Chapter 3 Exchange Rate Determination

Unit 2

LEARNING OUTCOMES 学习效果:

At the end of this lecture, students should be able to

understand the concepts of absolute and relative version of purchasing power parity

explain how the relative levels of interest rates and expected change in future spot rate affects the equilibrium ex-rates in short run

distinguish the long-run determinants and short-run factors of ex-rate movements

FOCUS AND DIFFICULTIES 知识重难点:

Focus: absolute PPP, relative PPP, asset market approach

Difficulty: the demand-supply analysis of short-run determinants of ex-rates, the causes of expectations

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Absolute Purchasing Power Parity

Posits that a basket of products will have the same price in different countries if the cost is stated in the same currency.

P=e×Pf

P: the price index in domestic country

Pf: the price index in foreign country

e: spot exchange rate measured as units of domestic currency per unit of foreign currency.

e=P/Pf, providing an estimate of the spot rate that is consistent with absolute PPP.

Absolute PPP is clearly closely related to the law of one price. The equations are the same, except that the price variables refer to only one product in the law of one price, while refer to a basket of products in absolute PPP.

Based on the evidence, however, absolute PPP does not practice much better than the law of one price in the real world.

2. Relative Purchasing Power Parity

Posits that changes in relative price levels in two countries determine changes in exchange rates over the long run.

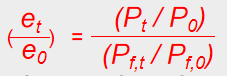

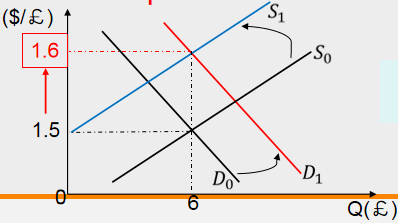

e: ex-rate, P: domestic price index, : foreign price index

The subscript "0" indicates the initial year values and the subscript "t" indicates values in a subsequent year.

Each ratio in parentheses shows the increase from the initial year to the later year for each variable.

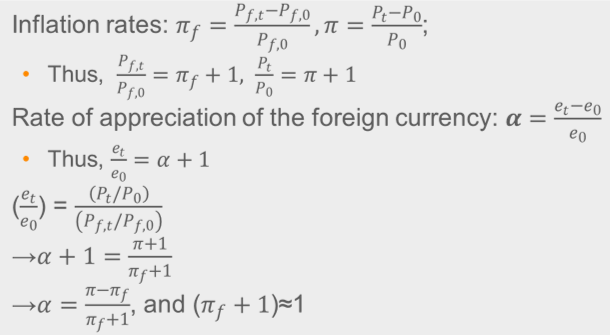

Approximately, , rate of appreciation of the foreign currency=domestic inflation rate - foreign inflation rate.

Hence, relative PPP posits that ex-rate changes over time at a rate equal to the difference in the two countries' inflation rates during that time period.

For example:

Consider the U.S. and Switzerland

Given that

=$0.5/franc.

Applying the relative PPP, we can estimate the new equilibrium ex-rate for period 1:

It indicates that the franc appreciate by 100%.

Between the initial period and period 1, the U.S. inflation rate is 100%, where as the Swiss inflation rate is 0.

Maintaining the PPP between the dollar and franc requires the franc to appreciate against dollar by 100%, which is the difference between the U.S. inflation rate and the Swiss inflation rate.

Conclusions:

A country with higher(lower) inflation rate relative to other nations tend to have a depreciating (appreciating) currency.

Rate of appreciation of foreign currency= domestic inflation rate – foreign inflation rate (α=π-πf).

The relative PPP is most appropriate for forecasting exchange rates in long run; in short run, it is a poor forecaster.

3. Determining Short Run Exchange Rates

In the short run, decisions to hold domestic or foreign assets play a primary role in exchange rate determination. Assets such as Teasury securities, corporate bonds, bank accounts, stocks and real property.

When making decisions about international investments, people will consider not only the return on assets, but also the expected future exchange rate.

In other words, changes on the return on assets, or changes on the expected future exchange rate, would alter people's international investment decisions, thus changing the demand or supply of foreign currencies in the foreign exchange market and then changing the exchange rate.

According to the asset market approach to exchange rate determination, investors consider two key factors when deciding between domestic and foreign investments: relative interest rates and expected changes in exchange rates.

We also apply the demand-supply curves of currencies to illustrate how these two factors affect the short-run equilibrium ex-rates.

(1) Relative level of interest rates.

We use the nominal interest rate as the approximation of the return on assets. As investors seek the highest return, differences in the nominal interest rates between economies will affect international investment flows.

Taking US T-bills and UK T-bills as an example, we suppose that U.S. interest rates decrease below UK interest rates, other things equal. It means the return on UK T-bills is greater than U.S. T-bills.

Thus, in financial market, U.S. investors will demand more UK T-bills while UK investors will demand fewer U.S. T-bills.

Therefore, in foreign exchange market, U.S. investors will demand more pounds so as to pay for purchasing UK T-bills while UK investors will supply less pounds since they buy less U.S. T-bills.

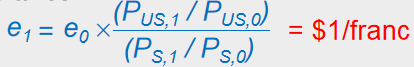

A lower U.S. interest rates relative to UK interest rates makes U.S. T-bills less attractive than UK T-bills. Therefore, U.S. investors will buy more UK T-bills and demand more pounds, the demand curve for pounds shifts to right. UK investors will buy fewer U.S. T-bills and supply less pounds, the supply curve of pounds shifts to left.

Then, the dollar price of pounds will rise from 1.5 to 1.6. It indicates that In the short run, the dollar depreciates relative to pound when US interest rates become lower than UK interest rates.

Since Inflation will erode the purchasing power of money, it is the real interest rate that really matthers the international investment flows.

An increase in U.S. real interest rate raises the expected return on dollar assets. This encourages flows of foreign investment into the U.S., thus causing dollar to appreciate.

Conversely, a decrease in U.S. real interest rate reduces the expecteprofitbility on dollar assets, which promotes a depreciation of the dollar's exchange value.

Conclusion:

A country with higher(lower) interest rates than that abroad tend to have an appreciating(depreciating) currency.

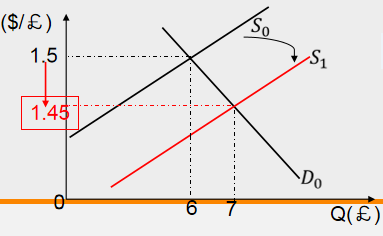

(2) Expected change in the exchange rate

Suppose that UK investors expect the dollar to appreciate against pound in next 3 months while the US interest rate and UK interest rate remain unchanged.

Then UK investors would shift toward dollar assets in order to gain on future dollar receipts. Therefore, in foreign exchange market, UK investors would supply more pounds to buy dollars so as to purchase more dollar assets.

Since U.S. investors' expectation toward exchange rate didn't change in this case, U.S. investors will not change their decisions of investment in pound assets. Hence, U.S. demand for pounds is unchanged.

In the demand-supply schedule for pounds, the supply curve of pounds will shift to right. Therefore, the dollar price of pound decreases from 1.5 to 1.45.

It means that the dollar will appreciate in short run when UK investores expect dollar will appreciate against pound in next 3 months.

What triggers these expectations towards future spot rate?

a) First, if expectations simply extrapolate recent trends, this is called a bandwagon. It means investors expect the recent trend in the exchange rate will continue.

For instance, because of the recent actual increase in the exchange rate value of pounds, investors would expect further increases of pounds' value in the near future and then they would demand more pounds. Therefore, the pound will tend to appreciate further on this belief. This bandwagon effect demonstrates that expectations can be destabilizing.

b) Second, expectations might be based on a belief that exchange rates eventually return to values consistent with economic fundamentals such relative price level, relative productivity level, consumer tastes and trade barriers.

For instance, if US price level decreases more than the UK price level, the PPP tells that dollar will appreciate in the long run. Based on this belief, investors would expect dollar to appreciate in next 3 months; in order to profit from the possible appreciation, UK investors would sell more pounds to buy more dollars for the purchases of dollar assets. Therefore, the dollar will appreciate against pound today. To conclude, if the dollar is expected to appreciate in the long run, then the dollar will appreciate today.

Generally, any long run factor that causes the expected future value of currency to appreciate will cause that currency to appreciate today.

c) Third, expectations are affected by various kinds of news. The important part of the news is unexpected information about politics, about national and international economic data or performance, and about political leaders and situations.

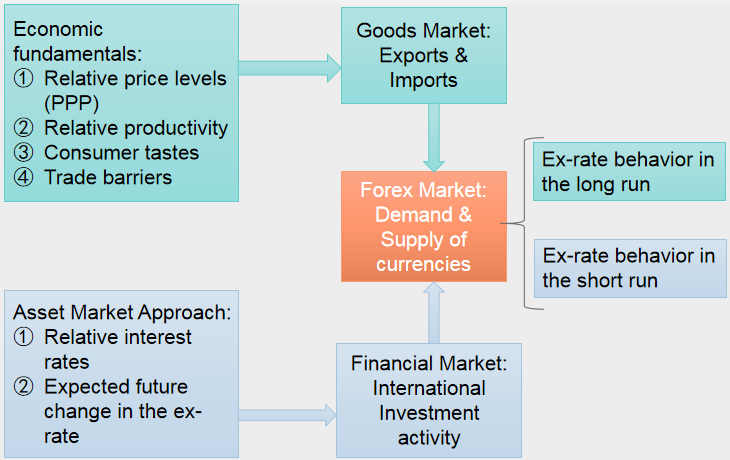

4. Exchange Rate Determination: framework

Exchange rate fluctuations in the long run result from changes in market fundamentals including relative price levels, relative productivity levels, preferences for domestic or foreign goods, and trade barriers. And, changes on those factors directly affect people’s demand for exports and imports. Subsequently, it changes demand and supply of currencies and thus dertermine the long-run behavior of exchange rate.

Decisions to hold domestic or foreign assets play a much greater role in exchange rate determination in the short run. The asset market approach is developed to identify how the two factors: relative interest rates and expected changes in exchange rates to determine the short-run fluctuations in ex-rate. Changes in relative interests and expected future exchange rate will alter people's international investment positioning, and subsequently affect demand and supply of currencies. Hence, they result in the short-run fluctuations of exchange rate.

ACTIVE LEARNING:

PPP from Time to Time

We have discussed three versions of PPP in this chapter under one implied condition that the country adopts a floating ex-rate system and allows the exchange rate to move freely without any government intervention.

Under a floating exchange rate system, PPP provides a useful guide to find potentially overvalued or undervalued currencies and to predict the exchange-rate fluctuations in the long run.

While, throughout the modern history, some countries have adopted fixed ex-rate system, and even nowadays, some countries and regions still use fixed ex-rate system or a managed floating system. Under fixed ex-rate system, the PPP hypothesis works very weak.

Try to explain why the PPP hypothesis less effective when major countries had fixed exchange rates.