Chapter 6 Macroeconomic Policy in an Open Economy

Unit 2

LEARNING OUTCOMES 学习效果:

understand the policy agreement and policy conflict

recognize the importance of policy coordination

examine the sources of currency crises

FOCUS AND DIFFICULTIES 知识重难点:

Focus: explain the difference bewteen Policy Agreement vs. Policy Conflict, understand the Policy cooperation and policy coordination

Difficulty: understand a variety of sources of currency crises

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Macroeconomic Stability and the Current Account: Policy Agreement vs. Policy Conflict

Assume that an open economy suffers from recession and its current account realizes a deficit where imports exceed exports.

Given a floating exchange rate system, to combat recession, an expansionary monetary policy can be used to stimulate the aggregate demand and it results in currency depreciation because of capital outflows caused by a lower domestic interest rate. A currency depreciation will increase the exports and depress the imports, thus reducing the current account deficit.

Thus, in this case, an expansionary policy is appropriate for combating the recession, is also compatible with the objective of reducing the current account deficit.

Policy agreement occurs when an economic policy helps eliminate internal disequilibrium and external disequilibrium, thus promoting overall balance for the nation.

Assume that an economy suffers from inflation and a current account deficit.

When adopting a contractionary monetary policy to moderate inflation, the domestic interest rate will increase which results in capital inflows and a currency appreciation. This appreciation will reduce exports and increase imports, thus leading to a larger current-account deficit.

So, in this case, a contractionary monetary policy used to combat inflation would conflict with the objective of promoting its current account balance.

Policy conflict occurs when an economic policy helps eliminate one economic problem, such as internal disequilibrium, but aggravates another economic problem such as external disequilibrium.

So, when an economy finds itself in a policy conflict zone, monetary or fiscal policy alone will not restore both internal and external balance. Then, a combination of policies is needed.

Assume a nation experiences inflation with unemployment.

We have known that to decrease inflation, a reduction in aggregate demand is needed; while, to decrease unemployment, a rise in aggregate demand is needed.

So, in this case, the objectives of full employment and stable pricecs cannot be reached just by changing aggregate demand through one policy instrument.

In this case, they are two independent targets, requiring two distinct policy instruments.

Achieving overall balance involves three separate targets: current account equilibrium, full employment, and price stability.

To ensure all three objectives can be achieved simultaneously, monetary and fiscal policy may not be enough; exchange rate adjustments, direct controls may also be needed.

2. International Economic-Policy Coordination

Because of the international flows of goods, services, capital, and labor, economic policies of one nation have spillover effects on others. The welfare of an economy is linked to that of the world economy. So, governments have often made attempts to coordinate their economic policies.

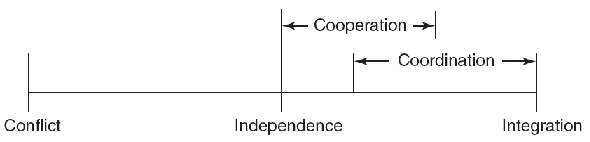

Economic relations among nations can be visualized along a spectrum, ranging from conflict to integration where nations implement policies jointly, such as the European Union.

At the midpoint lies policy independence: nations do not attempt to influence the actions of other nations or be influenced by them.

Between independence and integration are a variety of forms of cooperation and coordination.

Policy cooperation generally occurs when officials from different nations meet to present briefings on their individual economies, discuss current policies and evaluate world economic conditions.

And, policy coordination is a formal agreement among nations to initiate particular policies.

International economic policy coordination is the attempt to significantly modify national policies in recognition of international economic interdependence.

Consider the exmaple. Suppose the world consists of just two nations, Germany and Japan.

Assume these nations trade goods with each other and both nations achieve balanced trade with each other.

Assume both nations operate below full employment and each nation wants to avoid trade deficits with each other while achieving full employment for its economy.

To stimulate the real GDP, employment, Japan can implement an expansionary fiscal policy.

But if Japan expands its government spending unilaterally and Germany takes no actions, it will raise Japanese demand for German products, thus worsening the trade balance of Japan.

So, to avoid a trade deficit with Germany, Japan will not implement the expansionary policy. And, so did the Germany.

If Germany and Japan agree to simultaneously increase their government spending, then real GDP, employment and incomes will rise in each nation.

Higher German income promotes increased imports from Japan; (in other words, Japan exports rise)

Higher Japanese income promotes increased imports from Germany; (namely, German exports rise)

As a result, an increase in German imports is offset by an increase in its exports and an increase in Japan's imports is offset by a rise in its exports, so the balanced trade between Germany and Japan can be maintained as expansionary fiscal policies are used to stimulate the economic growth.

Thus, in our example of mutual implementation of expansionary fiscal policies, policy coordination permits each nation to achieve full employment and balanced trade.

In the real world, policy corrdination generally involves many countries and diverse objectives, such as low inflation, high employment, economic growth, and trade balance.

Among the problems confronting international economic policy coordination are (1) different national economic objectives, (2) different national institutions, (3) different national political climates, and (4) different phases in the business cycle.

3. Currency Crises

Sources of currency crises

(1)Currency speculators.

A popular explanation is that big currency speculators instigate the crises for their own profits. The world's best known currency speculator, George Soros, made $2 billion in 1992 by speculating against European currencies and 300 million dollars in 1997 by speculating against the Thailand baht.

(2)Budget deficits financed by inflation.

One source for a currency crisis is budget deficits financed by inflation. If the government is limited to raise taxes or borrow to finance its budget deficits, it may pressure the central bank to finance them by printing money. Printing money will cause high inflation and the value of money to decline.

(3)Weak financial systems.

The financial system is vulnerable to systemic risk. The public will be worried about the future value of local currency and be incentive to sell it to hold more stable foreign currencies, thus driving the value of local currency to fall.

(4)Recently deregulated financial systems.

When the governments remove some formerly used restrictions, reduce the direction of investments and allow more competition among financial institutions, financial institutions would be likely to invest aggressively in some risky assets. And once they failed, pulic fears about the future value of local currency will result.

(5)A weak economy.

A weak economy can trigger a currency crisis by creating doubt about the determination of the government and the central bank to continue with the current monetary policy if weakness continues. If the public expects the central bank to increase money supply to stimulate the economy, it may become pessimistic about the future value of the local currency and begin selling it on currency markets.

(6)Political factors.

Political instability would result in a weaker rule of law, and political uncertainty about monetary policy.

(7)External factors.

In particular, a sudden rise in interest rates in major international currencies such as the U.S. dollar would result in funds flow out of the local currency into foreign currency, decreasing the central bank's reserves and therefore pressuring the government to devalue its currency if the currency is pegged. Moreover, a big external shock that disrupts the economy, such as a war, or a oil shock.

(8)Choice of an exchange-rate system.

A fixed exchange rate system makes countries more vulnerable to speculative attacks on their currencies. It is no wonder that the most important currency crises have happened to countries having fixed system.

Ways to end selling pressure:

One way to end pressure is to devalue and establish a new exchange rate at a sufficicently low level.

Or, to directly float its exchange rate value, which permit the exchange rate of its currency to find its own level.

Currency crises that end in devaluations or accelerated depreciations are called currency crash. Not all crises end in crashes.

A way of trying to end the selling pressure of a crisis without suffering a crash is to impose restrictions on the ability of people to buy and sell foreign currency.

Another way to end selling pressure is to obtain a loan to support the foreign reserves of the central bank, typically ask the IMF for loans.

The final way to end selling pressure is to restore confidence in existing exchange rate.