本章阅读任务

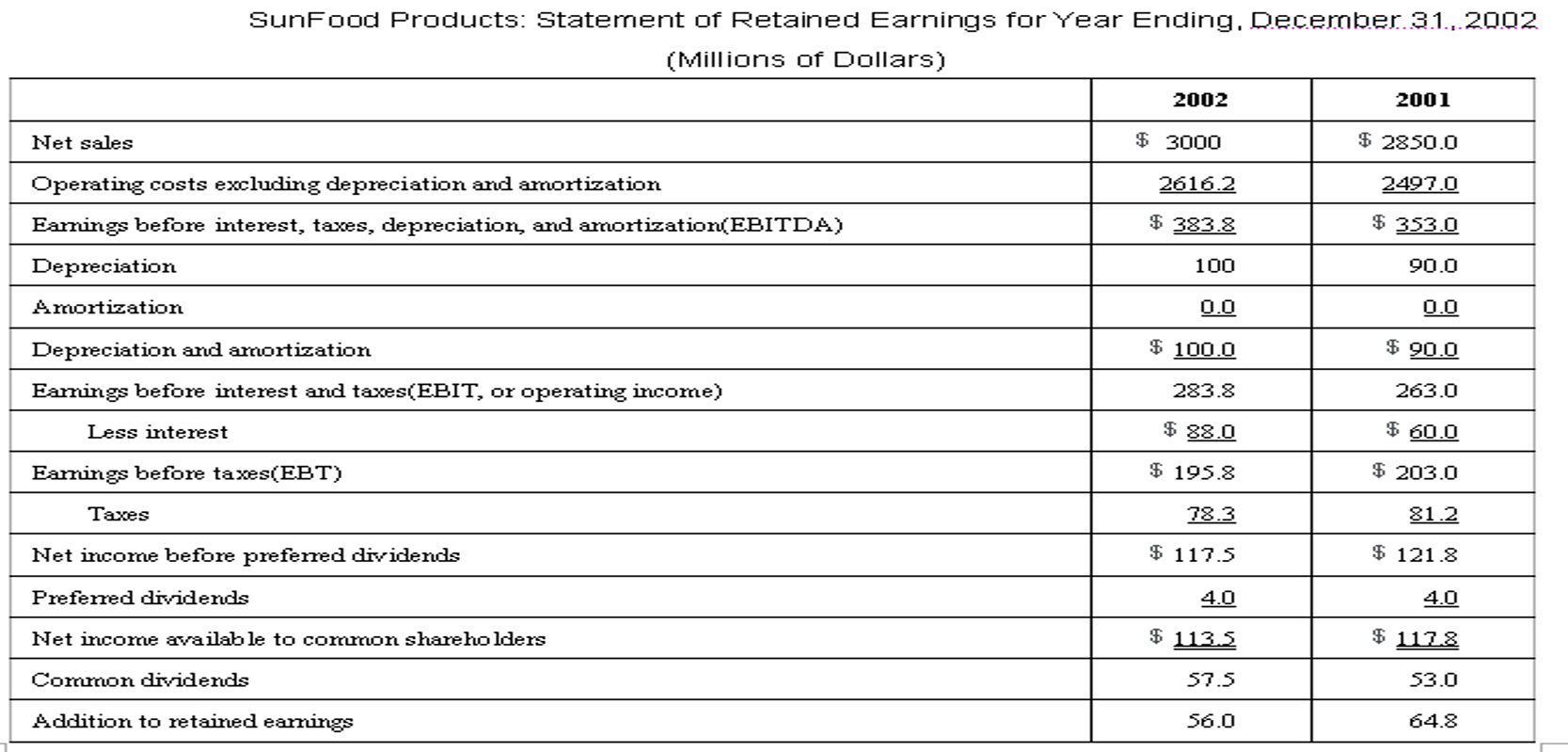

√ An income statement is a statement of earnings or a profit and loss statement.

Revenue - Expenses = Income

Operating and non-operating income

Operating income(营业利润): Subtracting operating expenses from operating income or revenue yields the operating income (or loss) for the firm. This is an important profitability measure of a firm's business operations.

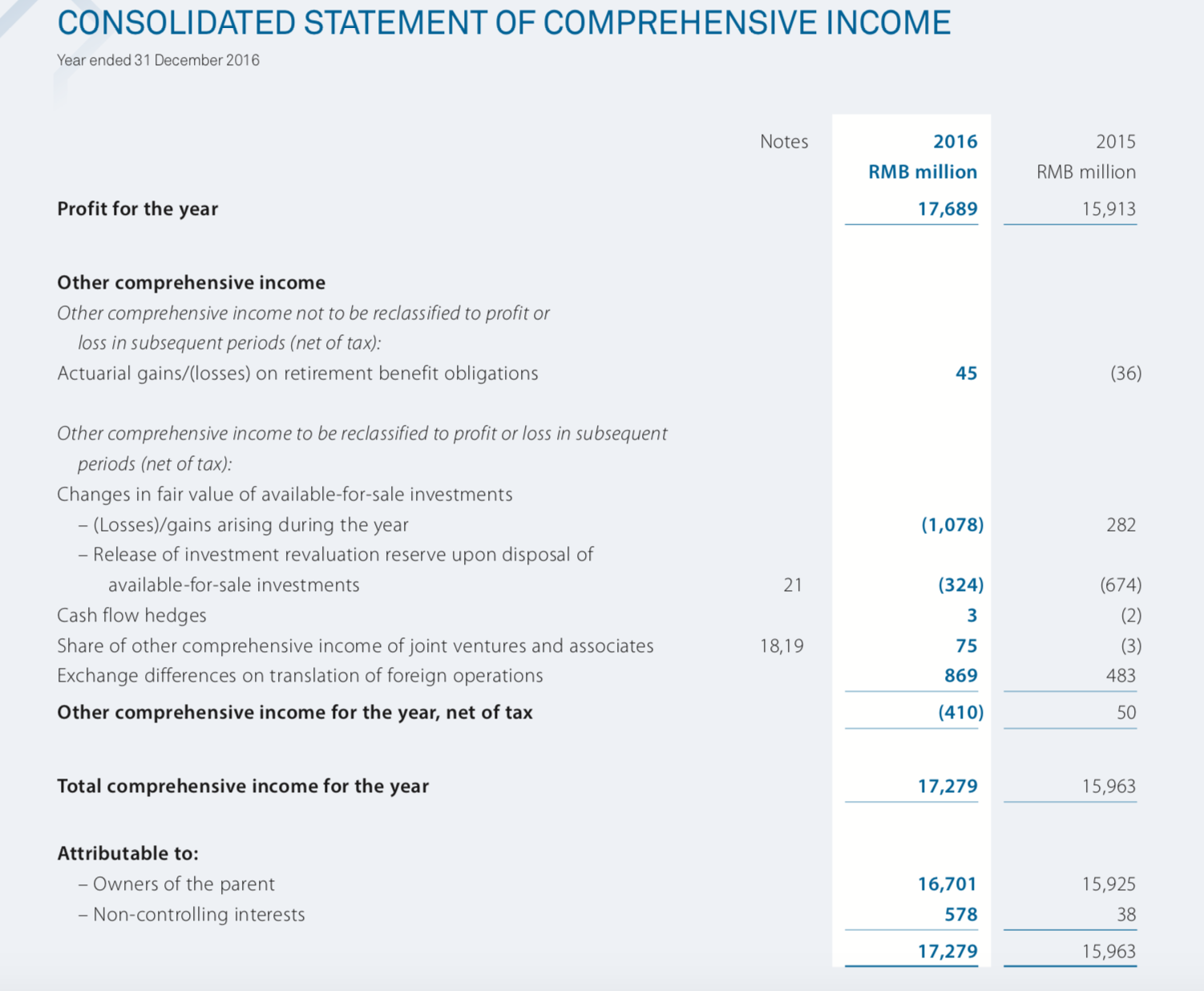

Non-operating income(营业外收入): The non-operating section includes income and expense items and gains and losses that are routine to most types of businesses, but viewed as peripheral to day-to-day business operations. Non-operating items include dividend and interest income earned, interest expense, and gains or losses associated with the disposal of assets or the elimination of liabilities.

※注:目前我国投资收益已经计入营业利润了,非因债务重组进行的资产处置利得和损失也体现在营业利润中。营业外收入只有债务重组利得、捐赠所得和盘盈利得,营业外支出包括以及固定资产处置报废毁损损失、盘盈损失、债务重组损失和捐赠支出等,投资收益及损失、资产处置收益和公允价值变动都计入营业利润了。

More examples

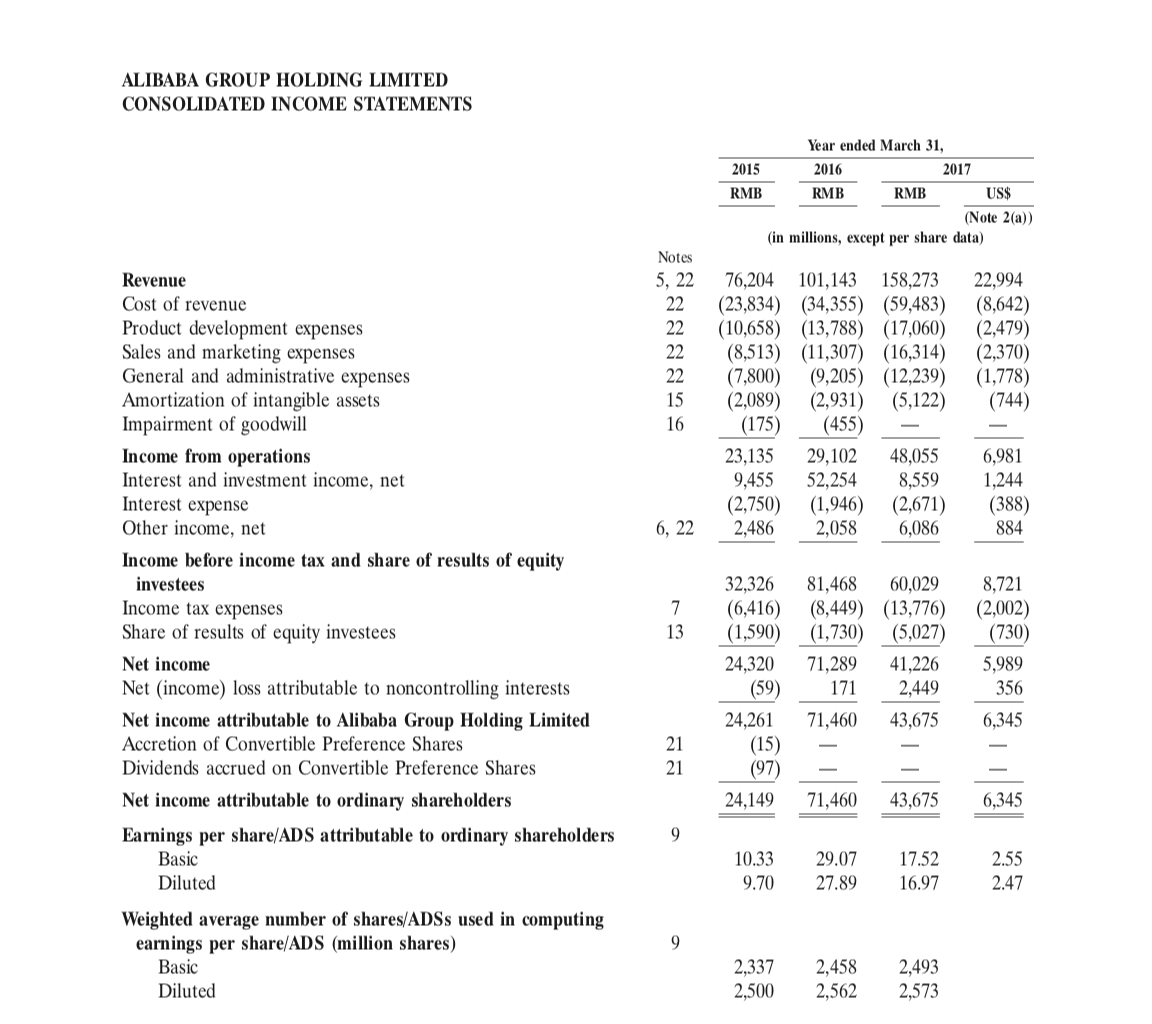

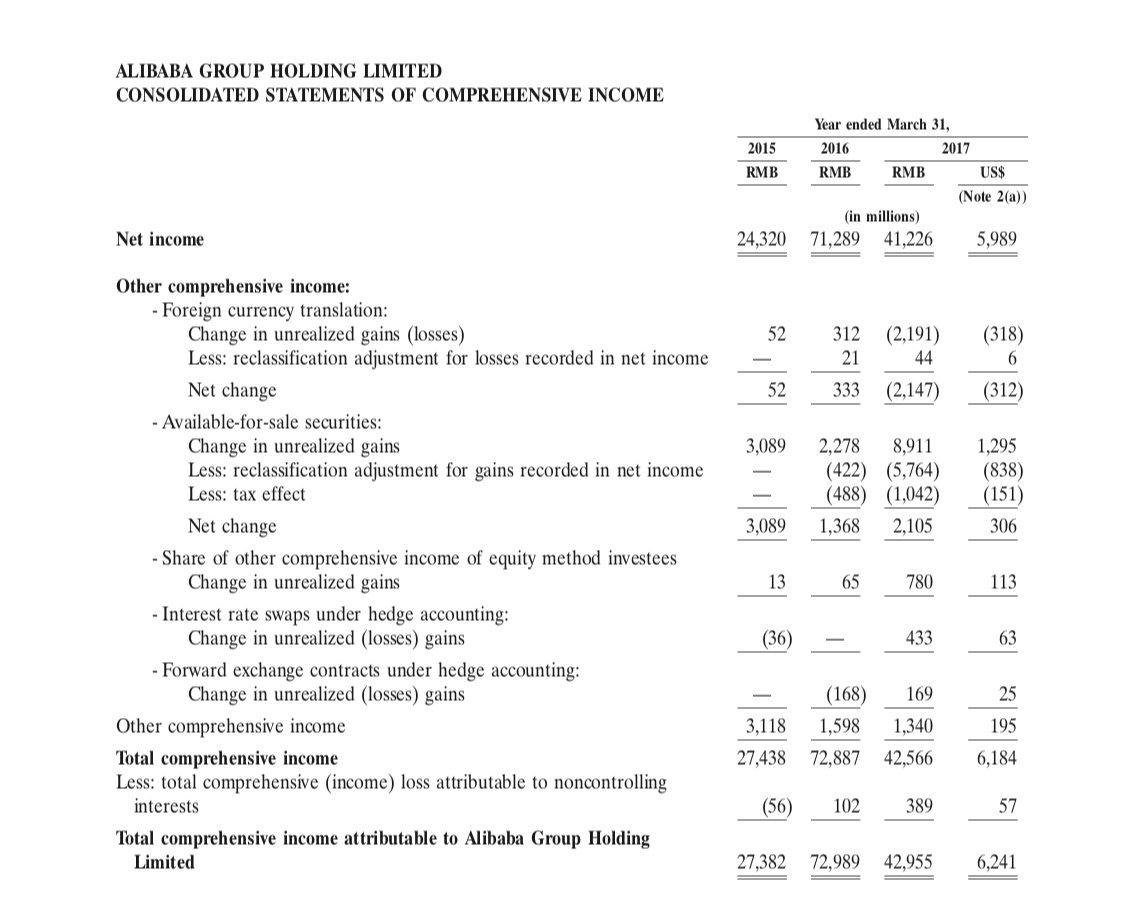

EXAMPLE 1: Consolidated Income Statement of ALIBABA

EXAMPLE 2: COMPREHENSIVE INCOME STATEMENT FROM CCCC

Earning Per Share

The presentation of earnings per share figures depends on whether the firm has a simple or complex capital structure:

√ A simple capital structure occurs when a firm is financed only with common stock and other non-convertible senior securities. That is, the firm's financing structure does not contain any potentially dilutive securities.

This firm will report basic earnings per share, which is calculated by dividing the net income less any preferred dividends paid out by the weighted average number of outstanding shares of common stock.

√ Firms with complex capital structures have potentially dilutive securities such as convertible securities, options, and warrents that could potentially dilute earning per share (EPR).

These firms must report both basic and diluted earnings per share figures. The diluted earnings figure per share provides a more conservative earnings estimate by assuming that the total shares of common stock in demonstrator include all shares of common stock plus future potential shares from the likely future conversion of outstanding convertible securities, stock options and warrants.

Net Income VS. Cash Flow

Accrual accounting

√Revenue is recognized in an income statement when the earnings process is virtually completed and the exchange of goods or services has occurred. (device for smoothing income)

Depreciation& Amortization

Taxes——differences between tax treatment and book accounting