希腊文的politikos,含有“社会的”、“国家的”、“城市的”等多种意思;政治经济学中的“经济”(economy)一词,来源于希腊文的oikonomia,原意是家庭经济管理。“政治经济学”一词是法国重商主义者A.蒙克莱田在1615年出版的《献给国王和王太后的政治经济学》一书中首先使用的。17世纪中叶以后,首先在英国,然后在法国,资本主义工场手工业逐渐发展成为工业生产的主要形式。资产阶级为了同封建势力作斗争,必然要求从理论上说明资本主义生产、分配的规律,论证资本主义生产的优越性。这就产生了以A.斯密和D.李嘉图为主要代表的资产阶级古典政治经济学。1825年经济危机的爆发,使资本主义制度的矛盾日益显露出来。面临这种形势,资产阶级更加需要的是对资本主义制度的辩护。为了适应这种需要,产生了庸俗政治经济学。以马尔萨斯为代表的庸俗经济学者抛弃了古典政治经济学中的许多科学成分,致力于抹煞阶级利益的对立,用各种各样的辩护理论,维护资产阶级利益。19世纪上半叶,在资本主义生产方式形成时期,产生了小资产阶级政治经济学。小资产阶级政治经济学抨击了资本主义制度,揭露了资本主义的矛盾,但是它们不了解资本主义矛盾产生的原因,只是站在维护小私有制的立场来反对资本主义私有制。在小资产阶级政治经济学产生的同时,也产生了空想社会主义。空想社会主义者在应用政治经济学剖析资本主义方面作了最初的尝试。他们对资本主义制度作了尖锐和无情的批判,否定了资本主义制度的永恒性,论证了社会主义制度代替资本主义制度的必然性。19世纪40年代初,马克思和恩格斯在批判地继承了资产阶级古典政治经济学的基础上创立了马克思主义政治经济学。最初出现的资产阶级古典政治经济学,研究的是在资本主义制度下如何使财富增长以及财富的生产和分配的规律。小资产阶级政治经济学研究的是人口和财富的比例问题是人们的物质福利问题。马克思主义政治经济学研究对象不是物,而是人与人之间的关系,是社会生产关系。

Laissez faire:Policy dictating a minimum of governmental interference in the economic affairs of individuals and society.It was promoted by the physiocrats and strongly supported by Adam Smith and John Stuart Mill.Widely accepted in the 19th century,laissez-faire assumed that the individual who pursues his own desires contributes most successfully to society as a whole.The function of the state is to maintain order and avoid interfering with individual initiative.The popularity of the laissezfaire doctrine waned in the late 19th century,when it proved inadequate to deal with the social and economic problems caused by industrialization.自由放任的经济理论被认为是纯粹的、经济上的自由意志主义的市场观点,主张让自由市场自行其道是更适当而更迅速的方法,将能省去任何由政府运作所造成的效率不彰。主张政府对于民间经济如价格、生产、消费、产品分发和服务等的干预越少,将能使经济运作得更好(更有效率)。经济学家亚当·斯密在他的《国富论》一书中,主张市场里看不见的手将能指引人们借着争取各自的利益来达成公共的利益。由于赚钱的唯一方法是自愿的交易行为,因此获取他人金钱的唯一方法便是给人们他们想要的东西。一个人不可能借着向农夫和肉贩诉诸兄弟之情而获得一顿免费晚餐,相反的,一个人必须借着诉诸他人的利益,支付他们劳动的代价才能从他们身上得到东西。

Further Online Reading(网络拓展阅读)

Rethinking Marx

By Peter Gumbel

http://www.time.com/time/specials/packages/printout/0,29239,1873191_1873190_1873188,00.html

A Challenge to Scientific Economics;

An Older School Looks at a Broad,More Intuitive Picture While Modernists See Just the Numbers and Facts

http://www.nytimes.com/1999/01/23/arts/challenge-scientificeconomics-older-school-looks-broad-more-intuitive-picture.html

Capitalism at Bay

Oct.16th,2008

What went wrong and,rather more importantly for the future,what did not

http://www.economist.com/opinion/displayStory.cfm?story_id= 12429544

Face It:Marx Was Partly Right About Capitalism

Rowan Williams24th September,2008

http://www.spectator.co.uk/print/the-magazine/features/2172131/ face-it-marx-was-partly-right-about-capitalism.thtml

The New Capitalism

Fraser Nelson26th September,2008

http://www.spectator.co.uk/print/coffeehouse/2176916/the-newcapitalism.thtml

Journalism 101(报刊点滴)

英美报刊的一些外形特点:

1.英美报纸比中国的厚很多,信息量较大。

2.同一份报刊会有不同版本(edition),既有可能是国内不同地区的版本,也可能是不同国家、地区的版本,如英国《金融时报》、美国《时代》周刊就有欧洲版、亚洲版等多种。同一份报纸还会有专题特刊或副刊,如英国《泰晤士报》的Times Literary Supplement《文学副刊》名气斐然。

3.一份报纸包含news,editorial,column,opinion等,其中news所占篇幅最多,涉及国际、国内要闻;business,technology,sports,science,health,arts,lifestyle,travel等等。

4.从版面看,报纸一般有报头、报耳、标题、新闻导语等。其中最重要的是标题headline。

Reading Comprehension Quiz(选文测验)

Ⅰ.According to the article,determine which statements are true and which are false.

1.Many US presidents in times of crisis happen to have been students of history at school.

2.Adam Smith was a founder of political economy as a discipline.

3.Karl Marx didn't actually predict the inevitable collapse of capitalism.

4.If he were alive today,playwright Tom Stoppard would like to invite the four major political economists to discuss the future of capitalism.

5.Keynes advocated laissez faire and would welCome a high degree of government interference in the market today.

Ⅱ.Choose the best answer to each of the following questions.

1.Joseph Schumpeter's“perennial gale of creative destruction”probably_______.

A.described the destructive power of frequent winds

B.was used figuratively to describe the inherent volatilities of capitalism

C.neither A and B

D.both A and B

2.Who said“peace,easy taxes and tolerable administration of justice”are needed to create a prosperous state?

A.Adam Smith.

B.Karl Marx.

C.John Maynard Keynes.

D.Joseph Schumpeter.

3.About capitalism and free-market economy,Paul Kennedy thinks_______.

A.just a few political economies are strictly free market economies B.North Korea is moving toward a less-free-market economy C.both A and B D.neither A nor B

4.“National and international zookeepers”in this article_______.

A.refers to present-day disciples of Adam Smith

B.refers to present-day disciples of Joseph Schumpeter

C.refers to market regulators to watch and control the animal spirits of the market

D.none of the above

5.In this article,Paul Kennedy believes that_______.

A.a modified version of capitalism will persist

B.George W.Bush reads a lot of books about Great Men at night

C.democracy has serious flaws

D.all of the above