第三节 最大诚信原则(Utmost Good Faith)

一、最大诚信的定义

当事人必须最大限度地按照诚实与信用精神协商签约。如果一方当事人违反“最大诚信原则”,另一方有权解除保险合同。

英国特许保险学会编的“Contract Law and Insurance”:

“Utmost good faith is a positive duty to voluntarily disclose, actually and fully, all facts material to the risk being proposed, whether asked for them or not.”

英国1906年《海上保险法》第17条:“A contract of marine insurance is a contract based upon the utmost good faith and, if the utmost good faith is not observed by either party, the contract may be avoided by the other party.”

二、最大诚信的内容(Contents of Utmost Good Faith)

(一)告知(Disclosure)

也称“披露”,被保险人在签订保险合同时,应该将其知道的或推定应该知道的有关保险标的物的重要事实(material fact)如实向保险人进行说明。

1.被保险人的告知

(1)the assured must disclose to the insurer, before the contract is concluded, every material circumstance which is known to the assured, and the assured is deemed to know every circumstance which, in the ordinary course of business, ought to be known by him.

(2)Every circumstance is material, which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will take the risk.

(3) 《中华人民共和国海商法》第222条:合同订立前,被保险人应当将其知道的或在通常业务中应当知道的有关影响保险人据以确定保险费率、或者确定是否同意承保的重要情况,如实告知保险人。

2.Disclosure by agent effecting insurance

(1)Every material circumstance which is known to himself, and an agent to insure is deemed to know every circumstance which in the ordinary course of business ought to be known by, or to have been communicated to, him; and

(2)Every material circumstance which the assured is bound to disclose, unless it came to his knowledge too late to communicate it to the agent.

(二)陈述(Representation)

在洽谈签约过程中,被保险人对于保险人提出的问题进行如实答复。陈述的内容关系到保险人承保与否,涉及海上保险合同的真实有效,成为最大诚信原则的另一基本内容。英国1906年《海上保险法》第20条把陈述单独列入。

1.Every material representation made by the assured or his agent to the insurer during the negotiations for the contract and before the contract is concluded, must be true. If it is untrue the insurer may avoid the contract.

2.A representation is material which would influence the judgment of a prudent insurer in fixing the premium or determining whether he will take the risk.

3. A representation may be either a representation as to a matter of fact or as to a matter of belief.

(注:我国海商法和保险法把它列为告知的一部分)

(三)保证(Warranty)

英国1906年《海上保险法》:

A warranty means a promissory warranty, that is to say, a warranty by which the assured undertakes that some particular thing shall or shall not be done, or that some condition shall be fulfilled, or whereby he affirms or negatives the existence of a particular state of facts.

保证可分为:express and implied warranty

1.明示保证(Express warranty)

明示保证通常用文字表示:

It may be in any form of words from which the intention to warrant is to be inferred.

An express warranty must be included in, or written in the policy, or must be contained in some document incorporated by reference into the policy.

2.默示保证(Implied Warranty)

无文字说明,而是根据有关法律、惯例及行业习惯。

默示保证与明示保证具有同等的法律效力。 海上货物运输保险的默示保证:

Seaworthiness of ship

Seaworthiness of goods

Legality

3. 弃权与禁止反言(Waiver and prohibition)

放弃自己的权利,以后不能反悔。

三、最大诚信的运用(Application of Utmost Good Faith)

(一)告知与没有告知

(Disclosure & Non-disclosure)

海商法:......不是由于被保险人的故意,未将本法第二百二十二条第一款规定的重要情况如实告知保险人的,保险人有权解除合同或者要求相应增加保险费。保险人解除合同的,对于合同解除前发生保险事故造成的损失,保险人应当负赔偿责任。

(二)正确陈述与错误陈述(Presentation & Misrepresentation)

把错误陈述分为三种:

Innocent Misrepresentation

Negligent Misrepresentation

Fraudulent Misrepresentation

如果一个人欺骗性地诱导某人签订一个长期保险合同,按照英国“Misrepresentation and Financial Services Act 1986”的规定, 将处以7年的监禁。

三、法律责任(Legal liability)

(一)违反告知义务的法律责任

1.投保方

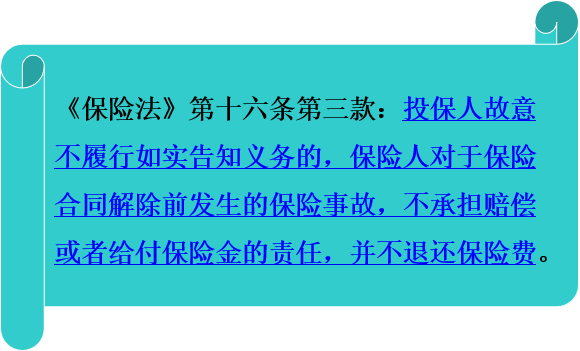

① 故意行为:

② 过失行为:《保险法》:投保人因过失未履行如实告和义务,对保险事故的发生有严重影响的,保险人对于保险合同解除前发生的保险事故,不承担赔偿或者给付保险金的责任,但可以退还保险费。(与海商法条款冲突)

③ 危险程度增加没有通知保险人:《保险法》:保险标的物危险程度增加的,被保险人按照合同约定应当及时通知保险人,保险人有权要求增加保险费或者解除合同。被保险人未履行通知义务,因保险标的危险程度增加而发生的保险事故,保险人不承担赔偿责任。

按《中华人民共和国立法法》第83条规定“同一机关制定的法律、行政法规、地方性法规、自治条例和单行条例、规章,特别规定与一般规定不一致的,适用特别规定;新的规定与旧的规定不一致的,适用新的规定” 来理解,适用“特别法优于一般法”应同时符合两个前提条件:一是“立法机关是同一机关”,二是“同一概念或事实或事项不一致时”。 比如:

《教育法》与《高等教育法》都是全国人大常委会制订的,当高等教育方面两都存在同一事项规定不一致时,适用高等教育法的规定而不适用教育法的规定。

《保险法》与《海商法》都是全国人大常委会制订的,当赔偿方面存在同一事项规定不一致时,适用《海商法》的规定而不适用《保险法》的规定。

④ 谎称发生保险事故:

2.保险人未尽告知义务的法律责任

《保险法》:保险合同中规定有关于保险人责任免除条款的,保险人在订立保险合同时应当向投保人明确说明,未明确说明的,该条款不产生效力。

(二)违反保证的法律责任

保险合同涉及的所有保证内容都是重要的内容,投保人与被保险人都必须严格遵守,如果有违背与破坏,其后果一般有两种情况:

保险人不承担赔偿或给付保险金的责任;保险人解除保险合同。