Chapter 2 Foreign Exchange

Unit 1

LEARNING OUTCOMES 学习效果:

At the end of this lecture, students should be able to

Understand the foreign exchange quotations

Describe how exchange rates are determined in a free market

Discuss the operation of the foreign exchange market

FOCUS AND DIFFICULTIES 知识重难点:

Focus: examine exchange rates quotations and determination of the equilibrium exchange rate

Difficulty: shifts on demand or supply curve of foreign exchange and currency appreciation/depreciation

LECTURE VIDEO 授课视频:

LEARNING OUTLINE 学习大纲:

1. Reading Foreign-Exchange Quotations

Exchange rate is the price of one currency in terms of another, which applied to trading any two of the national currencies in the foreign exchange market.

The exchange rate(ER) is expressed as the quoted currency per unit of base currency.

The currency in numerator is called quoted currency, while the currency in denominator is called base currency. The currency that is being priced or valued by the exchange rate is the base currency.

e.g. ER(yuan/$)=6.9947yuan/$, is the price of U.S. dollar in terms of Chinese yuan.

◇ If the ER rises, it means the base currency appreciates relative to the quoted currency.

◇ If the ER falls, it means the base currency depreciates relative the quoted currency.

◆ For direct quotation, ER is quoted as the domestic currency per unit of foreign currency (for example, EUR 0.8989 = USD 1.00 in the Eurozone).

◆ An indirect quote is the opposite of a direct quote, where the ER is quoted as the foreign currency per unit of domestic currency.

◆ U.S. Dollar quotation is commonly used in all the FX markets. The ER is quoted as the currency per unit of U.S. dollar.

◆ Unlike the US Dollar quotation, the cross exchange rate is the ER between two non-dollar currencies. For instance, an ER of euro against JPY is considered as a cross rate in the market sense because it does not include the U.S. dollar. It can be derived from the rates of these two currencies in terms of a third currency (the dollar).

2. Exchange Rate Determination

To understand what determines the equilibrium exchange rate in a free market, we should first examine the demand and supply of foreign exchange.

1) Demand for foreign exchange is driven by domestic demand for foreign goods and assets and corresponds to the debit items on a country's balance of payments.

◇ Debit items involve the following transactions: imports of goods and services, income payments, transfers made to foreigners, and lending to foreigners, purchasing foreign assets. These results in the demand for foreign currency and the supply of domestic currency.

◆ For instance, U.S. demand for pounds may result from U.S. imports of British goods and services, U.S. investment made in Britain, and U.S. transfer payments made to Btitain.

◆ When U.S. residents import British goods or invest in British securities, real estate and firms, U.S. residents need first purchase pounds with dollars because British goods and assets are priced in pounds, thus resulting in demand for pounds by U.S. residents.

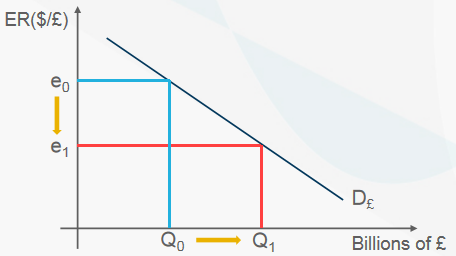

◆ As ER($/£) declines, the pounds depreciate relative to U.S. dollar, which means British goods and assets become cheaper to U.S. residents. U.S. residents will purchase more British products.

◆ Hence, in order to purchase more British products, U.S. residents now demand a larger quantity of pounds in the foreign exchange market.

◆ Thus, it indicates that a lower(higher) price of a currency generally mean more(less) of it is demanded.

2) Supply of foreign exchange is the amount of foreign exchange that is offered in the market at various exchange rates, all other factors held constant. It corresponds to the credit items on a country's balance of payments.

◇ Credit items involve exports of g&s, income receipts, gifts received from foreigners, and sell asssets to foreigners, borrow from abroad. These results in the supply of foreign currency and the demand for home currency in the foreign exchange market.

◆ For instance, supply of pounds is offered by British residents to obtain dollars they need to make payments to U.S. residents.

◆ In particular, when British buys U.S. goods, U.S. securities, buildings and firms, they need first exchange for dollars with pounds. Because U.S. goods and assets are priced in US dollar, thus resulting in supply of pounds by British residents in the foreign exchange market.

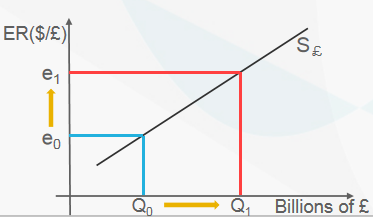

◆ As ER($/£) rises, the pounds appreciate relative to US dollar, which indicates U.S. goods and assets become cheaper to British residents. Then, British residents will buy more U.S. goods.

◆ In order to buy more U.S. goods, British residents offer a larger number of pounds to acquire more dollars in the foreign exchange market.

◆ Therefore, a higher (lower) price of a currency generally mean more (less) of it is supplied.

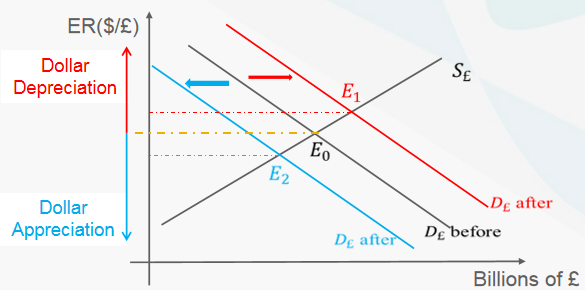

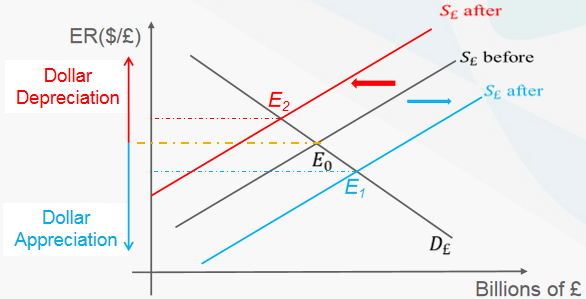

◆ The equilibrium exchange rate is established at the point of intersection of the supply and demand schedules of foreign exchange.

◆ While in practice, the exchange rate will deviate from the equilibrium level because some forces could shift the demand or supply curve for pounds.

a) If the demand curve for pounds shift rightward, the dollar will depreciate against pounds; if the demand curve for pounds shift leftward, the dollar will appreciate.

b) If the supply curve for pounds shift rightward, the dollar will appreciate against pounds; if the supply curve for pounds shift leftward, the dollar will depreciate.

3. Foreign Exchange Market

The foreign exchange(FX, or forex) market is one organizational setting in which individuals, businesses, governments, and banks buy and sell foreign currencies and other debt instruments.

1) The foreign exchange(FX) market is Largest and most liquid market in the world.

2) The FX market is dominated by four currencies: U.S. dollar, Euro, Japanese yen, British pound.

3) In past decades, chinese yuan trading increased rapidly and climbed higher in the global rankings. So far, Chinese yuan remained the world's eighth most traded currency and the most traded EME currency.

◆ Emerging Market Economy(新兴市场经济体,EME) is an economy that has some characteristics of a developed market, but does not satisfy standards to be termed a developed market.

◆ Emerging market economies can offer greater returns to investors due to rapid growth, but also offer greater exposure to some inherent risks due to their status.

◆ Because they generally do not have the level of development of market and regulatory institutions as found among developed nations.

4) Unlike stock or commodity exchanges, the foreign exchange market is not an organized structure. It has no centralized meeting place and no formal requirements for participation.

5) The FX market is not limited to any one country. It consists of all locations globally where various national currencies are exchanged.

◆ In April 2019, sales desks in five regions – the U.K., the U.S., Hong Kong SAR, Singapore and Japan – facilitated 79% of all forex trading.

6) Foreign exchange market welcomes traders 24 hours a day.