1.2 Financial Management Decision

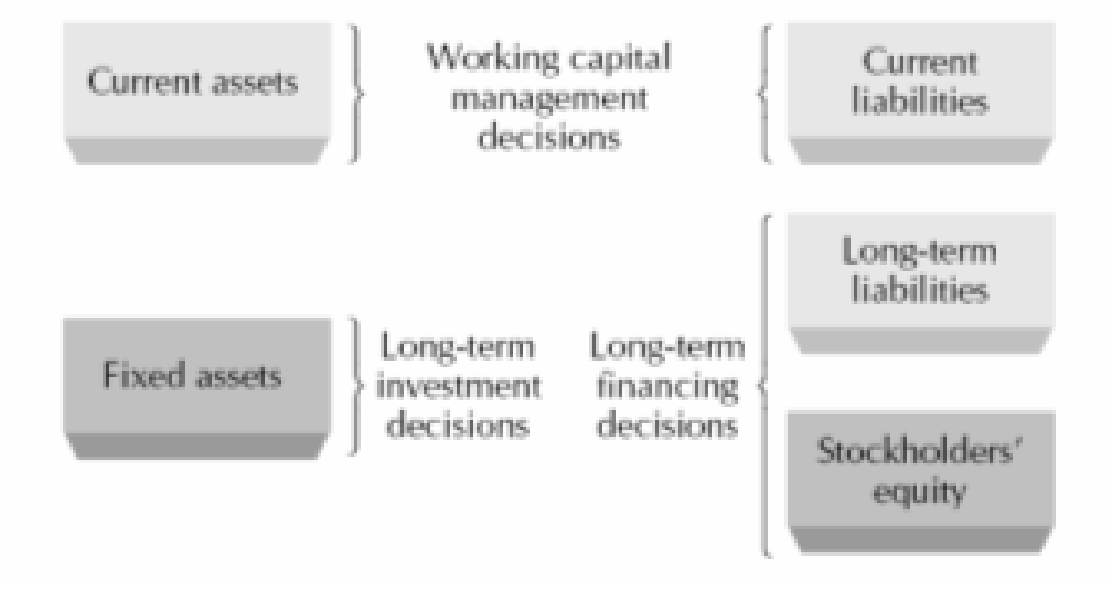

Three major types of financial decisions:

Long-term investment decisions

Long-term financing decisions

Working Capital Management Decisions

1.2.1 Long-term investment decisions

-Involving buying, holding, reducing, replacing, selling, and managing assets

-Investment principle: return should be greater than the hurdle rate

-What is hurdle rate?

1.2.2 Long-term financing decisions

-Involve the acquisition of funds needed to support long-term investment----capital structure;

-Obtain the needed funds either internally or externally;

-Internally generated funds: retained earnings, dividend policy;

-Externally raised funds: incurring debts, offering stocks;

-Financial mix should maximize the value of the investments and match the financing to the assets being financed.

1.2.3 Working Capital Management Decisions

-Decisions involves a firm’s short- term assets and liabilities.

-How much of a firm’s total assets should the firm hold in each type of current asset such as cash, marketable securities, and inventory?

-How much credit should the firm grant to customers?

-How should the firm obtain needed short-term financing?

Financial management decisions

1.3 Risk–Return Tradeoff

Risk aversion: investors should expect a higher return for taking on higher levels of risk