Comparability of MEA

Data: The standards of available data for all alternatives should be identically same.

Function: The expected functions of different alternatives should be similar.

Service Period (Useful Life): The service periods of all MEA should be same. If they are different, the adjustment is necessary.

MEA with equal service periods

MEA with unequal service periods

Incremental Analysis(增量分析)

Incremental Cash Flow: The differences of cash flows of two alternatives.

The alternative “do nothing” should be the first base alternative.

Develop the incremental cash flow for the alternative with the least increasing investment and the base alternative.

If the incremental cash flow is accepted, set the alternative with the least increasing investment as the new base alternative; and

Repeat all steps for all alternatives.

Decision Rules for NPW, NFW and AEW

The methods of NPW, NFW and AEW will obtain the same results in comparing MEA.

If NPW(A) > NPW(B), alternative A is better than B.

If NFW(A) > NFW(B), alternative A is better than B.

If AEW(A) > AEW(B), alternative A is better than B.

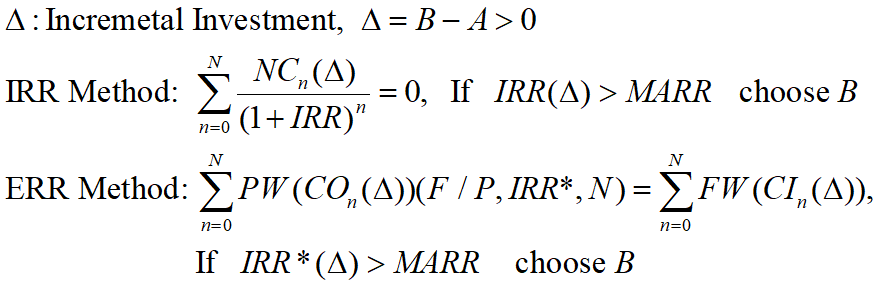

Incremental Analysis with IRR/ERR

Computing the IRR/ERR of incremental capital investment

Comparison of MEA with unequal service periods

Repeatability Assumption: common multiple of all service periods (最小公倍数法)

Service periods of all alternatives are shorter or equal to the common multiple of all service periods.

For each alternative, there are same economic consequences for all succeeding life spans.

Coterminated Assumption: one identical period among all service periods by adjusting cash flows

Using the shorter one: Calculate salvage value for longer one

Using the longer one: Involve lease option/reinvestment for shorter one