-

1 Outcome

-

2 Overview

Outcome

}By the end of this session you should beable to:

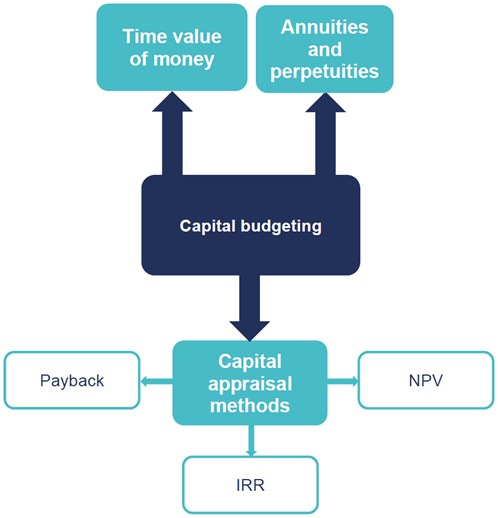

ØDiscuss the importance of capitalinvestment planning and control

ØDefine and distinguish between capitaland revenue expenditure

ØOutline the issues to consider and thesteps involved in the preparation of a capital expenditure budget

ØExplain and illustrate the differencebetween simple and compound interest, and between nominal and effectiveinterest rates

ØExplain and illustrate compounding anddiscounting

ØExplain the distinction between cash flowand profit and the relevance of cash flow to capital investment appraisal

ØIdentify and evaluate relevant cash flowsfor individual investment decisions

ØExplain and illustrate the net presentvalue (NPV) and internal rate of return (IRR) methods of discounted cash flow

ØCalculate present value using annuity andperpetuity formulae

ØCalculate NPV, IRR and payback (discounted and non-discounted)

ØInterpret the results of NPV, IRR andpayback calculations of investment viability.

}and answer questions relating to theseareas.