Chapter 4 Exchange Rate Adjustments and the Balance of Payments

Unit 2

LEARNING OUTCOMES 学习效果:

At the end of this lecture, students should be able to

understand the J-curve effect and ex-rate pass through

explain time path of depreciation

examine the absorption approach to currency depreciation

FOCUS AND DIFFICULTIES 知识重难点:

Focus: J-curve effect, complete pass-through, partial pass-through

Difficulty: Understand time lags bwteen changes in ex-rates and changes in export and import quantity

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Time Path of Depreciation

Example:

U.K. export 100 bicycles to U.S. at £100 each; V(UK Export)=100*£100=£10,000

U.K. import 200 stereo system from U.S. at $50 each; e=£1/$; V(UK Import)=200*$50*£1/$=£10,000

U.K. trade balance is in equilibrium initially. Because V(UK Export)=V(UK Import).

Suppose now £ depreciates 10%,

Pound depreciation makes UK bicycles cheaper for U.S. consumers and makes U.S. stereo more expensive for UK consumers than before.

Once realizing this price change, U.S. consumers are likely to buy more UK bicycles while UK consumers tend to buy less U.S. stereo, thus increasing the quantity of UK export and decreasing the quanity of UK import.

When demand elasticities are high, according to Marshall-Lerner condition, pound depreciation will improve its trade balance by increasing UK export receipts and decreasing UK import expenditures.

However, in real world, there tends to be a time lag between changes in ex-rates and their ultimate effect on trade balance. Because the quantity of exports and imports change little at first due to prior commitments.

For instance,

UK exporters and U.S. buyers have agreed on a two-year trading contract for 100 bicycles a year.

UK importers and U.S. producers also agreed on a two-year trading contract for 200 stereo a year.

The breaching party need pay huge unaffordable liquidated damages. So, under the binding force of the contract, it is not allowed to adjust the export quantity and import quantity in the short run.

(1)Therefore, in the short run,

Even though each UK bicycle costs U.S. consumers fewer dollars due to pound depreciation, U.S. consumers cannot increase their purchases of UK bicycles in short run due to the contract.

The quantity of UK export still stay at 100 bicycles. With the pound price of one bicycle at 100 pounds, the value of UK export receipts was still £10,000.

Meanwhile, 10% pound depreciation causes the pound price of one U.S. stereo to rise by 10%, to £55.

However, UK importers cannot reduce the quantity of imported stereo in short run due to its commitment.

The quantity of UK import still stay at 200 stereo. So, the value of UK import expenditures increase to £11,000 (=200*£55).

Notice that the UK export recepits become smaller than UK import expenditures at first. UK trade balance gets worse in the short run due to the pound depreciation.

(2)As time passes, the quantity of bicycles and stereo can be adjusted in the contract.

10% pound depreciation makes the dollar cost of UK bicycle decrease by 10%, if US demand elasticity for UK export is 1.5, thus increasing the quantity of UK bicycle demanded by 15%, from 100 to 115. The value of UK export = the quantity of bicycle demanded * the pound price of each bicycle=115*£100=£11500.

10% pound depreciation makes the pound cost of U.S. stereo increase by 10% to £55, if UK demand elasticity for import is 2.5, thus decreasing the quantity of UK import demanded by 25%, from 200 to 150. The value of UK import = the quantity of stereo demanded * the pound price of each stereo=150*£55=£8,250

Notice that the UK export recepits exceed UK import expenditures finally. UK trade balance is likely to improve in the long run due to the pound depreciation.

Implications from this example:

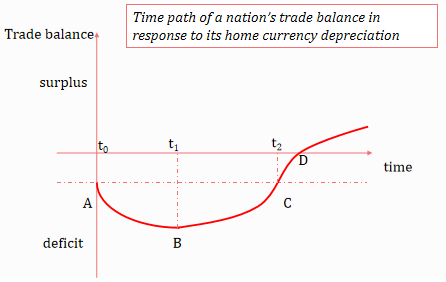

The initial effect of depreciation is an increase in import expenditures: the home currency price of imports has risen, but the quantity is unchanged owing to prior commitments.

After some time, the volume of exports start to rise because of their lower and more competitive prices to foreign buyers, and the volume of imports start to fall because of the more expensive foreign goods to domestic consumers.

Eventually, the trade balance should move to a smaller deficit or larger surplus compared to what it was before the devaluation.

After home currency's depreciation, the nation's trade balance continues to get worse in the very short term; but as time passes, the trade balance will likely improve, assuming that the demand elasticities are high. And, the description of the time path of trade flows is so called J-curve effect.

2. Exchange Rate Pass-Through

The extent to which changing currency values lead to changes in import and export prices

Complete exchange rate pass-through 完全汇率传递: Percentage change in import and export prices will be one for one adjustment to percentage change in ex-rates.

(1)Assume Toyota exports autos to U.S. and the price is fixed at 1,350,000yen; e=150yen/$,

U.S. import price=1350000/150=$9,000

Suppose now dollar depreciates 10% against yen; e'=135yen/$,

U.S. import price=1,350,000/135=$10,000, will rise by 10% in $ terms.

To conclude: U.S. Import prices in dollars rise by the same proportion of the dollar depreciation.

(2)Assume U.S. export tractors to Japan and the price is fixed at $50,000; e=150yen/$

Yen price of U.S. export=7,500,000yen

Suppose now dollar depreciates 10% against yen; e'=135yen/$

U.S. export price =50,000*135=6,750,000yen, decline by 10% in yen terms.

To conclude: U.S. Export prices in yen decline by the same proportion of the dollar depreciation.

(3)Example (continued.)

If dollar depreciates 10% against yen,

Toyota may realize that U.S. consumers tend to reduce their purchases of Toyota's autos due to a rising U.S. import price in $.

Thus, Toyota is likely to lower its yen price of autos so as to offset the negative effects of dollar depreciation on its sales. ( yen price of auto decreases below 1,350,000 yen)

In the end, U.S. import prices in $ terms rise by less than 10%.

Partial exchange rate pass-through部分汇率传递: percentage change in export or import prices is less than percentage change in the exchange rate.

3. The Absorption Approach to Currency Depreciation

Recall that GDP measures a nation's total spending, which consists of consumption (C), investment (I), government expenditures (G) and net exports (X-M).

Y = C + I + G + (X-M)

Absorption, A = C + I + G

Balance of trade, B = (X-M)

Total domestic output (Y) = Absorption (A) +Net exports (B)

B = Y – A

So, if national output exceeds domestic absorption(Y>A), the nation's trade balance is positive(B>0); while, if an economy is spending beyond its ability to produce(Y<A), its trade balance is negative(B<0).

The absorption approach suggests that currency depreciation will improve an economy’s trade balance only if national output rises relative to absorption.

So, a country must increase its total output or reduce its absorption or combine the two, so as to improve its trade balance.

(1)Suppose an economy faces unemployment and a trade deficit at the same time. It indicates that the economy is operating below its maximum productive capacity.

A currency depreciation tends to lower the nation's relative price, thus increasing the quantity of export demanded and decreasing the quantity of import demanded.

In this case, a currency depreciation can direct idle resources into the production of goods for export and transfer spending from imports to domestically produced substitutes.

Therefore, it can increase domestic output and improve the trade balance.

(2)If an economy already achieves full employment, which means it already achieves its natural rate of output, namely the long run equilibrium level of output under the maximum productive capacity. In other words, there are no idel resources left to expand production for exports.

In this case, the only way for a currency depreciation to reverse its trade deficit is to reduce domestic absorption.

Thus, domestic policymakers could use restrictive fiscal and monetary policies to reduce domestic absorption, but sacrificing some sectors' benefits.

So, currency depreciation or devaluation is not popular when an economy is operating at maximum capacity.