-

1.1出版说明

-

1.2修订说明

-

1.3前 言

-

1.4Part 1 Introduction

-

1.4.1Chapter 1 An Introduction to Business Writing

-

1.5Part 2 Routine, Negative and Persuasive Messages

-

1.5.1Chapter 2 Inquiries and Replies

-

1.5.2Chapter 3 Refusal Letters

-

1.5.3Chapter 4 Letters for Complaints and Adjustments

-

1.5.4Chapter 5 Sales Letters

-

1.6Part 3 In-house Correspondence

-

1.6.1Chapter 6 Invitations

-

1.6.2Chapter 7 Company Profile

-

1.6.3Chapter 8 Notice

-

1.6.4Chapter 9 I.O.U. and Receipt

-

1.6.5Chapter 10 Memos

-

1.6.6Chapter 11 Minutes

-

1.6.7Chapter 12 Business Reports

-

1.7Part 4 Employment Correspondence

-

1.7.1Chapter 13 Job-Application Cover Letters

-

1.7.2Chapter 14 Resume

Chapter 9 I.O.U. and Receipt

Objectives

Learn to write appropriate I.O.U.s;

Learn to write effective receipts;

Understand the difference between I.O.U. and Promissory Note.

Getting Started

Intern Student—Cindy Wu’s Story

Chinese New Year Makes Our Biz Uneasy

In the season of every Chinese New Year, factory output grinds to a halt as many of the migrant workers return to their home provinces during a two- to four-week period. Fewer workers have meant delayed shipments and lost sales for small companies. Some overseas business owners often complained: “Even though we planned for the New Year holiday and ordered early, my supplier in China couldn’t get to my order on time.”

The Chinese New Year is a challenging time for us too; we are short of hands during this special season. That’s why Mrs. Nagle decided to recruit two or three foreign trade clerks and a sales manager with responsibility for the European market. So this Friday morning, as soon as she came to the office, she told me to make preparations for the“Zhuhai Talent Recruitment Job Fair” held in the sports centre on Sunday.

My workmates and I are busy preparing for the job fair: calling participating staff together, sorting out files and folders, drafting job requirements, and etc. Everything gets ready except some desks for the fair. Mrs. Nagle said that’s easy and called our neighbor Julian to say to borrow some from his company. Julian, the chief executive of Zhuhai Yintong Energy Co., Ltd., is very friendly and cooperative. When he heard of this, he agreed without any hesitation but asked me to write an I.O.U. to him. That’s a piece of cake, I quickly write down the I.O.U. as follows:

January 8, 2012

Dear Julian,

I Borrowed from Julian, Zhuhai Yintong Energy Co., Ltd., three desks to be returned next week.

Cindy Wu

Listen to Mr. Tutorial

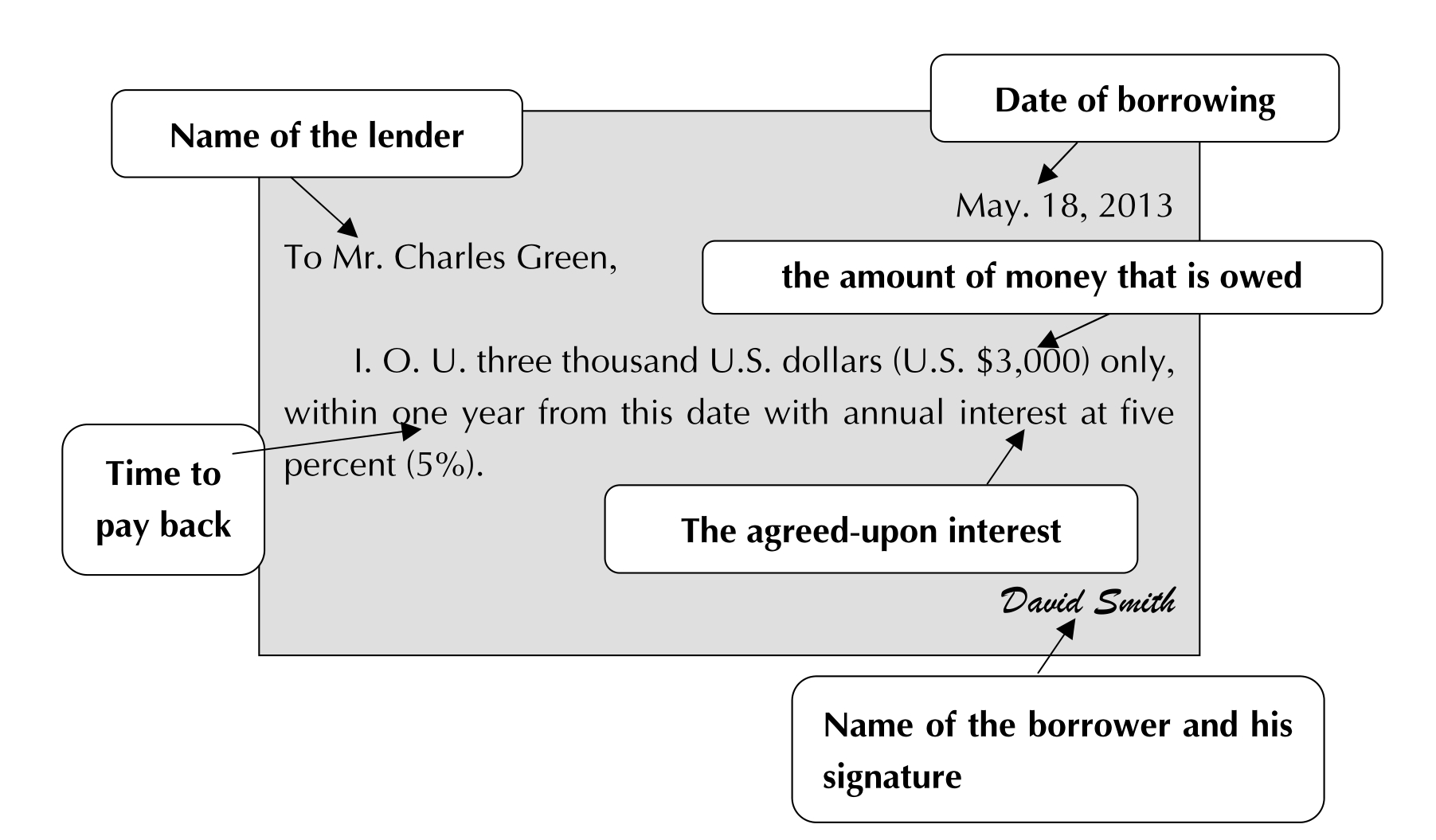

I.O.U. means “I owe you”. I.O.U. is a written statement that proves one has borrowed something, especially money. What needs to be filled out may include the date, the object, the amount of money, the time to pay back, the lender, and the borrower’s signature.

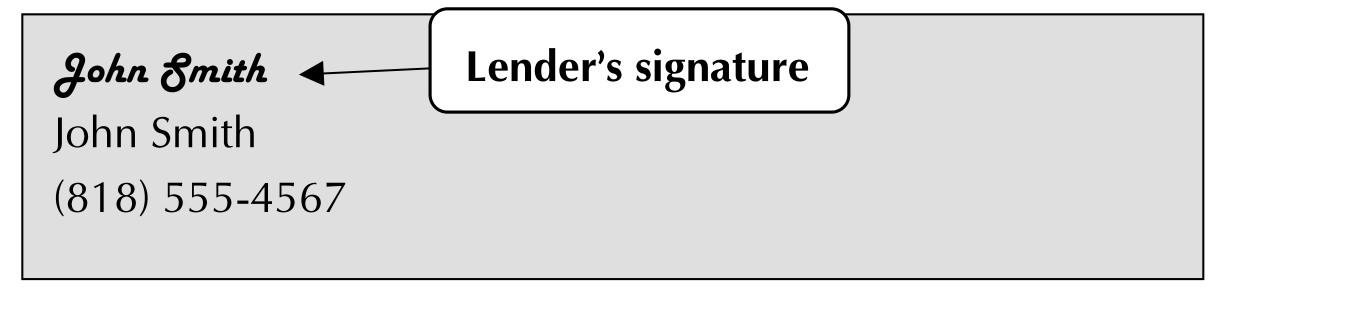

When we read Cindy’s I.O.U. at a glance, we think she knew some basic elements for writing I.O.U.s: such as the salutation, the borrowing date, the borrowing objects, the time to be returned and her own signature. And no grammar mistakes, no spelling mistakes. These are very important for an I.O.U. But when we read and re-read, we can see there do exist some small format mistakes. First, when we write an I.O.U., the salutation we use is “To Julian” instead of “Dear Julian”, which is often used in writing letters; Second , the position of the borrowing date is usually on the upper right corner instead of the upper left corner; And the third problem is that when we write an I.O.U., the first person pronouns are often left out to make it more objective and formal (i.e. change “I borrowed” into “borrowed”).

Now knowing the problems of this I.O.U., can you be able to correct these mistakes and rewrite an I.O.U. for Cindy?

Compose Your Message

I.O.U.

In our daily life, money or things are borrowed or lent from time to time. In this case, it is necessary for people to write an I.O.U. or a receipt because they can be important legal evidence.

I.O.U. is an acronym that literally means “I Owe You.” The I.O.U. is acknowledgement of a debt. It is often used when an individual borrows a relatively small amount of money from another that must be paid back. By creating an I.O.U., the lender is able to lay out the terms and conditions of how the money will be repaid. This will ensure that both parties involved know what to expect.

Provide the name of the individual who is owed the money (lender) as well as the name of the individual responsible for paying the money owed (borrower).

Document things borrowedor the amount of moneythat is owed and when the things or money is to be repaid.

Document the interestthat is agreed upon, if the full amount owed is not paid by the date specified in the I.O.U.

Document the penaltiesthat will occur if the I.O.U. agreement is not adhered to.

Create “Signature” and “Date” lineson the I.O.U. This will allow the person responsible for paying the I.O.U. to sign and date the document.

Make a copy of the I.O.U. Give one copy of the I.O.U. to the borrower. Keep the original copy for yourself.

Sample Study 1

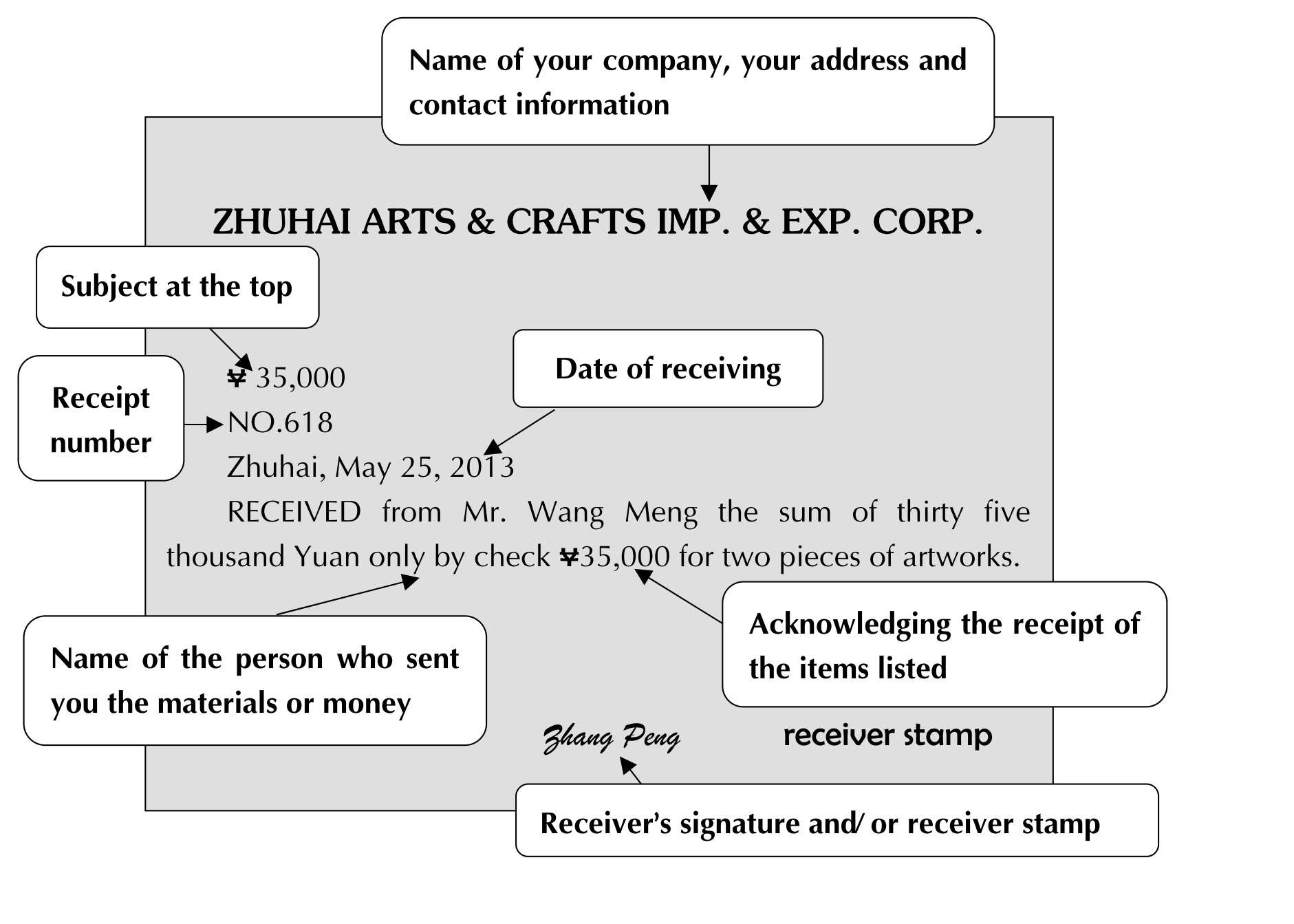

Receipt

If you do office work for a business, educational institution or other organization, you will find that people or other organizations often send you materials and documents. While some of these items require no response, others necessitate some sort of acknowledgment from your office. For example, if a student has sent his letters of recommendation for a program he is applying to, it would be courteous to send a quick letter letting him know you have received the materials.

A receipt is a written statement that proves one has received something, especially money. It is usually in a fixed format with the title of the company, the receipt number and the stamp of the company. What needs to be filled out includes the date, the amount of money or the materials you received and the receiver’s signature.

It is a good idea to keep a copy for yourself and give the original to the person you received the money from.

Type the name of your company, your address and contact information. Below this type the subjectand the date.

Below your information (your company’s name, your address and etc.), type the information for the person who sent you the materials, including his name, address and the name of his organization.

Type the salutation, using the full name of the person who sent you the materials, such as, “Mr. John Milton.”

Type in a statementbelow this that you are acknowledging the receipt of the items listed, and received them on the given date.

Type below this a bulleted list of the items received. Below this, sign the letter.

Sample Study 2

Writing Tips

An I.O.U. may not be considered enforceable in court. Before lending large sums of money that you want to get back, consult an attorney or use a legal document, such as a promissory note, that is signed, witnessed and notarized.

The sum of money should be written both in English words and Arabic numbers or just in English words in order not to be rewritten on purpose.

Look over the laws concerning the maximum amount of interest that can be charged on a loan before completing the I.O.U. document. Ignoring these state statutes may bring criminal offenses.

Make sure you keep the I.O.U. in a safe place.

If possible, scan the document and give a copy to the other party.

Write Your Message

Situation: Suppose you are the president of student union and are going to take some business English students to have one month’ s graduation practice for the Chinese Export Commodities Fair. Before you go, you want to borrow 6,000 Yuan from the foreign languages faculty of your college to pay for students’ charted bus and other expenses. So on Sep. 28, you went to the office to borrow money, the staff of the office agreed to the request, but asked you to write an I.O.U., and told you to pay back the money within two months by submitting an expense account to them.

Ways of Thinking

1. What’s the date of borrowing?

2. What are you going to write? Highlight it ( I.O.U. );

3. Who is the money lender ?Provide the name of the lender;

4. What’s the amount of money that is owed? And when and how the money is to be repaid?

5. Remember to sign your name (the borrower) at the end of the I.O.U.

Read for Reference

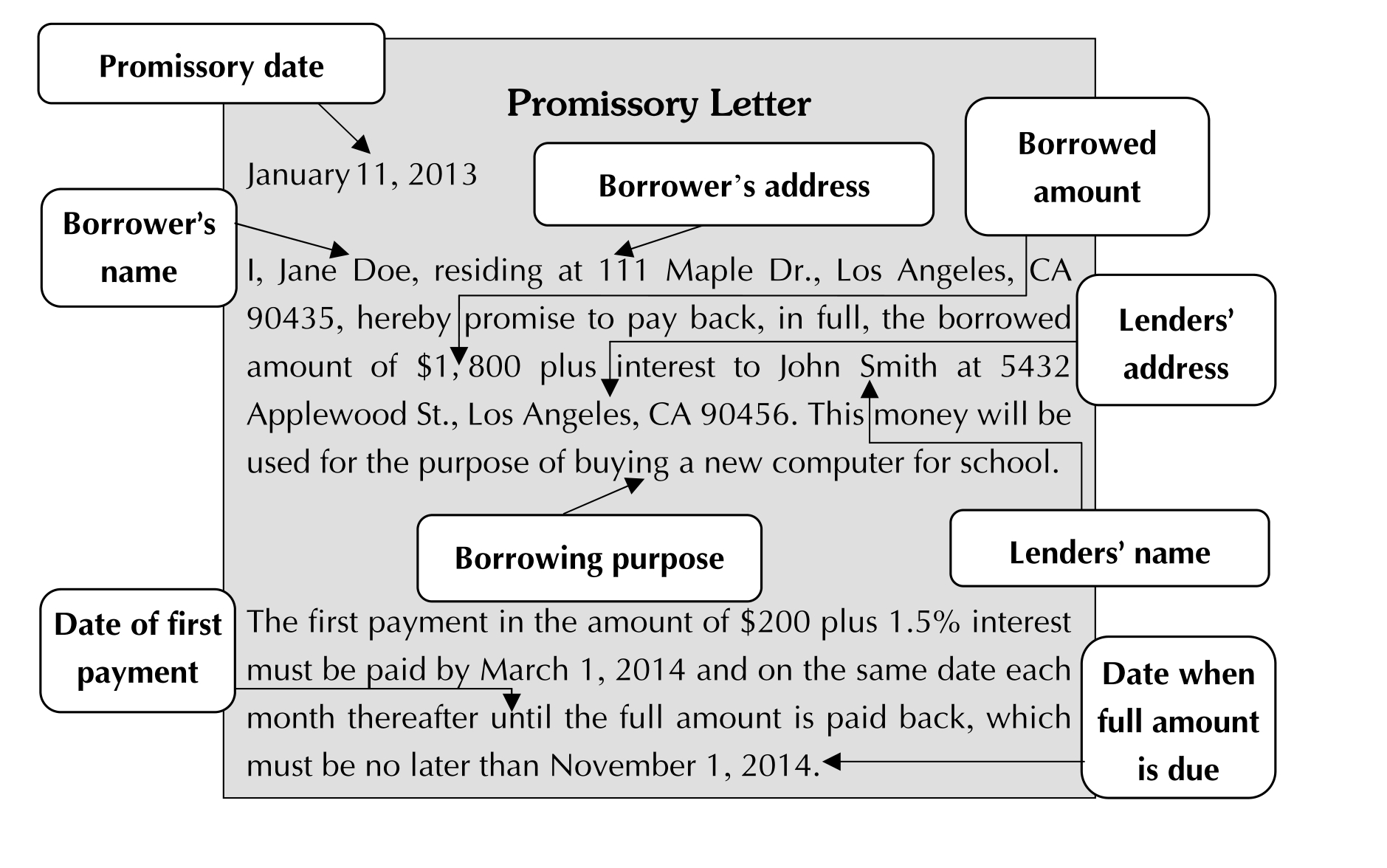

I.O.U. and Promissory Note

What is a promissory note? And what’s the difference between an I.O.U. and a promissory note?

A promissory note or a promissory letter is often mistakenly referred to as an I.O.U. While the two are similar: an I.O.U. is typically a statement indicating that one party owes party money, but often saying little or nothing about how it is to be repaid; a promissory note details the terms of repayment. Promissory notes are legally binding as long as essential information, such as who borrowed the money, when it was borrowed, and who lent the money, are included and all involved parties sign the note.

I.O.U.s are often difficult to enforce in court, being informal agreements usually agreed upon without the benefit of a witness. Whereas some I.O.U.s only state an amount agreed upon, promissory notes state an agreed-upon amount in addition to the steps necessary to pay back the debt and the consequences if the borrower fails to do so.

If you’re lending a larger amount than you’re comfortable with, take the time to make a promissory note. A promissory note will make it easier than an I.O.U. to recoup any money you lent out in court.

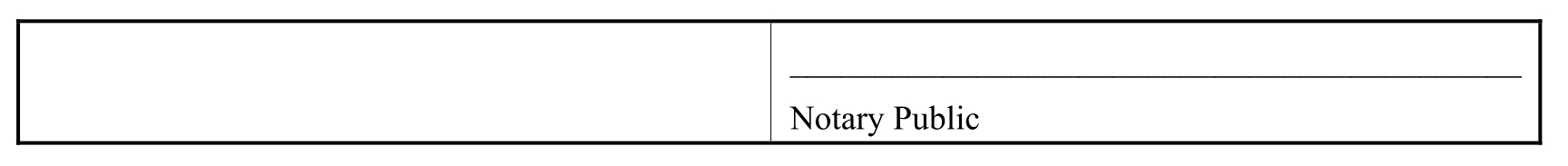

In order to establish a promissory note, you should have it notarized. Notarizing a document just means signing it in the presence of a state-sponsored witness and stamping it with a seal of approval.

How to Write a Personal Promissory Note?

1. Identify the borrower by her full name in the opening of the promissory note,and then refer to her as the “promisor” throughout the rest of the note. Similarly, identify the loan institution or individual by full name in the openingand as the “promisee” thereafter. The format for promissory notes may vary, and the language need not be particularly formal. It should begin with something like this:

“For value received, (borrower’s full name), residing at (borrower’s address), promises to pay to (name of person or institution lending money) the sum of $1,000 plus interest at the rate of 2 percent, with the first installment beginning on (date loan payback begins).”

2. Drop down two lines from the opening of the note and include stipulations to the terms of repayment,especially regarding payment dates, amount of payment, and any late fee amountsthat may apply:

“Promisor agrees to repay loan amount bi-weekly, beginning on the date specified in Section One above, at the rate of $40.00. A late fee will apply if payment is not made on time.”

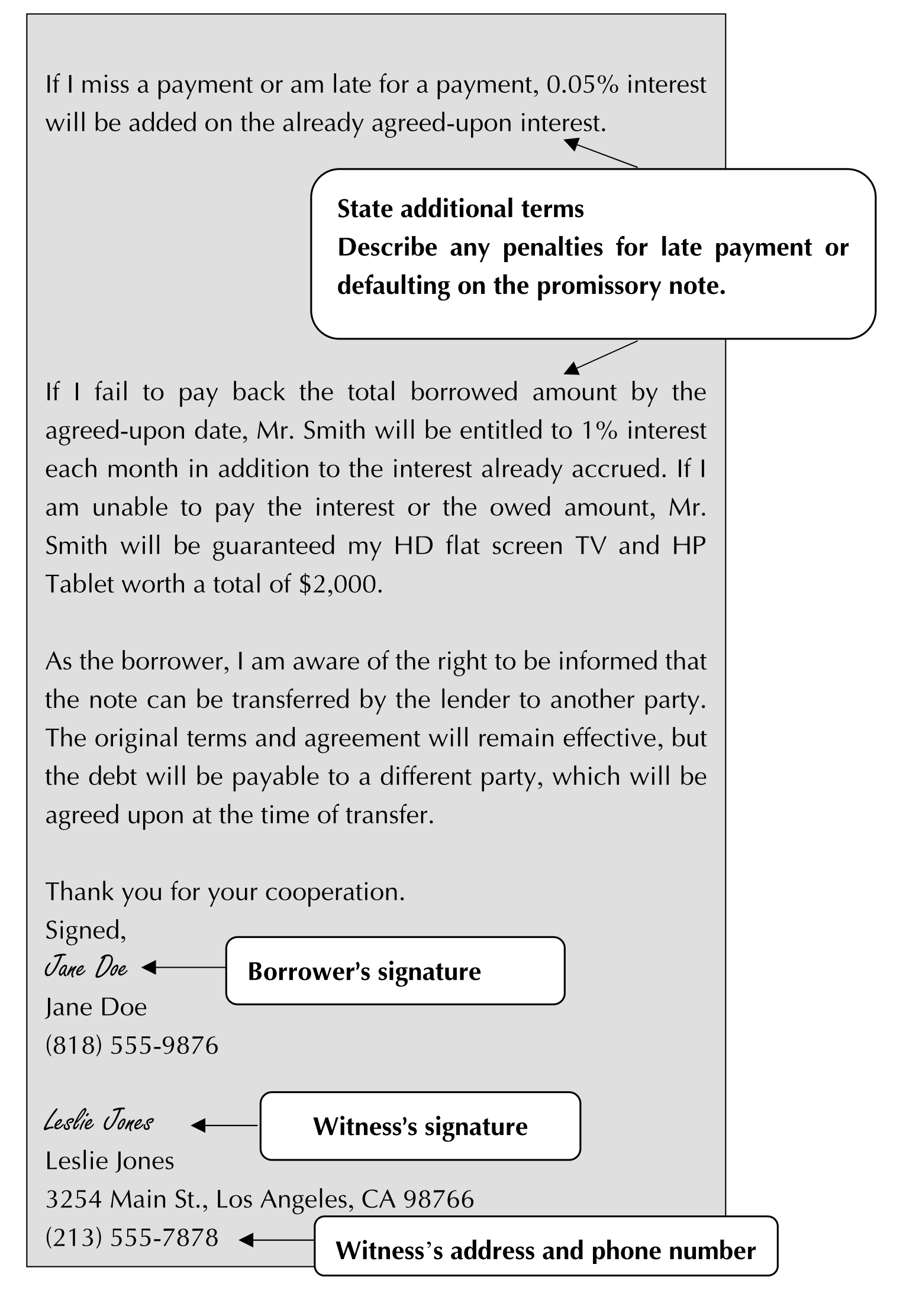

3. State additional terms on separate lines. These may include the currency in which payment is to be made, whether the note is secured or unsecured and whether prepayment is allowed. Describe any penalties that will accrue for late payment or defaulting on the promissory note. A secured loan is one in which the promisor has offered collateral (such as a car) that she will lose if she doesn’t repay the loan. Unsecured means there is nothing the promisee can take if the promisor defaults on the loan. This should be stipulated in writing:

“Promisor has agreed to offer his car as collateral in the event of loan default. Promisee will hold the title until loan has been paid in full, including all interest and late penalties.

Promisor can pay the loan off in full at any time without penalty, so long as full interest is paid.”

4. Sign and date the note(both promisee and promisor) in front of a witness and have it notarized. Both parties retain a copy.

Sample Study 3

New Words and Expressions

promissory note: 本票,期票。本票是一人向另一人签发的,保证即期或定期或在可以确定的将来时间,对某人或其指定人或执票人支付一定金额的无条件书面承诺。

grind: vt. & vi. 磨碎,嚼碎;折磨

document: vt. 证明;记录;为……提供证明

attorney: n. 律师

statutes: n. 法令法规

late fee: 滞纳金

recoup : vt. 补偿,收回;偿还

notarize: vt. 对……公证

state-sponsored: adj. 政府机构组织的、发起的,国家资助的

promisor: n. 契约者

promisee: n. <律>受约人

accrue: vt.(利息等)自然增值

default: vi. 未履行任务或责任

secured loan: 抵押放款,担保贷款

collateral: n. 担保物

unsecured loan: 无担保放款,无担保贷款

Useful Expressions

1. I.O.U. RMB two thousand (2,000) Yuan only. 我欠你2 000元。

2. with annual interest at three percent (3%) 按年利三厘计息

3. to be paid back within two months from this date自即日起两个月内还清

4. Borrowed from the phonetics laboratory of Foreign Languages Department two Sony recorders. 从外语系语音室借两台索尼录音机。

5. Four years after this date we promise to pay Mr. Chen Hua the sum of one hundred thousand Yuan (RMB¥100,000). 我们承诺自即日起四年后归还陈华先生人民币10万元整。

6. Received from Miss Zhang Hua the amount of RMB five thousand Yuan (RMB ¥5,000).今收到张华小姐人民币5 000元。

7. Received from Mr. Li Bo the under mentioned goods: One basketball, two books and three footballs.今收到李波先生送来的下列物品:一个篮球、两本书和三个足球。

Check Yourself

Task 1

There are five blanks in the fol lowing passage. For each blan k there are four choices marked A, B, C and D. Choose the best answer and mark the corresponding letter.

Commercial banks are business firms; like all firms, they strive to earn a profit. The object of commercial bank management is therefore to 1 profits while maintaining a very low risk of becoming 2 . To remain solvent(有清还债务能力的), a commercial bank must take precautions to ensure that the value of its assets(资产) 3 the value of its liabilities at all times. If at any time losses from securities(有价证券) 4 loans, or other investments force the value of the bank’s assets 5 the value of its liabilities(债务,负债), the bank becomes insolvent(无力偿付债务的;破产的).

1. A. minimize B. maximize C. control D. manage

2. A. insolvent B. solvent C. default D. fault

3. A. equals B. contracts C. exceeds D. lags

4. A. fault B. defaulted(不履行的) C. liquid D. speculated(投机的)

5. A. above B. under C. beyond D. below

Task 2

Translate the following phrases and sentences into Chinese or English.

1. 按年利5厘计息。

2. 自即日起两年内还清。

3. 今收到李娜小姐300元。

4. 我们承诺自即日起两年后归还王军先生人民币20万元整。

5. We jointly promise to pay Miss Helen Green back the sum of three thousand US dollars with annual interest at five percent (5%).

6. Received from Ms Huang Ying three-piece suites with two chairs and a sofa.

7. Received from Mr. Li Ping the under mentioned goods: one cap, two shirts and three trousers.

8. I agree that if I, John Bob, fail to repay the $2,500.00 to Jane Doe, as agreed upon, that appropriate legal action may be taken against me.

Task 3

Read the following passage and complete the I.O.U. letter according to the Chinese.

An I.O.U. letter which is derived from the term I owe you. The letter should contain all the relevant facts of the loan. Generally the letter would contain names of the parties involved in the transaction, date of the transaction and the amount of the loan. Terms and conditions of payment and when payment is due should also be included if applicable. Finally both parties should sign the letter.

I.O.U. Letter

I...........................(李强),hereby declare that I owe .......................(王建)the amount of ...................(人民币800元),borrowed on .....................(2013年3月28日)to be paid in full by ...........................(2013年5月30日).

Borrower’s full name .....................(李强) Signature.................

Lender’s full name .....................(王建) Signature.................

Witnessed by: .....................(李凯) Signature.................

Task 4

Write I.O.U.s according to the following Chinese information.

1. 广州的李民、王枫和陈小强三人承诺自即日起(2012年7月18日)两年后归还肖华先生人民币10万元整,按年利2厘计息。

2. David Smith承诺自即日起(2013年9月18日)七个月后归还格力集团公司财务部5千美元整,按年利3厘计息。

Task 5

Write receipts according to the Chinese information given below.

1.

收 据

兹收到韩德尔先生下述物件:

飞鱼打字机一台

索尼录音机一台

佳能数码相机一台

布鲁斯·怀特

2013年6月15日

2.

收 据

今收到外语系党支部为地震灾区人民募捐的款项人民币八千元(RMB¥8 000)整。

此据

收款人:许平

2009年5月18日

Task 6

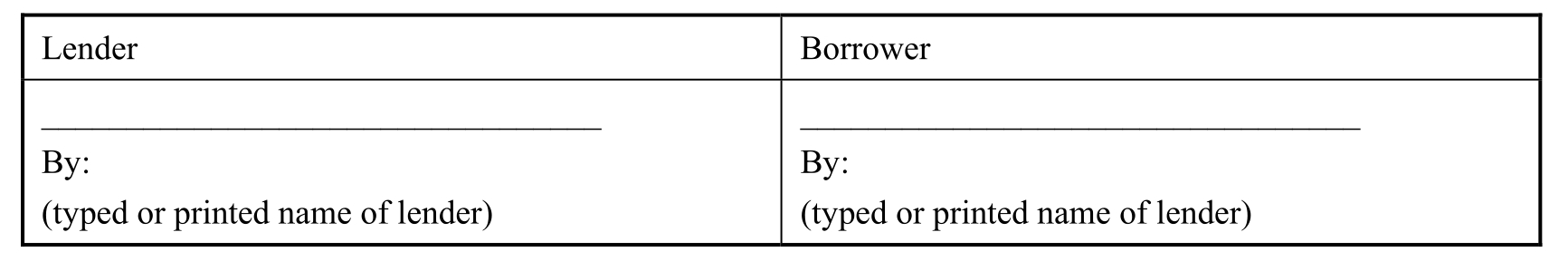

Finish the following promissory note, and learn another different form of promissory notes.

Promissory notes or loan agreements are drawn up as a formality in many financial transactions, but they are also necessary if the loaner believes the borrower may try to avoid repaying the loan. Promissory notes, if written properly, are evidence in the court of law to force the borrower to pay.

Promissory notes come in different forms.

Promissory Note

___________________(“Lender”) and ___________________ (“Borrower”) hereby enter into this loan agreement this _____ day of _______________, 20___.

1. Amount of L oan. Lender shall loan Borrower the sum of _________________________ dollars ($___________).

2. Interest. Interest shall be calculated on the unpaid balance as Simple/Compound (circle one) interest at the rate of _________________________ percent (_____%).

3. Payment Terms. Payments shall be applied first to interest and then to the unpaid balance of the loan and shall be made according to the following terms.

3.1 Monthly Payments. Monthly payments shall be due on the ______ day of each month.

3.2 Late Payments. Payment shall be considered late if not paid by the close of business on the ______ day of the month. A late fee of $_______ shall apply to all late payments.

3.3 Term of Contract. Payments shall be due beginning on the _____________________ day of ________________(month), 20___ with a final payment due on the ___________ day of _____________ (month), 20_____, for a contract term of _________________ (____) months.

4. Collateral. (担保金;抵押物)This loan shall be secured by ________________________(describe the collateral), to which Lender shall hold title until such time as the loan is paid in full.

5. Loan Acce leration. Should Borrower fail to make any monthly payment before the following months payment becomes due, he/she shall be in default. Should Borrower be unable to cure the default within ________ (_____) days, Lender may call the entire amount of the loan due.

6. Attorney Fees and Court Costs. Should Borrower fail to comply with the terms of this loan agreement, he/she will be responsible for all of Lender’s attorney fees and any Court costs associated with enforcement of this agreement.

7. General Provisions.

7.1 Governing Law. The parties agree that this agreement shall be governed by the laws of the state of ____________________ and that the Courts of the state of __________________ shall have exclusive jurisdiction to resolve any disputes that may arise out of this loan agreement.

7.2 Entire Agreement. This Agreement constitutes the entire agreement of the parties and supersedes(取代接替)all prior or contemporaneous oral or written agreements concerning this subject matter.

7.3 Severability. If any provision of this agreement is held by a court of law to be illegal, invalid or unenforceable, (a) that provision shall be deemed amended to achieve as nearly as possible the same economic effect as the original provision, and (b) the legality, validity and enforceability of the remaining provisions of this agreement shall not be affected or impaired thereby.

IN WITNESS WHEREOF, the parties have executed this Promissory Note on this _____ day of ______________________________, 20____.

STATE OF ______________________________

COUNTY OF ____________________________

Before me, the undersigned Notary Public in and for said county and state, did personally appear _____________________________ (Lender) and _____________________________(Borrower) and signed this Promissory Note as their free and voluntary act and deed.

(Seal or Stamp)

Note:

compound interest: 复利

hold title: 拥有所有权

severability: n.(为保持条款的最大限度约束力的)条款可分割性

impair: v. 损害,削弱

notary public: 公证人