Financial Evaluation before Financing

The FNPV, FIRR and Pt of capital investment are calculated for the project.

All investments are assumed to be obtained from the equity. That is, interest is not included in the cash outflow.

It evaluates the real profitability of a project by excluding the effects of financing plan.

Before-tax Evaluation (所得税前分析)

It analyzes the profitability with excluding the impact of income tax.

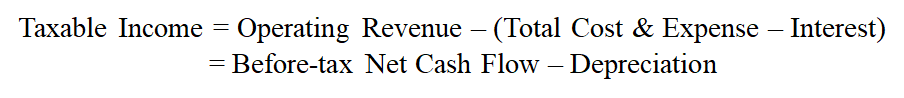

After-tax Evaluation (所得税后分析)

It includes the income tax in the cash outflow, and hence it is impacted by the depreciation plan.

Since interest are not involved in the outflow, income tax herein will be called as Adjusted Income Tax.

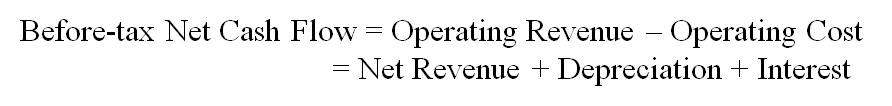

Before-tax Cash Flows

Cash Inflow: operating revenue

Cash Outflow: capital investment & operating cost

Net Cash Flow

EOY 0: negative capital investment

EOY 1 - N:

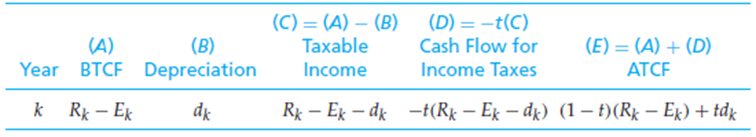

After-tax Cash Flows

Depreciation & amortization are not cash outflows, but they affects taxable income and after-tax net cash flow.

The earlier the depreciation deduction is, the more favorable the after-tax FNPV and FIRR will become.

After-tax FNPV and FIRR are less than before-tax FNPV and FIRR.