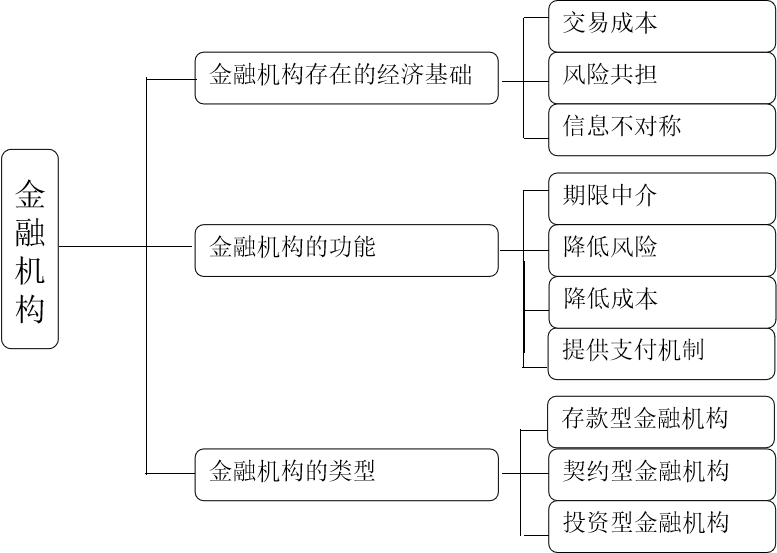

Chapter 6 Financial Institutions 金融机构

Learning Objectives:

1.To learn about the economic basis for financial institutions.

2.To understand the roles of the financial institutions.

3.To grasp the types of the financial institutions.

6.1 Economic Basis for Financial Institution 金融机构存在的经济基础

教学视频:

课堂练习:

1 Transaction Cost 交易成本

Transaction cost, the time and money spent in carrying out financial transactions, is a major problem for people who have excess funds to lend. Small savers like you or potential borrowers might be frozen out of financial markets and thus are unable to benefit from them.

Financial institutions can substantially reduce transaction cost because they have developed expertise in lowering them and because their large size allows them to take advantage of economies of scale, the reduction in transaction cost per dollar of transactions as the size (scale) of transactions increases.

In addition, a financial institution’s lowtransaction cost means that it can provide its customers with liquidityservices. For example, banks provide depositors with checking accounts thatenable them to pay their bills easily; depositors can earn interest on savingsaccounts and yet still convert them into goods and services whenever necessary.

2 Risk Sharing 风险共担

Another benefit made possible by the low transaction costs of financial institutions is that they can help reduce the exposure of investors to risk-that is , uncertainty about the returns invertors will earn on assets.

Financial institutions do this through the process known as risk sharing: they create and sell assets with risk characteristics that people are comfortable with, and the institutions then use the funds they acquire by selling these assets to purchase other assets that may have far more risk.

3 Asymmetric Information:Adverse Selection and Moral Hazard 信息不对称

In financial markets, one party often does not know enough about the other party to make accurate decisions. This inequality is called asymmetric information.

Lack of information creates problems: adverse selection and moral hazard.

Adverse selection is the problem created by asymmetric information before the transaction occurs. Adverse selection in financial market occurs when the potential borrowers who are the most likely to produce an undesirable(adverse) outcome—the bad credit risks—are the ones who most actively seek out a loan and are thus most likely to be selected.

Moral hazard is the problem created by asymmetric information after the transaction occurs. Moral hazard in financial markets is the risk(hazard) that the borrower might engage in activities that are undesirable(immoral) from the lender’s point of view because they make it less likely that loan will be paid back.

Checkpoint:

How can the adverse selection problem explain why you are more likely to make a loan to a family member than to a stranger?