-

1.1前 言

-

1.2Chapter 1 Overview of Accounting

-

1.2.11.1 Accounting History

-

1.2.21.2 Accounting Definition and Function

-

1.2.31.3 Accounting Standards

-

1.2.41.4 Categorization of Accounting

-

1.2.51.5 Accounting Postulations

-

1.2.61.6 Accounting Principles

-

1.3第一章 会计概述

-

1.3.11.1 会计的历史

-

1.3.21.2 会计的定义与功能

-

1.3.31.3 会计标准

-

1.3.41.4 会计分类

-

1.3.51.5 会计假设

-

1.3.61.6 会计原则

-

1.4Chapter 2 Accounting Recognition and Measurement

-

1.4.12.1 Accounting Elements and Equations

-

1.4.22.2 Accounting Subjects and Account

-

1.4.32.3 Double Entry System

-

1.5第二章 会计确认与记量

-

1.5.12.1 会计要素与会计等式

-

1.5.22.2 会计科目与账户

-

1.5.32.3 复式记账系统

-

1.6Chapter 3 Accounting Process

-

1.6.13.1 Accounting Cycle

-

1.6.23.2 The Journal

-

1.6.33.3 The Ledger

-

1.6.43.4 Adjusting Entries

-

1.6.53.5 Trial Balance

-

1.7第三章 会计程序

-

1.7.13.1 会计循环

-

1.7.23.2 日记账

-

1.7.33.3 分类账

-

1.7.43.4 调整分录

-

1.7.53.5 试算平衡表

-

1.8Chapter 4 Current Assets

-

1.8.14.1 Assets

-

1.8.24.2 Current Assets

-

1.8.34.3 Cash

-

1.9第四章 流动性资产

-

1.9.14.1 资产的概念

-

1.9.24.2 流动资产

-

1.9.34.3 现金

-

1.10Chapter 5 Accounts Receivable

-

1.10.15.1 Receivables

-

1.10.25.2 Accounts Receivable

-

1.11第五章 应收账款

-

1.11.15.1 应收款项

-

1.11.25.2 应收账款

-

1.11.35.2.1 应收账款的确认

-

1.11.45.2.2 应收账款的入账金额

-

1.11.55.2.3 应收账款的处置

-

1.12Chapter 6 Inventory

-

1.12.16.1 Inventory and Its Classification

-

1.12.26.2 Determine Inventory Quantities

-

1.12.36.3 Basic Issues in Inventory Valuation

-

1.13第六章 存 货

-

1.13.16.1 存货及其分类

-

1.13.26.2 存货数量的确定

-

1.13.36.3 存货计价的基本方法

-

1.14Chapter 7 Non-current Assets

-

1.14.17.1 Fixed Assets

-

1.14.27.2 Depreciation of Fixed Assets

-

1.14.37.3 Intangible Assets

-

1.14.47.4 Long-term Investment

-

1.15第七章 非流动性资产

-

1.15.17.1 固定资产

-

1.15.27.2 固定资产的折旧

-

1.15.37.3 无形资产

-

1.15.47.4 长期投资

-

1.16Chapter 8 Liabilities and Equity

-

1.16.18.1 Concept of Liabilities

-

1.16.28.2 Current Liabilities

-

1.16.38.3 Long-term Liabilities

-

1.16.48.4 Owner's Equity

-

1.16.58.5 The Nature of Owner's Equity

-

1.16.68.6 Sources of Owner's Equity

-

1.17第八章 负债与权益

-

1.17.18.1 负债的概念

-

1.17.28.2 流动负债

-

1.17.38.3 长期负债

-

1.17.48.4 所有者权益

-

1.17.58.5 所有者权益的特点

-

1.17.68.6 所有者权益的来源

-

1.18Chapter 9 Revenue and Expenses

-

1.18.19.1 Revenue

-

1.18.29.2 Expenses

-

1.18.39.3 Gains and Losses

-

1.19第九章 收入与费用

-

1.19.19.1 收入

-

1.19.29.2 费用

-

1.19.39.3 收益和损失

-

1.20Chapter 10 Financial Statements

-

1.20.110.1 Overview of Financial Statements

-

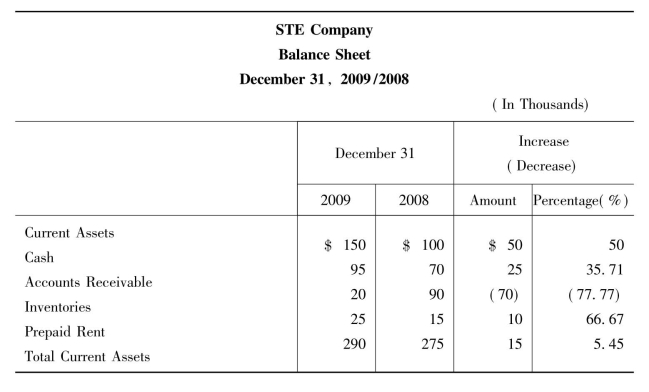

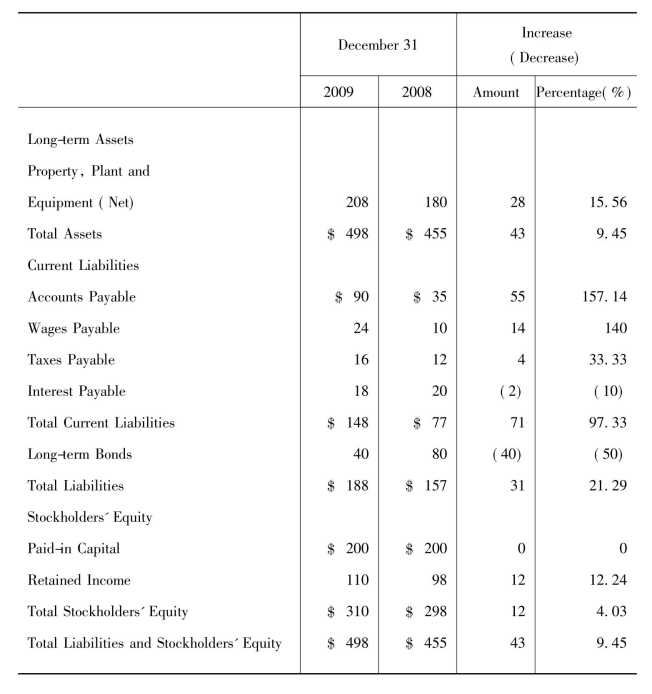

1.20.210.2 The Balance Sheet

-

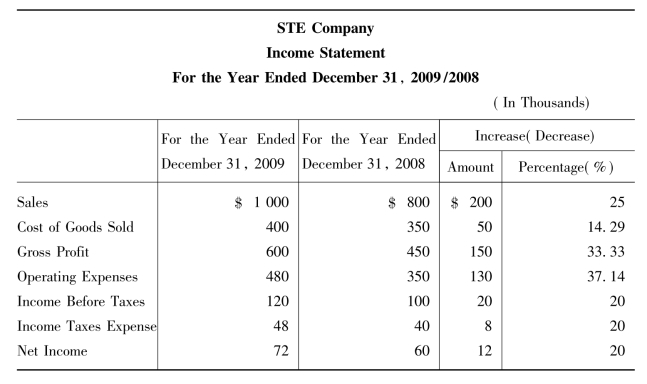

1.20.310.3 The Income Statement

-

1.20.410.4 The Statement of Cash Flows

-

1.21第十章 财务报表

-

1.21.110.1 报表概述

-

1.21.210.2 资产负债表

-

1.21.310.3 利润表

-

1.21.410.4 现金流量表

-

1.22Chapter 11 Financial Statement Analysis

-

1.22.111.1 Objectives of Financial Statement Analysis

-

1.22.211.2 Trend Analysis

-

1.22.311.3 Common-size Analysis

-

1.22.411.4 Ratio Analysis

-

1.23第十一章 财务报表分析

-

1.23.111.1 财务报表分析的目的

-

1.23.211.2 趋势分析

-

1.23.311.3 结构分析

-

1.23.411.4 比率分析

-

1.24Chapter 12 Accounting in the New Epoch

-

1.24.112.1 International Accounting

-

1.24.212.2 Computerized Accounting System

-

1.24.312.3 Three Basic Software in Accounting

-

1.25第十二章 新时代会计

-

1.25.112.1 国际会计

-

1.25.212.2 电算化会计

-

1.25.312.3 三种基本会计软件

-

1.26Chapter 13 Accountants,Organizations and Examinati...

-

1.26.113.1 Profession of Accounting

-

1.26.213.2 Top Accounting Organizations

-

1.26.313.3 Accounting Examinations

-

1.26.413.4 Ethics and the Accounting Environment

-

1.27第十三章 会计人员、机构与考试

-

1.27.113.1 会计职业

-

1.27.213.2 世界顶级会计师事务所

-

1.27.313.3 会计考试

-

1.27.413.4 道德规范与会计环境

-

1.28Chapter 14 Accounting Language

-

1.28.114.1 Abbreviation and Acronyms缩略语及简称

-

1.28.214.2 British and American Accounting Vocabulary英美会...

-

1.28.314.3 Accounting Terms常用会计术语

-

1.28.414.4 Accounting Diagrams常见会计报表中英对照

-

1.29Keys to the Exercises

-

1.30附录一 《中华人民共和国会计法》

-

1.31附录二 《中华人民共和国会计法》知识问答

-

1.32Bibliography

1

实用会计英语