CHAPTER 5

§

Budgeting Basics for Meeting Professionals

LEARNER OUTCOMES

§

A. Explain the importance of developing budgets for meetings.

B. Describe how a meeting’s budget relates to the financial goals of the organization.

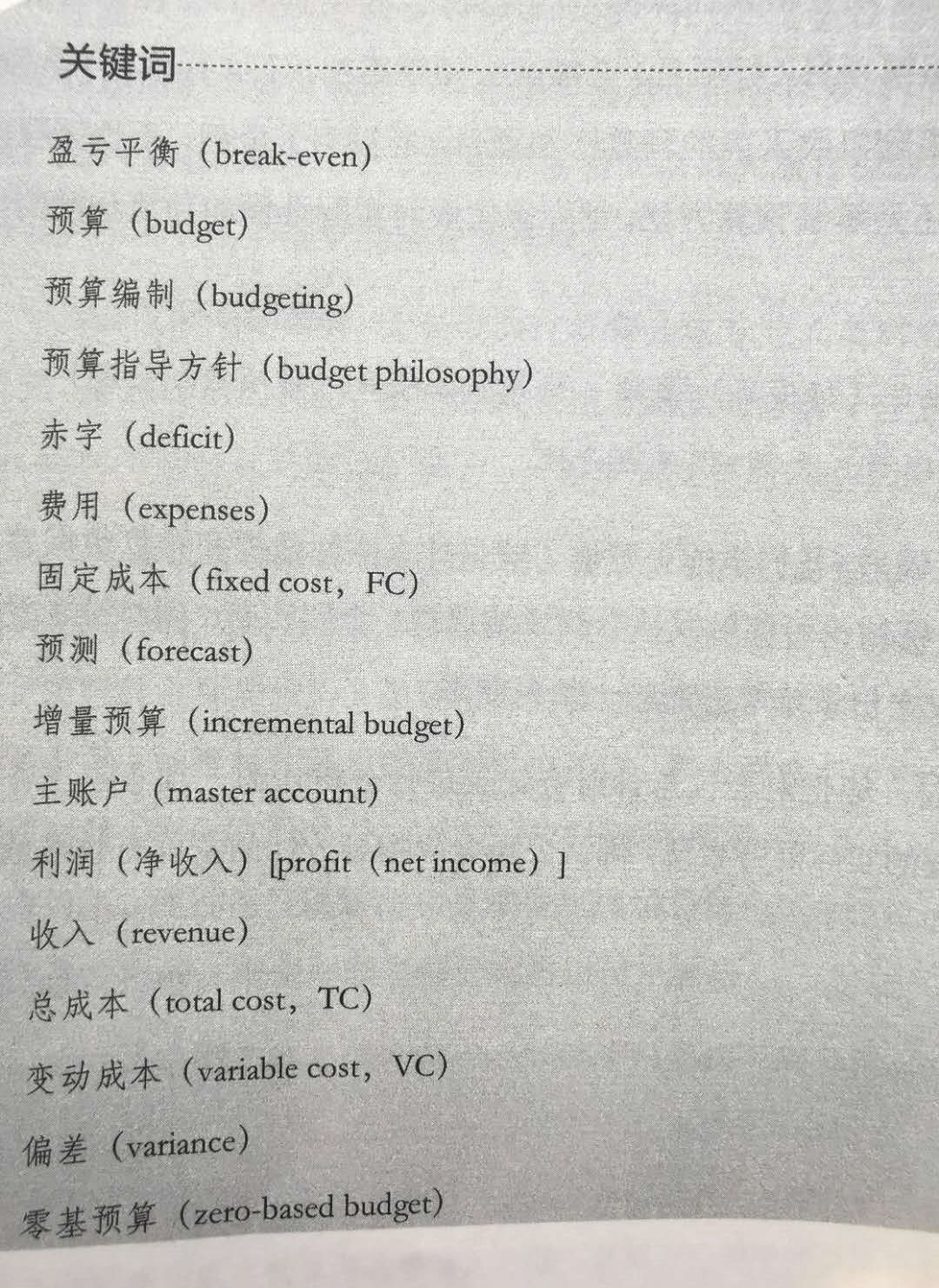

C. Compare and contrast incremental and zero-based budgeting techniques.

D. Identify revenue streams common to meetings.

E. Calculate a meeting’s net income.

Chapter Summary

Understanding the basics of budgeting provides the meeting professional an estimate of revenues and expenditures for their meeting. A key responsibility for any planner is to meet financial goals, communicate the amount of money to produce the meeting, and to be assured of available resources towards the meeting goals.

The meeting professional wears many hats in the production of an event. They recognize that a well-developed budget allows for a strategic plan to manage revenue resources. These plans are providing the basics for the meetings financial performance, and at the end of the meeting will provide a comparison and a contrast of what was budgeted to what was actually spent and revenues procured.

A well-developed budget is a framework of the financial goals for the meeting and consists of three common goals: the profit (net income) goal, the breakeven goal, and host or organization funding supplemental need/goal. The funding supplemental goal is determined by the type of meeting organization of the Association or government agency. A meeting professional who works for an association organizes their meeting budget to make a project, which will be dedicated to their mission. A government meeting professional designs their meeting budget to break-even.

There are key questions that a meeting professional tackles, when producing an event, such as whether or not the minimum amount of funds and resources needed, to produce the meeting, are available. Another concern and subsequent question that needs to be answered is whether the level of revenue and expenses that are calculated are an appropriate level to meet the return on investment of that meeting.

A Meeting Professional is not necessarily an accountant, but a general understanding of Budget elements is necessary in meeting management. Budget terms such as revenue, expenses, and net-income are fundamental. Our meeting planner works from the Financial Transaction formula of Revenue – Expenses = Net Income.

Meeting revenue is usually generated through registration fees, exhibit sales, sponsorships, advertisements and merchandise sales. A creative meeting professional is always looking to generate income opportunities for their event. They are vigilant in identifying the total expenses of their meeting before planning the revenue portion of their budget.

Meeting expenses are identified as fixe costs (FC). Fixed Costs are the day-to-day costs of doing business and are pre-committed. The Variable Costs (VC) are those expenses that are based on various factors, i.e. the number of attendees. These are considered controllable costs by a planner. The total costs (TC) are the total expenses needed to produce the meeting and is noted as TC = FC + VC.

Continuing on with budget elements, the meeting professional is striving for a positive net income. This is the difference between total revenue and expenses. Consideration of the tax system based on the location of the meeting must be considered when preparing the budget.

Budget development is done to create income transparency for key stakeholders of the event. The construction of a budget also guides the meeting professional the budget philosophy of the organization.

The first step in developing a meeting/event budget is to determine expenses of that event. Much care is taken in developing reasonable estimate from all suppliers that are invaluable in the creation and execution of the gathering. Many meeting professionals rely on the previous costs of an earlier meeting. Maintaining historical accounts of costs serves as an excellent guideline in the development of a new budget. Naturally, consideration of inflation or any other changes to the new meeting are accounted for in this budget development. An experienced meeting professional is cognizant not to underestimate expenses, especially if the meeting philosophy is to make a profit.

The development of a record is done to show expense categories, quantities, costs, and the calculation for each line item within the budget. It offers precise development of the meeting professional’s budget with detailed records as incurred. In general, this will make budgeting future meetings considerably easier.

Revenue budgets follow critical steps in their development. Those steps include estimating expenses, setting financial goals, forecasting realistic numbers of meeting attendance, rational goals for revenue source, and computing the registration fees.

Fund management requires the development of a separate bank account that is set up in advance of the meeting. This account will allow all income directly related to the meeting to be deposited in one account. This is done for easier tracking of income and fees associated with the meeting.

There will be as a part of Fund Management the need to recognize tax-exempt status for items associated with a meeting. It is important to have tax exempt status instituted well in advance as it requires knowledge of tax laws associated with a particular destination, and experienced meeting professionals may have a prior knowledge to the fact that tax exemption may only be applicable in certain location! This type of information can result in substantial decrease in expenses.

Another important aspect of fund management is the collection of cash onsite at the meeting. The meeting professional must determine the amount of cash that could be collected while onsite at the event. Many meeting professionals have arranged for a bank account at the meeting location so that daily deposits can be made and then transferred. IT is necessary when dealing with cash that there are clear and defined policies for those handling cash. Placing tight controls on the receipt and disbursement funds are prudent measures taken by a meeting professional.