-

1 Outcome

-

2 Overview

Outcome

}By the end of this session you should beable to:

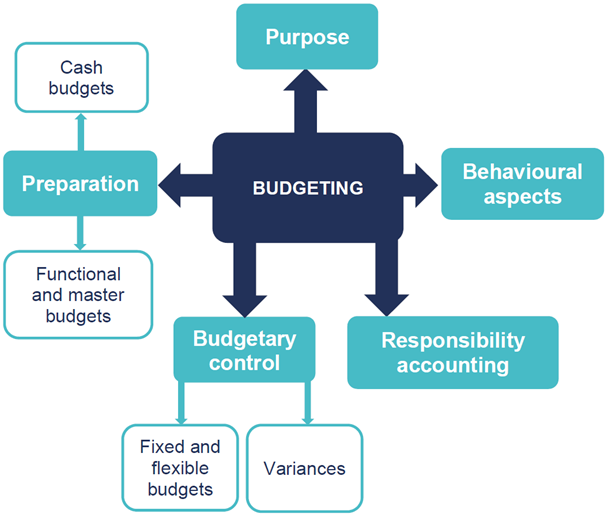

ØExplain why organisations use budgeting

ØDescribe the planning and control cyclein an organisation

ØExplain the administrative proceduresused in the budgeting process

ØDescribe the stages in the budgeting process (including sources of relevant data, planning and agreeing draft budgets and purpose of forecasts and how they link to budgeting)

ØExplain the importance of motivation inperformance management

ØIdentify factors in a budgetary planningand control system that influence motivation

ØExplain the impacts of targets uponmotivation

ØDiscuss managerial incentive schemes

ØDiscuss the advantages and disadvantagesof a participative approach to budgeting

ØExplain top down, bottom up approaches to budgeting

ØExplain the importance of principalbudget factor in constructing the budget

ØPrepare sales budgets

ØPrepare functional budgets (production,raw materials usage and purchases, labour, variable and fixed overheads)

ØPrepare cash budgets

Øprepare master budgets (statement of profit or loss and statement of financial position)

ØExplain and illustrate 'what if' analysisand scenario planning

ØExplain the importance of flexiblebudgets in control

ØExplain the disadvantages of fixed budgets in control

ØIdentify situations where fixed orflexible budgetary control would be appropriate

ØFlex a budget to a given level of volume

ØCalculate simple variances between flexed budget, fixed budget and actual sales, costs and profits

ØDefine the concept of responsibility accounting and its significance in control

ØExplain the concept of controllable anduncontrollable costs

ØPrepare control reports suitable for presentation to management (to include recommendation of appropriate controlaction).

}and answer questions relating to these areas.