-

1.1原著作者

-

1.2译者简介

-

1.3要点整理 Key Words

-

1.45分钟摘要

-

1.5MAIN IDEA

-

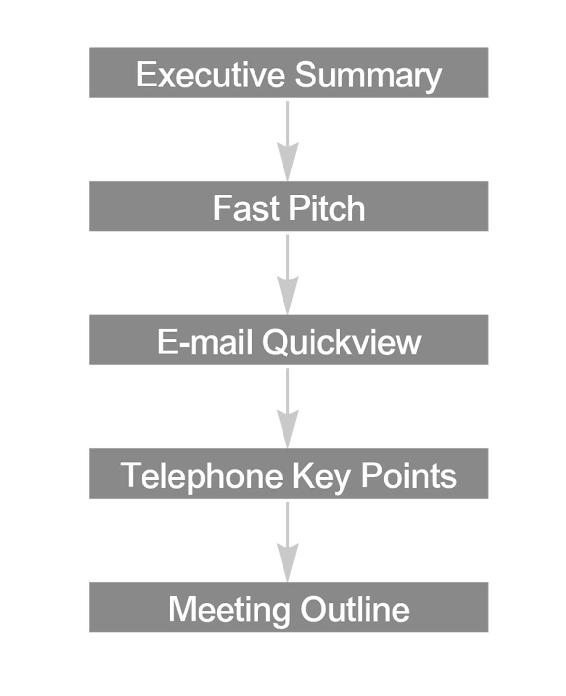

1.6执行大纲 从创业计划和你与投资人沟通的信息中摘录出来的简明要点

-

1.7Executive Summary A succinct summary of the most i...

-

1.810大价值驱动因素1 机会与产业分析

-

1.910 Key Value Drivers 1 Opportunity and industry an...

-

1.1010大价值驱动因素2 商业策略与竞争优势

-

1.1110 Key Value Drivers 2 Strategy and competitive ad...

-

1.1210大价值驱动因素3 建立与管理新事业团队

-

1.1310 Key Value Drivers 3 Team development and manage...

-

1.1410大价值驱动因素4 控制与分配资金来源

-

1.1510 Key Value Drivers 4 Control and allocation of c...

-

1.1610大价值驱动因素5 进军市场策略

-

1.1710 Key Value Drivers 5 Market entry strategy

-

1.1810大价值驱动因素6 营销与业务策略

-

1.1910 Key Value Drivers 6 Marketing and sales strateg...

-

1.2010大价值驱动因素7 成长策略与管理能力

-

1.2110 Key Value Drivers 7 Growth strategy and managem...

-

1.2210大价值驱动因素8 企业策略网络

-

1.2310 Key Value Drivers 8 Networked enterprise strate...

-

1.2410大价值驱动因素9 融资策略

-

1.2510 Key Value Drivers 9 Financing strategy

-

1.2610大价值驱动因素10 退出策略与退出目标

-

1.2710 Key Value Drivers 10 Exit strategy and exit goa...

-

1.28辅助数据 所有新事业投资人在详尽的企业经营查核过程中可能需要的数据

-

1.29Supporting Documents All of the materials a ventur...

-

1.30在地观点