Chapter 6 Macroeconomic Policy in an Open Economy

Unit 1

LEARNING OUTCOMES 学习效果:

Identify objectives of macroeconomic policy and the tools of international economic policy

Discuss how the monetary and fiscal policy influence the performance of an economy

Examine the difference of the effectiveness on of monetary and fiscal policy in promoting internal balance for a closed versus open economy

FOCUS AND DIFFICULTIES 知识重难点:

Focus: understand internal and external balance, recoganize the tools of macroeconomic policies

Difficulty: explain the initial and second effect of expansionary policy in an open economy

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Economic Objectives of Nations

Internal balance, this goal has two dimensions: a fully employed economy and no inflation---or more realistically, a reasonable amount of inflation. Nations typically more value internal balance and thus adopted economic policies to achieve this goal.

Policymakers are also concerned about a nation's currenct account balance. A nation is said to be in external balance when it realizes neither deficits nor surpluses in its current account.

And, an economy realizes overall balance when it achieves both internal balance and external balance.

Policy Instruments

Expenditure-changing policies influence the level of total spending for goods and services produced domestically, namely aggregate demand.

They include fiscal policy that involves changes in government spending and taxes and monetary policy that involves changes in the money supply and interest rates, through open makert purchases or reserve requirements by the central bank.

Expenditure-switching policies modify the direction of demand, switching expenditures away from foreign goods to domestic goods.

Exchange rate adjustments is the most commonly used expenditure-switching policy,

Under a fixed ex-rate system, a nation with trade deficit could devalue its currency to increase the international competitiveness of its firms, thus increasing foreign demand for domestically produced goods and decreasing domestic demand for importing goods.

Under a managed floating system, a nation could purchase foreign currencies with selling home currencies, causing its currency to depreciate, so as to increase its competitiveness.

Direct controls consist of government restrictions on the market economy in order to control particular items in the current account.

For instance, trade barriers such as tariffs and quotas are imposed on importes in an attempt to switch domestic spending away from foreign goods to domestic goods.

Export-promotion measures such as export susidies can increase the nation's export, through which the government provides cash subsidies or tax advantages to exporters so as to reduce the relative price of export goods, improve the international competitiveness of export goods.

Foreign-exchange controls and investment controls may also be used to restrain capital outflows or to stimulate capital inflows.

2. Aggregate demand-aggregate supply model

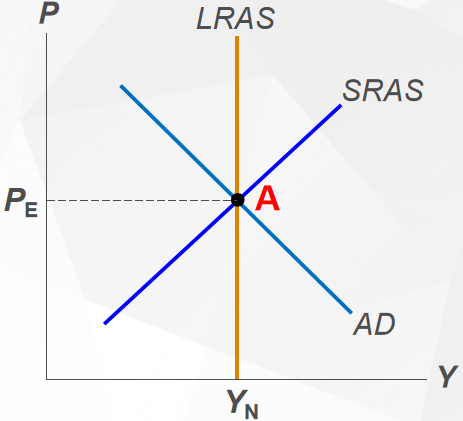

Aggregate demand curve (AD) describe the level of real output (real GDP) purchased at any given price level during a given year.

AD consists of spending by domestic consumers, by businesses, by government, and by foreign buyers (net exports).

As the price level falls, the quantity of real output demanded increases.

Aggregate supply curve (AS) shows the amount of real output that will be produced by the economy at any given price level during a given year.

In the short run, the aggregate supply curve is upward-sloping. In the long run, the aggregate supply curve is vertical.

The economy is in equilibrium where the AD curve intersects the AS curve. This intersection determines the equilibrium price level and output for the economy.

In equilibrium, the economy realizes the full employment level of real GDP and a natural rate of unemployment.

Shifts in AD curve result from changes in the determinants of AD like Consumption, investment, government purchases, or net exports.

Shifts in AS curve result from changes in the production factors, technology or the expected price level.

3. Monetary and Fiscal Policy in a Closed Economy

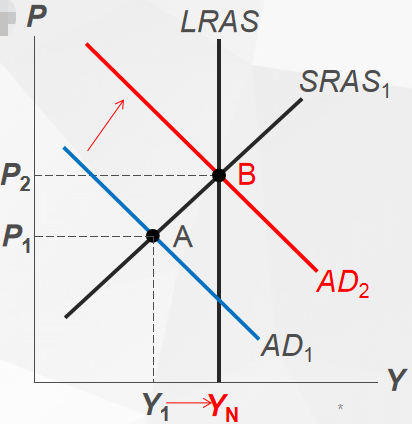

(1) Suppose a recession reduces the aggregate demand largely, the economy suffered from a low real GDP and a high unemployment.

The government traditionally adopt expansionary monetary or fiscal policies to increase aggregate demand.

In particular, to end the recession, an expansionary monetary policy is implemented that increases the money supply and reduces the interest rate. A lower interest rate will encourage consumption and investment spending, thus raise the aggregate demand, shifting the AD curve to right until achieveing the full employment level of real GDP at point B.

Or, the government can implement an expansionary fiscal policy through increasing the government spending, or lowering income taxes that would increase the amount of disposable income in the hands of households and thus stimulate more consumption spending, so that the aggregate demand would increase and unemployment would decline in the economy.

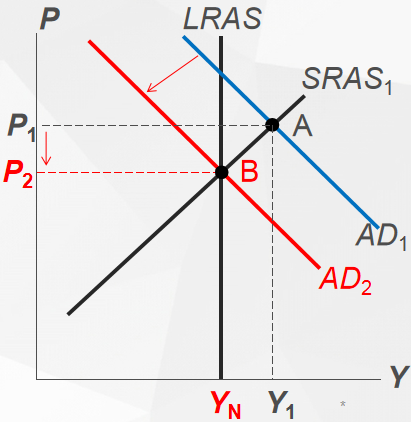

(2) Consider the economy suffered from a very high inflation, the government could use contractionary monetary or fiscal policy to reduce the aggregate demand, thus moderating the inflation.

In particular, to offset the high inflation, the central bank can decrease the money supply by selling securities in open market and the interest rate will rise. A higher interest rate will reduce consumption and investment spending, thus decreasing the aggregate demand. The AD curve shifts to left, so the price level will decline.

Or, the government can use contractionary fiscal policy to decrease government spending or increase the income taxes that discourage consumption spending, so that the aggregate demand would decrease and the price level will be chilled down.

Conclusion:

In a closed economy, it doesn't involve international trade and investment. So, an expansionary monetary or fiscal policy has a single effect on aggregate demand: it causes an increase in aggregate demand by increasing domestic consumption, investment or government spending.

4. Monetary and Fiscal Policy in an Open Economy

In an open economy, the policy has second effect on aggregate demand: it causes aggregate demand to increase or decrease by changing net exports and other determinants of aggregate demand.

If the initial and second effects both result in increases in aggregate demand, the expansionary effect of the policy is strengthened.

If the initial and second effects have conflicting impacts on aggregate demand, the expansionary effect of the policy is weakened.

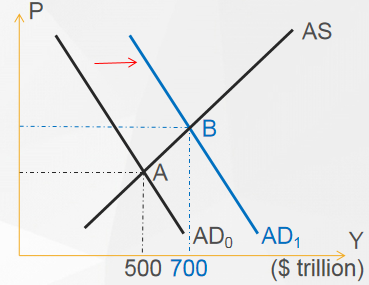

(1) Expansionary fiscal policy; fixed exchange rates

The economy operates under a fixed exchange rate system and in the begining, the government has a balanced budget in which the government spending equals the tax revenue.

Suppse now the economy suffered from a recession.

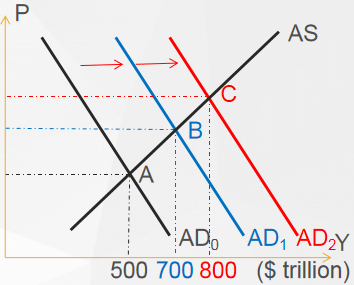

To stop a recesssion, the government conducts an expansionary fiscal policy, an increase in government spending (G↑).

This initial effect is to increase aggregate demand from AD0 to AD1, just like what occurs in the example of expansionary monetary policy in closed economy.

This increase causes equilibrium real GDP to rise from 500 to 700 trillion dollars.

The second effect of the expansionary fiscal policy is that increased government spending causes the government budget to run into a deficit. As the government demands more money to finance its budget deficit, it would occupy part supply of loanable funds and leave smaller amount of loanable funds for private sector to borrow for investment, and thus drive up the domestic interest rate.

A higher interest rate attracts a foreign capital inflow that results in an increased demand for domestic currency in foreign exchange market.

So, the nation's currency tends to appreciate. However, to defend a fixed rate, the government would intervene in foreign exchange market by purchasing foreign currency with domestic curreny, thus increasing the supply of domestic money.

An increase in the domestic money supply will stimulate consumption spending and investment spending.

So, the aggregate demand would increase further to AD2.

This increase causes equilibrium real GDP to rise further from 700 to 800 trillion dollars.

To conclude, the initial effect and second effect of an expansionary fiscal policy in an open economy with fixed exchange rate both cause the aggregate demand to increase, so real GDP increases by a larger amount than in the example of expansionary fiscal policy in a closed economy.

(2) Expansionary monetary policy; fixed exchange rates

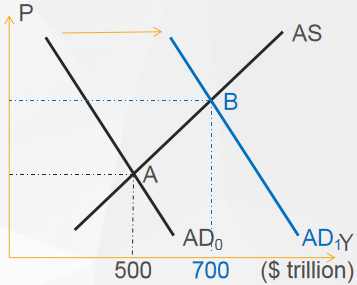

To stop a recession, the government also can implement an expansionary monetary policy.

The initial effect of the monetary policy is to reduce the interest rate, causing the consumption and investment to increase, so the aggregate demand increase from AD0 to AD1.

Real GDP rises from 500 to 700 trillion dollars initially.

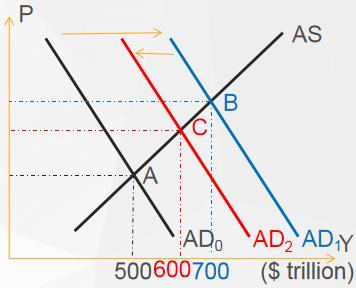

Second effect:

A lower interest rate will reduce foreign investment in this country, resulting in capital outflows. So, the demand for the nation's currency in foreign exchange market will decline, and the domestic currency tends to depreciate.

To defend the fixed exchange rate, the central bank will intervene by purchasing domestic currency and selling foreign currency in foreign exchange market.

So, this purchase causes the domestic money supply to decrease, causing the consumption and investment spending to decline. Then, the aggregate demand would decline from AD1 to AD2.

Real GDP declines from 700 to 600 trillion dollars.

Thus, the initial effect of expansionary monetary policy in an open economy with fixed exchange rate is to increase the aggregate demand but the second effect is to decrease the aggregate demand. Under a fixed system, monetary policy is less effective in stimulating the economy than it is in a closed economy.

(3) Expansionary fiscal policy; floating exchange rates

To stop the recession, the government implements an expansionary fiscal policy. The initial effect is to increase the aggregate demand because of the direct increase in government spending.

As the increased government spending causes the government budget to run into deficit, the domestic interest rate rises.

A higher interest rate will attract foreign capital inflows, thus increasing demand for domestic currency in the foreign exchange market.

In a floating system, the domestic currency will appreciate freely. An appreciation of domestic currency will discourage exports and encourage imports, thus net exports decreases and aggregate demand declines.

Since, the initial effect and second effect of the fiscal policy are conflicting, under a floating system, the policy's expansionary effect is weakened.

(4) Expansionary monetary policy; floating exchange rates

The initial effect is to lower the interest rates and stimulate consumption and investment spending, thus aggregate demand increases initially.

After that, a lower interest rate will result in capital outflows. With a floating system, the domestic currency will depreciate.

While, a depreciation of domestic currency will benefit the exports and decrease the imports, thus net exports increases and aggregate demand increases.

So, the initial effect and second effect of monetary policy are complementary, both increasing the aggregate demand. The monetary policy is strengthened under a floating system in a open economy.

The effectiveness of monetary and fiscal policy in promoting internal balance for an economy with a high degree of capital mobility:

Exchange-Rate Regime | Monetary Policy | Fiscal Policy |

Floating exchange rates | Strengthened | Weakened |

Fixed exchange rates | Weakened | Strengthened |

In an open economy with a floating system, the monetary policy is more effective and the fiscal policy is less effective in promoting real GDP than they are in a closed economy.

For an open economy with a fixed system, the fiscal policy is more effective and the monetary policy is less effective in promoting real GDP than they are in a closed economy.