Profitability Ratios

上一节

下一节

√Profitability ratio measures management's ability to control expenses in relation to sales and reflect a firm's operating performance, riskiness, and leverage.

Gross profit margin, operating profit margin, net profit margin

Return on Total Equity(ROE/ROTE)

![]()

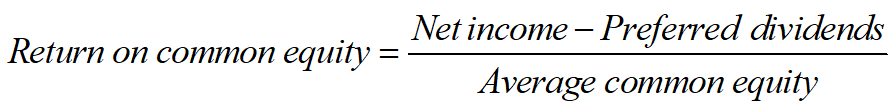

Return on Common Equity (ROCE)

Question: Can ROE represent the actual return earned by the firm’s shareholders?

DuPont Analysis of ROE

![]()

![]()

By separating ROE into these three components, an analyst can determine whether changes in a firm‘s ROE are attributable to changes in the level of earnings generated from sales, the sales generated from total assets, or the equity multiplier (leverage factor) employed in the financing of the firms assets.