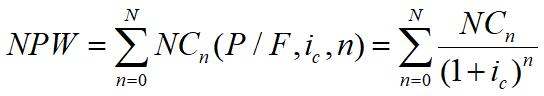

Net Present Worth (NPW, 净现值)

The present worth of all cash inflows and outflows

NCn — Net cash inflow at the end of period n, NCn = CIn – COn;

CIn — Cash inflow at the end of period n;

CIn — Cash outflow at the end of period n;

ic — MARR of the project;

N — Periods of the project.

Decision Rule of NPW

If NPW ≥ 0, the project is economically justified.

If NPW < 0, the project is not accepted.

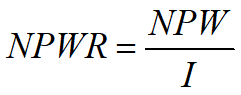

Net Present Worth Rate (NPWR, 净现值率)

It embodies the impact of investment scales.

I — Initial investment of the project.

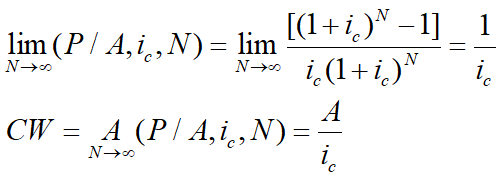

Capitalized Worth (CW)

If a project is perpetual or its service life is extremely long with infinite uniform cash flows, the present worth of the uniform cash flows is capitalized as:

Decision Rule

If CW ≥ 0, the project is economically justified.

If CW < 0, the project is not accepted.

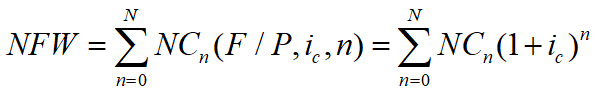

Net Future Worth (NFW , 净将来值)

The future worth of all cash inflows and outflows.

Decision Rule

If NFW ≥ 0, the project is economically justified.

If NFW < 0, the project is not accepted.

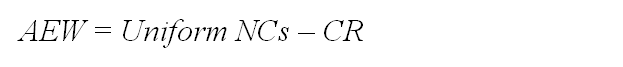

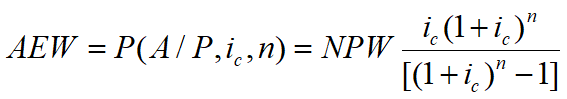

Annual Equivalent Worth (AEW, 净年值)

Measure the worth of a project by determining equal payment on an annual basis.

Decision Rule

If AEW ≥ 0, the project is economically justified.

If AEW < 0, the project is not accepted.

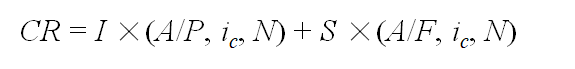

Capital Recovery Cost (CR)

The equivalent uniform annual cost of the capital investment and salvage value, if any.

I — Initial investment of the project;

S — salvage value of the project.