Chapter 3 Exchange Rate Determination

Unit 3

LEARNING OUTCOMES 学习效果:

At the end of this lecture, students should be able to

understand the concepts of overshooting

explain why the exchange rate overshoots in the short run and returns back to the long run equilibrium value

identify the methods that currency forecasters use to predict exchange-rate movements

FOCUS AND DIFFICULTIES 知识重难点:

Focus: the concepts of overshooting, judgemental, technical, and fundamental analysis

Difficulty: ex-rate path when a country increases its money supply unexpectedly

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Exchange Rate Overshooting

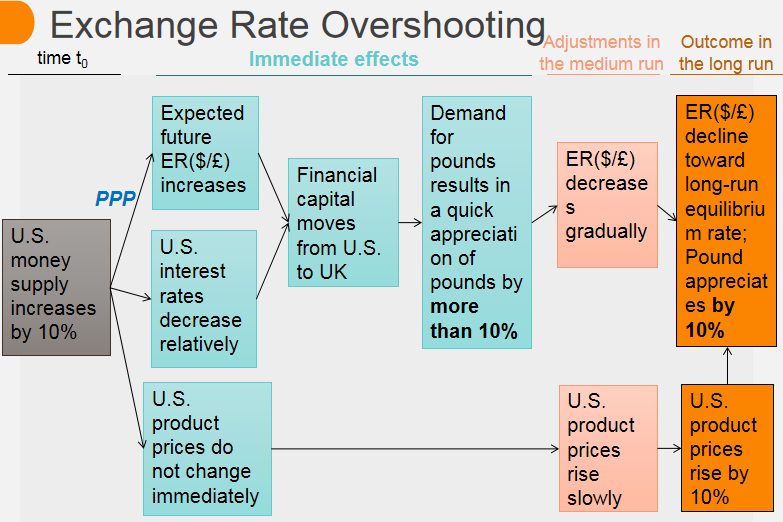

Another factor influencing exchange rates is the phenomenon of exchange-rate overshooting. An exchange rate is said to overshoot when its short-run response to a change in market fundamentals is greater than its long-run response.

Overshooting is a way to think about and explain high levels of volatility in exchange rates.

The overshooting model is considered especially significant because it helps explain why exchange rates depreciate or appreciate so sharply from day to day.

Overshooting was introduced by German economist Rudiger Dornbusch in the famous paper "Expectations and Exchange Rate Dynamics," published in 1976.

An important assumption/fact underlying the overshooting model:

The rate at which different markets' prices respond to changes in market fundamentals is different.

In the short run, goods' prices (or workers' wages) are sticky, or slow to change;

But the financial market prices (like exchange rates, interest rates of assets) are highly flexible.

At the time when the overshooting model was being introduced, it was regarded as somewhat radical due to its assumption of sticky prices. Today, however, sticky prices are widely accepted as fitting with empirical economic observations. Today, Dornbusch's Overshooting Model is widely regarded as the forerunner to modern international economics.

Dornbusch was arguing that initially, foreign exchange markets overreact to changes in market fundamentals, which creates equilibrium in the short term through shifts in financial market prices. And, as the price of goods gradually respond to these financial market prices, the foreign exchange markets temper their reaction, and create long-term equilibrium.

Therefore, exchange rates often depreciate or appreciate more in the short run than in the long run.

For example:

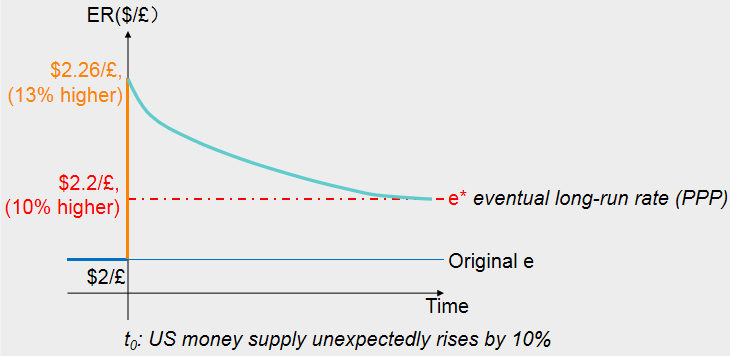

Suppose that the US government unexpectedly increases its money supply by 10% at time , keep other things equal.

In the short term:

(1) Recall the quantity theory of money in Macroeconomics (ch30 in Mankiw's textbook), an increase 10% in U.S. money supply will result in an 10% increase in U.S. price level in the long run.

Quantity equation: MV=PY

Assuming the velocity of money(V) is constant and money is neutral.

When the money supply(M) increases by 10%, the real output(Y) is unchanged because money is neutral.

Hence, the quantity equation tells that in the long run, the price level(P) will increase by 10% equal to the growth of money supply.

The quantity theory of money explains that the money growth determines the inflation rate in the long run.

According to PPP, if U.S. price level rises by 10% while UK price level unchanged, namely U.S. inflation rate 10%, UK inflation rate 0%, the rate of appreciation of pound in the long run would approximately equal 10%, the US-UK inflation rate difference.

Relative PPP: rate of appreciation of pound relative to dollar = U.S. inflation rate - UK inflation rate; and PPP is applied to explain how the relative price levels determines the equlibrium ex-rate in the long run.

In this case, the exchange value of pound relative to dollar will appreciate by 10% in the long run when the U.S. price level rises by 10%.

Therefore, international investors understand that this 10% increase in U.S. money supply would eventually lead to an appreciation of pound by 10% if they believe that the quantity theory of money and the purchasing power parity theory hold in the long run.

Based on such a belief, investors would expect the future exchange rate of dollar per pound would increase by 10% in the future.

(2) Moreover, the increase in the money supply drives down both nominal interest rate and real interest rate in US.

Recall the Keynes' theory of liquidity preference in Macroeconomics (ch34 in Mankiw's textbook), an increase in the money supply reduces the equilibirum interest rates in short run.

For two reasons: U.S. interest rates become lower than UK, and pound is expected to appreciate in future, international investors will move their funds from U.S. assets to UK assets, according to the asset market approach.

Therefore, the demand for pounds will increase immediately and then the exchange value of pound against dollar will appreciate by more than 10% in short term.

(3) U.S. product prices are somewhat sticky in the short run and then U.S. goods market doesn't respond to the increase in money supply immediately. Hence, the sharp appreciation of pound against dollar in short run is resulted from shifts in financial market prices not the goods prices.

In the medium run:

After initial jump in the exchange rate, U.S. product prices will rise slowly over time and the exchang value of pound will then gradually decline toward its PPP values in the long run.

In the long run:

U.S. product prices will rise by 10% eventually and according to the PPP, the exchange value of pound will appreciate relative to dollar by exactly 10% in the long run.

So, once the news of the 10% increases in money supply is out, investors' overreactions will quickly trigger an immediate rise in the spot price of pound by more than 10%, like 13% in this example, before it declines back to just a 10% appreciation derived from the PPP theory.

This case shows that exchange rates can be highly variable in the short run driven by the reactions of international financial investors to policy surprises and other news, while the exchange rates eventually change in the long run in ways consistent with PPP.

2. Forecasting Foreign Exchange Rates

Even if various factors that determine ex-rate fluctuations have been examined, there is no guarantee that we can forecast precisely how ex-rates will change. Because it is still difficult to predict how these determinants will change.

Forecasting exchange rates is very tricky, especially in the short term.

While, it is necessary for exporters, importers, investors, bankers and foreign exchange dealers.

For instance, when choosing a currency in which to make deposits, corporations care about the ex-rate forecasts; when making decisions about foreign investments, investors also care about the ex-rate forecasts in short term or long term.

The need of business and investors for ex-rate forecasts has resulted in the emergence of consulting firms, including Global Insights and Goldman Sachs, other banks such as JP Morgan and Bank of America.

Their forecasting approaches are classified as judgemental, technical, or fundamental.

(1) Judgmental forecasts are known as subjective or common sense models.

They require the collection of large amount of political and economic data and interpretation of these data.

To be specific, they consider economic indicators, political factors, technical factors, and psychological factors.

(2) Technical forecasts uses the historical exchange-rate data to estimate future values and ignores economic and political determinants of exchange-rate movements.

Technical approach is based on the idea that history repeats itself.

And, technical analysts look for specific exchange rate patterns, and it will involve a variety of charting techniques.

Technical analysis is the main methods of analyzing short-term movements in an exchange rate.

(3) Fundamental Analysis consider economic variables that are likely to affect the supply and demand of a currency and typically uses computer-based econometric models.

The econometric models are best suited for forecasting long-run trends in the ex-rate movements and attempt to incorporate the fundamental variables that underlie exchange-rate movements.

However, econometric models rely on predictions of key economic variables, and obtaining reliable information can be difficult. Besides, there are some factors that cannot be easily quantified. And the precise timing of a factor’s effect on a currency’s exchange rate may be unclear, in other words, it cannot generally provide traders precise information regarding when to purchase or sell a particular currency.

Thus, there also exists limitations of econometric models used to forecast exchange rates. A combination of fundamental, technical, and judgmental analysis probably are much useful.

We would like to be able to forecast ex-rates. One purpuse of having theories is to predict tendencies in the real world. How accurate would we want our theories to be in predicting changes in ex-rates? Clearly we should not expect perfect forecasts.

But probably we would expect a useful economic model at least be able to outpredict a naive model that says the spot exchange rate follows a random walk, so we have no ability to predict whether it will go up or down. This is a minimum standard.

However, there tends to be a now general agreement that economic structural models (like the asset market approach or the PPP approach) are generally of no use in predicting exchange rates in the short run.

A major reason for this inability to forecast is that the current spot exchange rate reacts quickly and strongly to unexpected (and therefore unpredictable) news.

A second reason may be that traders and investors form their short-run expectations of exchange rates based less on economic fundamentals and more on recent trends. like what the bandwagon effect says.

For instance, people would expect the dollar to depreciate in future just simply because the dollar deprecited in last two weeks and then people will sell out their holdings of dollar, leading to a further depreciation of dollar.

Therefore, the actions taken by investors can make their expectations self-confirming, recent trends in ex-rates can be reinforced and persist for a while, resulting in bubbles in the movement of exchange rates over time.

Speculative bubble means the resulting movement in exchange rates appears to be simply inconsistent with any form of economic fundamentals.