Letter of Credit

Creditmeans any arrangement, however named or described, that is irrevocable andthereby constitutes a definite undertaking of the issuing bank to honor acomplying presentation.

Primary Liabilities for Payment

Self-Sufficient Instrument

Pure Documentary Transaction

Parties Involved

Applicant – Importer

Beneficiary – Exporter

Issuing Bank – Importer’s BankÞDepositfor establishment of L/C

Advising Bank – Branch orCorrespondent Bank principle of surface authenticity

Negotiating Bank

Paying Bank

Confirming Bank

Reimbursing Bank

Differences between Paying Bank and Reimbursing Bank

PayingBank is the DraweeBank designated by L/C. Usually it is the Issuing Bank itself. It should checkthe documents against L/C.

Reimbursing Bank is the Clearing Bank of L/C,and has no responsibility to check the documents against L/C.

EveryL/C has its Paying Bank, but not every L/C has its Reimbursing Bank.

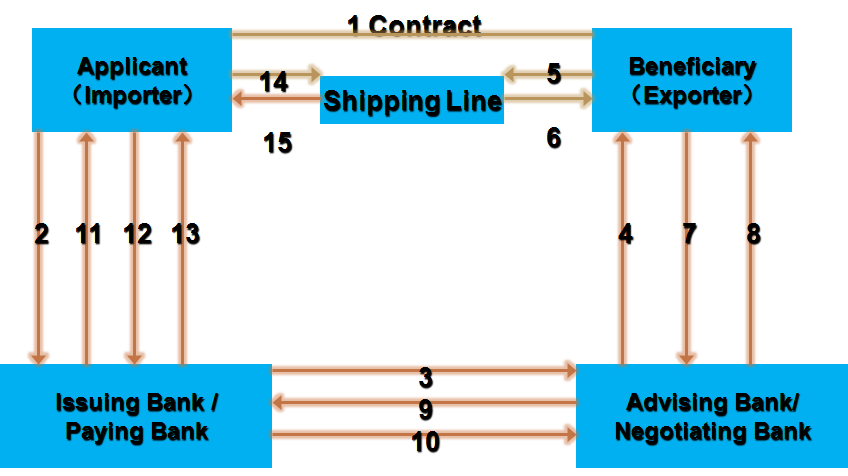

flow chart of a L/C

Types of L/C

Revocable Credit

Irrevocable Credit

Clean Credit

Documentary Credit

Sight Payment Credit

Usance Credit

Time Credit

Negotiable L/C

Confirmed L/C

ßTransferable L/C

Back-to-Back L/C

Revolving L/C-

Anticipatory L/C (Prepaid L/C)

factors influencing the payment mode

1.Macro-economy of the import country(Foreign exchange control)

2.Regulations on payment methods

3.Creditability of the buyer

4.Types of goodsAmount of the contract

Reading