}One of the main difficulties in servicecosting is the establishment of a suitable cost unit.

}Service organisations mayuse several different cost units to measure the different kinds of service thatthey are providing.

}Examples for a hotel might include:

ØMeals served for the restaurant

ØRooms occupied for the cleaning staff

ØHours worked for the reception staff.

}A composite cost unit is more appropriateif a service is a function of two variables.

}Examples of composite cost units are as follows:

ØHow much is carried over what distance (tonne-miles) for haulage companies

ØHow many patients are treated for how many days (patient-days) for hospitals

ØHow many passengers travel how many miles(passenger-miles) for public transport companies

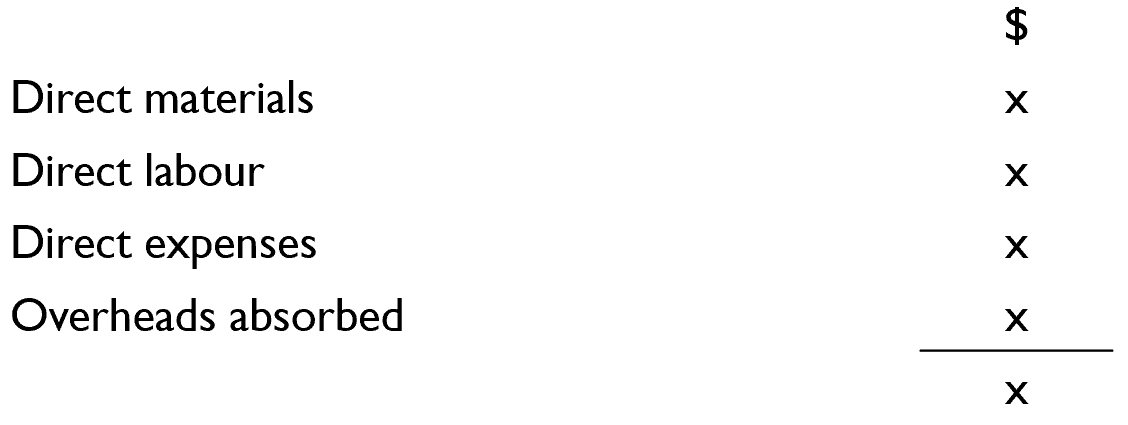

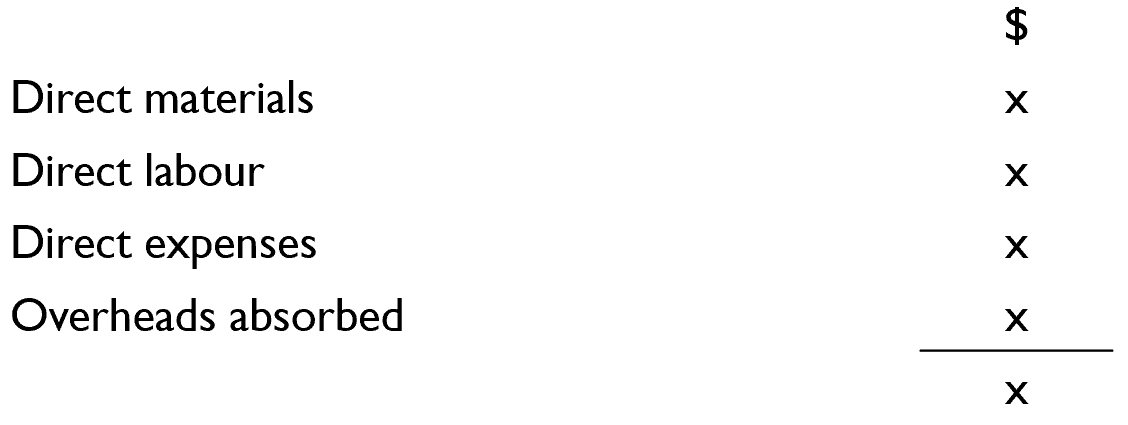

}The total cost of providing a service will include labour, materials, expenses and overheads (the same as the costs associated with theproducts produced in manufacturing industry).

}It is not uncommon for labour to be the only direct cost involved in providing a service and for overheads to make upmost of the remaining total costs.

}In service costing costs can beclassified as being fixed, variable or semi-variable.

}If costs are semi-variable, it is necessary to separate them into their fixed and variable constituents using the high/low method.

}The calculation of a cost per serviceunit is as follows:

}Cost per service unit = Total costs for providing the service/Numberof service units used to provide the service

Illustration 1

}The canteen of a company records thefollowing income and expenditure for a month.

}During the month thecanteen served 56,200 meals. The canteen’s cost unit is one meal.

}Calculate the average cost per mealserved and the average income per meal served.

}Total canteen expenditure in month =$42,150

}Total meals served in the month = 56,200

}Average cost per meal served =$42,150/56,200 = $0.75 per meal

}Average income per meal = $59,010/56,200= $1.05 per meal