Operating Revenue (营业收入)

Revenue (based on sales) from the core business

Revenue = Sales Volume × Price of Goods/Services

Price of Goods/Services: A balance of supply and demand, which may fluctuate to respond short term and long-term changes in supply and demand.

Sales Volume: The amount of units that are sold of a product or service, which needs to be estimated in terms of the market volume.

Revenue from the other business (other income)

Lease of property or equipment

Gain on disposal and release of working capital

Net Revenue (Gross Profit, 净收入)

The Cost of Goods Sold (COGS), i.e., manufacture cost, is decreased first from operating revenue.

![]()

The Operating Expense (Sales, General and Administrative, SG&A), secondly, is decreased from contribution margin.

![]()

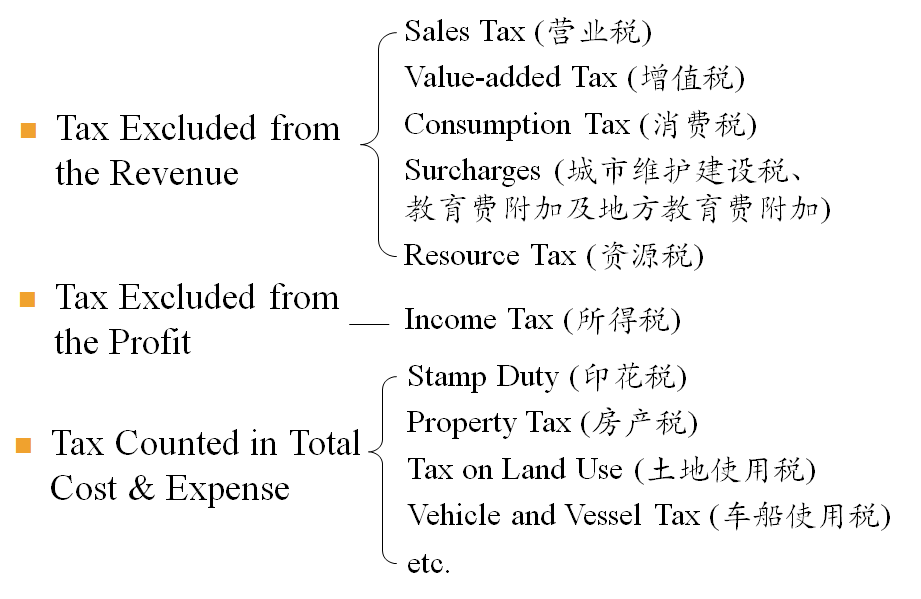

Tax

Income Tax (所得税)

Tax levied on taxable income, which is a function of operating revenues minus all allowable deductions.

![]()

Taxable Income: Net Revenue

In the actual commercial rule, the income tax will be zero and the loss (negative net revenue) can be used to offset the revenue in 5 years.

In the economic analysis, the income tax will be negative, that is, it is treated as an income of the firm.

Income Tax Rate

Marginal Tax Rate

The rate applied to the last dollar of income earned.

It usually is a ladder increase with the increase of taxable income.

Effective (Average) Tax Rate

The average rate paid for total income.

Gain or Loss on Disposal

The gain (loss) on sale is the fair market value minus its book value at the time point of disposal.

![]()

Gains tax: Tax on gains

![]()

Net Profit (Profit after Tax, 税后净利润)

Net Profit = Gross Profit (Net Revenue) – Income Tax