Chapter 3 Exchange Rate Determination

Unit 1

LEARNING OUTCOMES 学习效果:

At the end of this lecture, students should be able to

identify the market fundamentals which underlie movements in exchange rates

explain how the economic fundamentals influence the long-run equilibrium value of exchange rates

examine the law of one price and big mac index

FOCUS AND DIFFICULTIES 知识重难点:

Focus: market fundamentals and market expectations, long-run determinants of exchange rates

Difficulty: demand-supply analysis applied to explain how these factors alter the long-run value of the exchange rate

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. What Determines Exchange Rates?

Factors that cause the shifts on demand and supply curve of currencies include market fundamentals and market expectations.

Market fundamentals refer to economic variables such as productivity, inflation rates, real interest rates, consumer preferences, and government trade policy.

Market expectations includes news about future market fundamentals and trader’s opinions about future exchange-rate.

Pressures on exchange rates in the short run can be best understood in terms of the demands and supplies of assets denominated in different currencies.

In the short run, decisions to hold domestic or foreign assets play a primary role in exchange rate determination.

In particular, Foreign exchange markets seems sensitive to movements in interest rates.

Expectations of future exchange rates can have a powerful impact on international financial positioning, and thus on the value of the current exchange rate.

While, over medium term, ex-rates are governed by cyclical factors such as cyclical fluctuations in economic activity.

Over the long run, exchange rates are determined by international flows of g&s, and investment capital that respond to forces such as inflation rates, investment profitability, consumer tastes, productivity, and government trade policy.

These factors tend to change slowing, their impact on the ex-rate occurs over the long term.

2. Determining Long Run Exchange Rates

The long-run determinants of exchange rates include relative price levels, relative productivity levels, consumer preferences for domestic or foreign goods, and trade barriers.

Respond to the changes in these factors, traders would change the demand of exports and imports, subsequently influencing the long run value of the exchange rate.

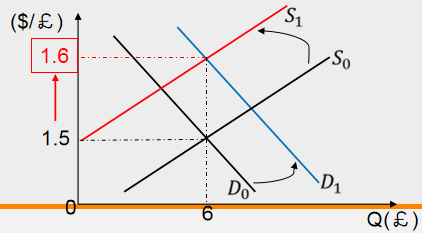

(1) Relative price levels

Suppose an increase in the U.S. price level relative to British price level,

In merchandise market, U.S. residents will purchase more lower-priced UK goods and British residents purchase less higher-priced US goods.

Thus, in foreign exchange market, U.S. demand for pounds rises while UK supply of pounds declines.

Therefore, demand curve for pounds shifts to right while supply curve of pounds shifts to left.

Then, the dollar price of pounds will rise from $1.5/£ to $1.6/£.

It indicates that the dollar will depreciate relative to pounds in the long run when the U.S. price level increases relative to the UK price levels.

Generally, we can infer that as a country's price level increases relative to the price levels in other countries, its currency depreciates in the long run.

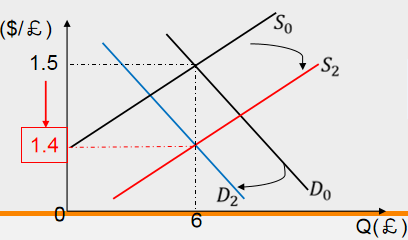

(2) Relative producitivity levels

Suppose US productivity growth is faster than the UK. Productivity refers to the average quantity of g&s produced from each unit of labor input.

A country with higher productivity can produce each unit of goods with less inputs, then being able to charge a relatively lower price on buyers.

Therefore, if US becomes more productive than the Britain, US goods become relatively cheaper than UK goods in the merchandise market.

Hence, U.S. residents buy less UK goods while British residents will buy more US goods.

Thereby, it leads to a decrease in US demand for pounds and an increase in UK supply of pounds in the foreign exchange market.

Shown in the demand-supply model, the demand curve for pounds shifts to left while the supply curve of pounds shifts to right.

Then, the dollar price of pounds will decline from 1.5 to 1.4. It indicates that in the long run, the dollar appreciates when US productivity is higher than UK.

Generally, we can infer that as a country becomes more productive relative to other countries, its currency appreciates in the long run.

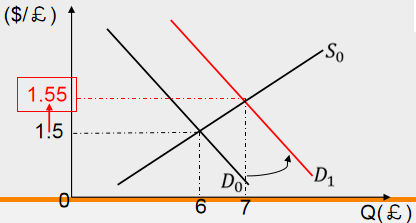

(3) Preferences for domestic or foreign goods

Suppose that U.S. consumers develop stronger preferences for British goods, then US residents will demand more pounds to purchase these goods.

While, such an event doesn't affect the UK purchase of U.S. goods, thus supply of pounds remain unchanged.

Since the demand for pounds rises and UK supply of pounds unchanged, the demand curve for pounds shifts to right.

Then, the dollar price of pound increases from 1.5 to 1.55. It means that the dollar will depreciate in the long run, when U.S. consumers develop stronger preferences for British goods.

Generally, we can conclude that a stronger preference for domestic goods by foreigners causes the domestic currency to appreciate in the long run; conversely, a stronger preference for foreign goods results in a depreciation in the domestic currency.

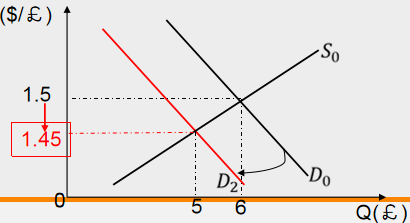

(4) Trade barriers (e.g. tariffs and quotas)

Suppose U.S. government imposes tariffs on British steel, it means British steel producers need pay extra taxes when they sold steel to U.S. consumers.

Thereby British steel producers will charge a higher price on US consumers so as to cover the additional tariffs.

It makes British steel more expensive than domestic produced steel.

Thus, US residents will purchase fewer British steel and then it causes a decrease in demand for pounds in foreign exchange market.

While, such an event doesn't affect the UK purchase of U.S. goods, thus supply of pounds remain unchanged.

Thus, the demand curve for pounds shift to left, causing the dollar price of pounds to decrease from 1.5 to 1.45.

It means that, in the long run, dollar will appreciate relative to pounds when U.S. government imposes tariffs on British goods.

Generally, we can conclude that trade barriers cause a currency appreciation in the long run for the country imposing the barriers.

3. Purchasing-Power-Parity and the Law of One Price

Thoery of Purchasing-Power-Parity (PPP) is a notion that in the long run, exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (or a single good, like a burger) in any two countries.

It suggests that market exchange rates adjust to make goods and services cost the same everywhere.

The simplest concept of PPP is the law of one price.

Law of One Price states that identical goods should be sold everywhere at the same price when converted to a common currency.

Assuming that no international transport costs, no trade barriers, and markets are competitive.

The law of one price holds reasonably well for heavily traded commodities such as oil, metals, chemicals, and some agricultural commodities.

The law of one price can be expressed as follows: P=e×Pf.

P: domestic price, Pf: foreign price for that good, e: current spot rate.

This formula indicates that once the law of one price holds well, the market ex-rate is the true equilibrium rate.

For example:

Suppose no transport cost, one bushel of wheat in Chicago costs $4.8; while, in London, one bushel of wheat costs £3, given the current spot rate: $1.6/£.

Thus, the dollar price of wheat in London is $4.8 per bushel, identical to the dollar price in Chicago.

It means that the purchasing power of pound and dollar is at parity and the law of one price holds well.

If an unexpected increase in British demand for wheat temporarily forces the price of wheat in London up to £3.75 per bushel and the exchange rate is still $1.6/£,

the dollar price of wheat in London becomes $6, higher than the dollar price in Chicago.

As long as the free trade is possible, we expect that someone will buy trade wheat wheat in Chicago meanwhile sell it in London to profit from the price gap with $1.2 per bushel wheat

and eventually a larger amount of arbitrage will drive dollar price in chicago to rise and dollar price in London to fall, while these two prices will move to essentially the same within a week.

As a result, law of one price can hold.

Although the law of one price would hold in theory, it doesn't hold closely for many products. Because, in fact, international transport costs are not negligible; and governments do not permit free trade; and many markets are imperfectly competitive, thus firms would use price discrimination to maximize profits by charging different prices in different markets.

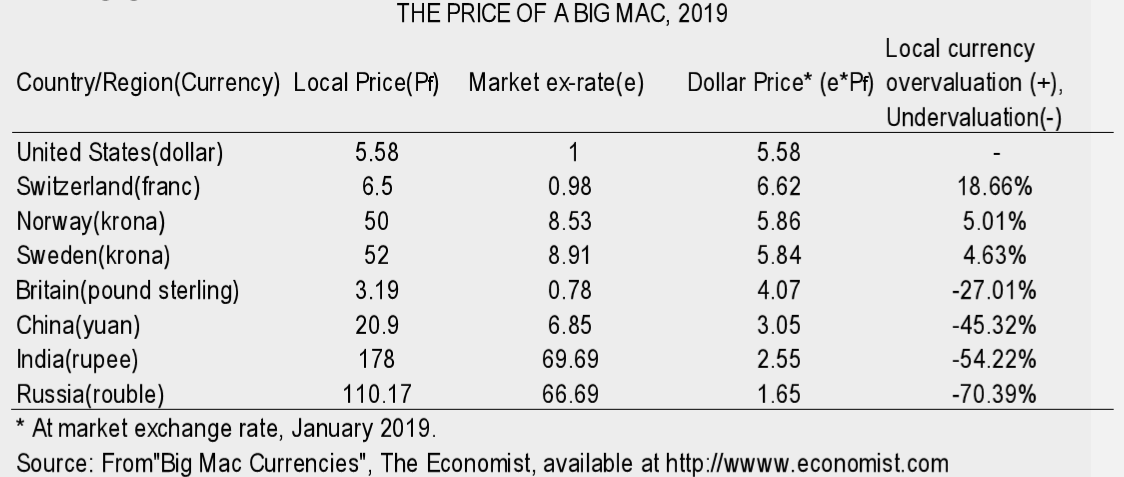

The Big Mac index was created by The Economist magazine in 1986 as a way of comparing the relative values of different currencies.

It is based on the the law of one price. According to the law of one price, a Big Mac hamburger should cost the same dollars wherever it is purchased in the world, suggesting that the market ex-rate is the true equilibrium rate.

Firstly, Big Macs don't cost the same in each country, thus the law of one price breaks down. In other words, the market ex-rate differs from the true equilibrium rate. Second, The Swiss franc has retained its position as 'most expensive' - according to the Big Mac index.

A Big Mac costs SFr6.50 in Switzerland and US$5.58 in the United States. at the market exchange rate of 0.98franc per dollar, the dollar equivalent price of a big mac in Switzerland is $6.62; compared to the dollar price of $5.58 in U.S., the Swiss franc was overvalued by 18.66%.

However, the dollar equivalent price of a big mac in China is $3.05; compared to the dollar price of $5.58 in U.S., the Chinese yuan was undervalued by 45.32%.

In theory, arbitrage trading will push the dollar prices to be essentially in different locations. However, due to the existence of transport costs and trade barriers, such arbitrage trading never occur.

Besides, because of income difference, it seems reasonably to charge different prices in different countries: prices tend to be higher in rich countries where people have greater ability to pay higher prices.

In one word, Big Mac prices show that the law of one price doesn't hold across countries.

ACTIVE LEARNING:

watching the additional videos about "Purchasing Power Parity" and "Big Mac index".

Video "Purchasing Power Parity" is presented by Investopedia.

Video "Big Mac index" is presented by @Wendoverpro.

According to the Big Mac index, if the big mac costs more equivalent dollars in one country under the market ex-rate than that in U.S., the country's currency is overvalued against the U.S. dollar, such as the Swiss franc.

Coversely, if the big mac costs less equivalent dollars in one country than that in U.S., its currency is said to be undervalued against the U.S. dollar, such as the Chinese yuan.

While, some critics argue that Big Mac index is limited as a tool to measure currency misalignment. What do you think the limitations towards Big Mac Index as a way of comparing the relative values of different currencies?