Market Value Ratios

上一节

下一节

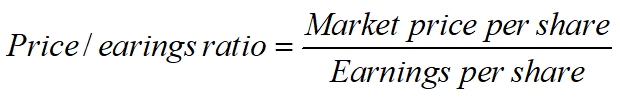

Price/earnings Ratio

The P/E ratio indicates how much investors are willing to pay per dollar of earnings for shares of the firm's common stock. It provides an important indication of how the market perceives the growth and profit opportunities of a firm.

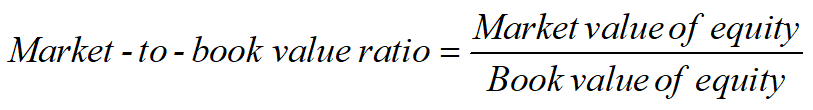

Market-to-book Value Ratio

In this ratio, book value of equity equals total assets minus total liabilities less preferred stock. The market-to-book value ratio measures how much value the firm has created for its shareholders.

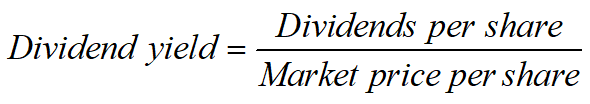

Dividend Yield

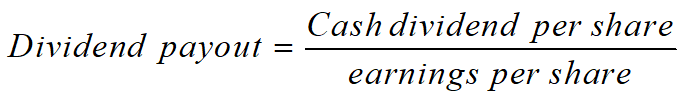

Dividend Payout

Dividend yield represents parts of a stock's total return; another part of a stock's total return is price appreciation.