Chapter 5 Exchange Rate Systems

Unit 1

LEARNING OUTCOMES 学习效果:

Identify the current ex-rate practices revealed by IMF

Examine the concepts of fixed ex-rate system

Explain how the government use foreign intervention to defend its official rate

FOCUS AND DIFFICULTIES 知识重难点:

Focus: explain how the government defend its official rate throught purchase and sale of currencies

Difficulty: understanding the nature of each ex-rate arrangement in IMF classification

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Exchange Rate Practices

In choosing an exchange rate system, a nation must decide whether to allow its currency to be determined by market force (floating rate) or to be fixed (pegged) against some standard of value.

Under a floating rate system, a nation need decide whether to float independently, or float in unison with a group of other currencies, or to crawl according to a predetermined formula, such as relative inflation rates.

While, under a pegged system, a nation need decide whether to anchor to a single currency like U.S. dollar, euro, or anchor to a basket of currencies, or anchor to gold –however, gold was not used to value the currencies anymore since 1971.

IMF members are free to choose the exchange rate regime, subject to three conditions:

Exchange rates should not be manipulated to prevent effective balance-of-payments adjustments or to gain unfair competitive advantage over other members;

Members should act to counter short-term disorderly conditions in exchange markets;

When members intervene in exchange markets, they should take into account the interests of other members.

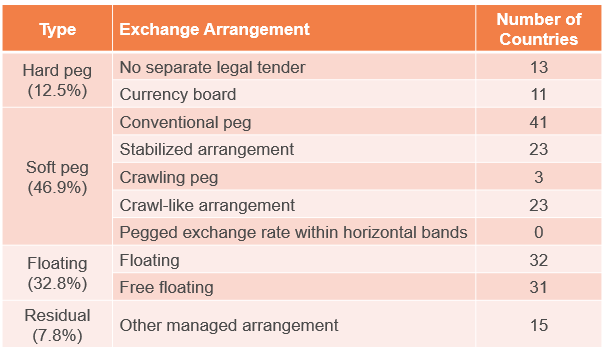

Exchange Rate Arrangements of IMF Members, April 30, 2020 (Source: 2020 Annual report on exchange arrangements and exchange restrictions by International Monetary Fund)

Countries with soft pegs make up the single largest type of exchange rate arrangement, accounting for 46.9 percent of all members. Soft pegs were 14 percentage points higher than floating arrangements at the end of April 2020.

(1) With an exchange rate arrangement with no separate legal tender, the currency of another country circulates as the sole legal tender. Adopting such an arrangement implies the complete surrender by the monetary authorities of control over domestic monetary policy.

Since 1907, Panama has used the U.S. dollar as the currency in circulation. Its local currency is balboa, which is equivalent to the U.S. dollar. It is the first country in the world to use the U.S. dollar as legal tender except the United States.

(2) A currency board arrangement involves an explicit legislative commitment to exchange domestic currency for a specified foreign currency at a fixed exchange rate. This implies that domestic currency is usually fully backed by foreign assets, eliminating traditional central bank functions such as monetary control and lender-of-last-resort and leaving little scope for discretionary monetary policy.

The Linked Exchange Rate System (LERS) has been implemented in Hong Kong since 17 October 1983. Through a Currency Board system, the LERS ensures that the Hong Kong dollar exchange rate remains stable within a band of HK$7.75-7.85 to one US dollar.

(3) The conventional peg arrangement holds the largest share among soft pegs. The number of countries in this category remained at 43.

For this category the country formally (de jure) pegs its currency at a fixed rate to another currency or basket of currencies, where the basket is formed, for example, from the currencies of major trading or financial partners and weights reflect the geographic distribution of trade, services, or capital flows. The anchor currency or basket weights are public or notified to the IMF.

The exchange rate may fluctuate within narrow margins of less than ±1% around a central rate.

In 1986, the Saudi Riyal was pegged to the dollar at a fixed rate of 1:3.75.

(4) For a stabilized arrangement, the maximum and minimum value of the spot market exchange rate must remain within a narrow margin of 2% for six months or more. The classification does not imply a policy commitment on the part of the country authorities. The category “stabilized arrangement” remained the second largest among the soft pegs.

(5) For a crawling peg, the currency is adjusted in small amounts at a fixed rate or in response to changes in selected quantitative indicators, such as past inflation differentials relative to major trading partners or differentials between the inflation target and expected inflation in major trading partners. The rules and parameters of the arrangement are public or notified to the IMF.

(6) For a crawl-like arrangement, the exchange rate must remain within a narrow margin of 2% relative to a statistically identified trend for six months or more and the exchange rate arrangement cannot be considered as floating. Normally, a minimum rate of change is greater than that allowed under a stabilized arrangement.

Countries adopting stabilized and crawl-like arrangements often adjust their exchange rates in response to external events, including differences in inflation across countries, capital flow pressures, and new trends in world trade.

China officially confirmed a managed floating exchange rate regime based on market supply and demand with reference of a basket of currencies since July 1, 2005. While, IMF classified China's de facto ex-rate as a crawl-like arrangement.

(7) Pegged exchange rates within horizontal bands, for this catergory, the exchange rate may fluctuate within narrow margins of at least ±1% around a fixed central rate or the margin between the maximum and minimum value of the exchange rate exceeds 2%.

(8) A floating exchange rate is largely market determined, without an predictable path for the rate. Floating arrangements may exhibit more or less exchange rate volatility, depending on the size of the shocks affecting the economy.

(9) A floating exchange rate can be classified as free floating if intervention occurs only exceptionally and aims to address disorderly market conditions and if the authorities have provided information or data confirming that intervention has been limited to at most three instances in the previous six months, each lasting no more than three business days. If the information or data required are not available to the IMF staff, the arrangement will be classified as floating.

(10) Other managed arrangement, this category is a residual and is used when the exchange rate arrangement does not meet the criteria for any of the other categories. Arrangements characterized by frequent shifts in policies may fall into this category.

This type of arrangement is characteristic of periods during which volatile foreign exchange market conditions hinder the use of more clearly defined exchange rate arrangements.

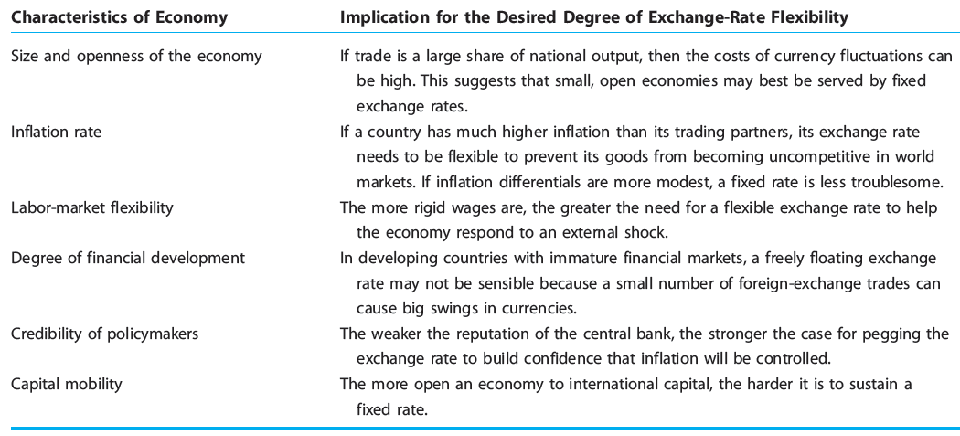

How to choose an exchange rate system? It depends on the size and openness of the economy, inflation rate, labor-market flexibility, the degree of financial development, credibility of policymakers, and capital mobility.

Note that there will never be a single exchange rate regime suitable for all countries or all periods. The choice of exchange rate system depends on a country's national conditions.

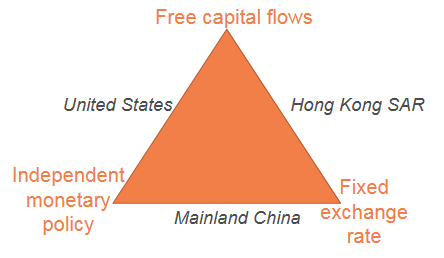

Allowing free capital flows constrains a country’s choice of an exchange-rate system and its ability to operate an independent monetary policy.

A country can maintain only two of the following three policies: Free capital flows, A fixed exchange rate, An independent monetary policy; called an Impossible Trinity.

U.S. allows the free capital flows and adpots an independent monetary policy, thus has a floating ex-rate system. For instance, to control inflation, the Fed rasies the relative interest rates, attracting capital flowing into U.S. and pushing the exchang value of U.S. dollar to appreciate. Conversely, to stimulate the economic growth, the Fed lowers the relative interest rates, capital flowing out of U.S. and causing the exchang value of U.S. dollar to depreciate.

While, Hong Kong SAR adopts a link ex-rate system to fix the ex-rate of HKD to USD and allows free capital flows, but it eliminates the independence on Hong Kong's monetary policy. The primary function of HK monetary administration is to maintain the stability of HKD's ex-rate. The HK monetary administration cannot use the monetary policies to stimulate the economic performance.

For mainland China, to remain a relatively stable ex-rate and keep an independent monetary policy, it need constraint the capital flows in a large degree. However, as an increasing openess of China's capital market, China must face with a more volatile ex-rate than before.

2. Fixed Exchange Rate System

In a fixed ex-rate system, a currency’s value is fixed against the value of another currency, or a basket of other currencies such as SDRs, or a commodity such as gold, known as the gold standard.

Fixed ex-rate systems tend to be used primarily by small, developing nations whose currencies are anchored to a key currency.

A key currency is widely traded on world money markets, demonstrated relatively stable values over time, and widely accepted as a means of international settlement, and accounts for the largest of international reserves assets such as the U.S. dollar.

The developing country pegs its currency to the currency of its dominant trading partner.

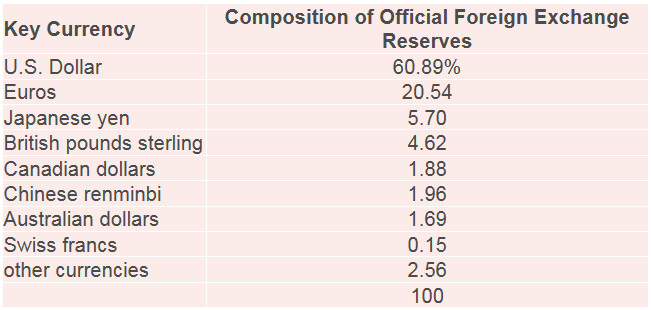

IMF released data on the currency composition of foreign exchange reserves of member countries. 2019Q4.

The U.S. dollar still dominates the ranking, thus maintain its international reserve currency position.

Under a fixed ex-rate system, governments have assigned their currencies a par value in terms of gold or other key currencies.

For instance, under the Gold Standard (1880-1914), the U.S. buy and sell the gold at a fixed price of $35 per ounce while the U.K. buy and sell gold at £12.50 per ounce.

By comparing the par values of two currencies we can determine their official ex-rate: $35/£12.50=$2.80 per pound. The classical gold standard was the earliest establishment of fixed ex-rate system.

To defend the official ex-rate, governments set up an exchange stabilization fund. Through purchases and sales of foreign currencies, the exchange stabilization fund can ensure the market ex-rate doesn’t move above or below the official ex-rate.

Example:

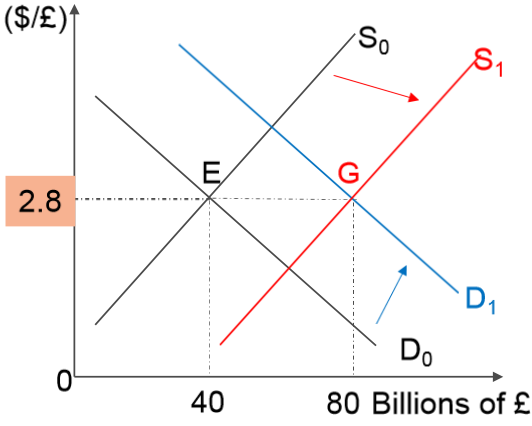

Assume British officials define its official rate as $2.8 per pound.

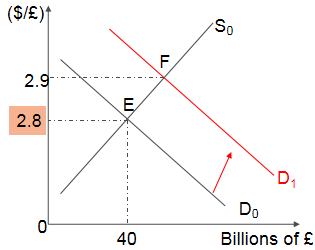

(1) Now suppose the rising attracts additional purchases of UK securities, resulting in excess demand for pounds, shifting the demand schedule rightward from D0 to D1. Under free market conditions, the pound would appreciate from $2.8 to $2.9/£.

(under free market conditions, pounds would appreciate above the official rate of $2.8/£)

(under free market conditions, pounds would appreciate above the official rate of $2.8/£)

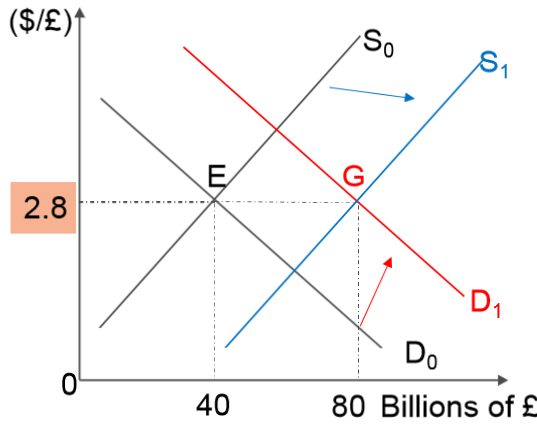

But under fixed ex-rate system, the British officials need defend its official rate at $2.8/£. However, at this rate, there now exists a shortage of pounds supply equal to £40 billion.

Thereby, the U.K. exchange stabilization fund would provide the shortage of supply through selling the pounds and buying dollars, in order to prevent the pound from appreciating beyond $2.8/£.

Thus, the supply schedule of pounds shifts from S0 to S1 and the market ex-rate can be stable at $2.8/£.

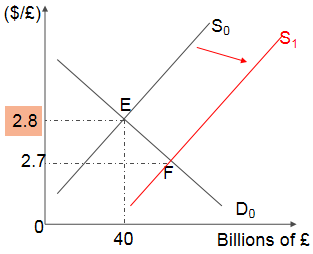

(2) Now suppose U.K. imports more from U.S., increasing the supply of pounds and shifting the supply curve of pounds to right. Under free markets, the pound would depreciate from $2.8/£ to $2.7/£.

(under free market conditions, pounds would depreciate below the official rate of $2.8/£)

(under free market conditions, pounds would depreciate below the official rate of $2.8/£)

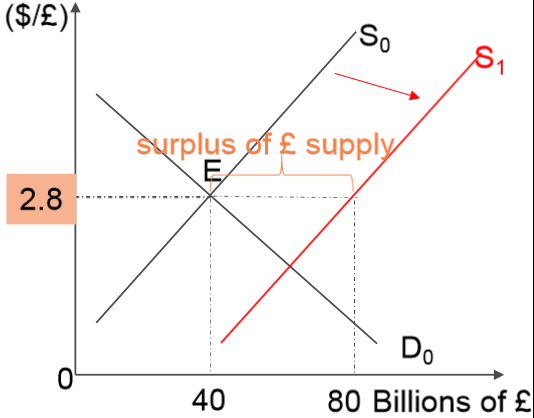

To defend the official rate of $2.8/£, the U.K. exchange stabilization fund would purchase the excess supply of pounds with dollars.

The demand curve of pounds would shift from D0 to D1. And, the market ex-rate can be stable at $2.8/£.

To conclude:

If the currency is going to appreciate above the official rate, government must sell that currency to meet the shortage of supply.

If the currency is going to depreciate below the official rate, government must buy that currency to absorb the excess supply.

The terms: Devaluation 法定贬值/ Revaluation 法定升值refer to a legal redefinition of a currency’s par value under a fixed ex-rate system;

The terms: Depreciation 货币贬值/ Appreciation 货币升值refer to changes in the market ex-rate caused by a redefinition of a par value or changes in the supply or demand for foreign exchange.

Under a fixed ex-rate system, government could achieve a BOP equilibrium by devaluing or revaluing its currency.

To be specific, currency devaluation is to cause the home currency’s exchange value to depreciate thus reducing a payments deficit;

while, currency revaluation is to cause the home currency’s exchange value to appreciate, thus reducing a payments surplus.