Payment Instruments

International Payment

I. Cash

II .Financial Documents

Features:

Negotiability (流通性)

Non-causative Nature (无因性)

Requisite in Form (要式性)

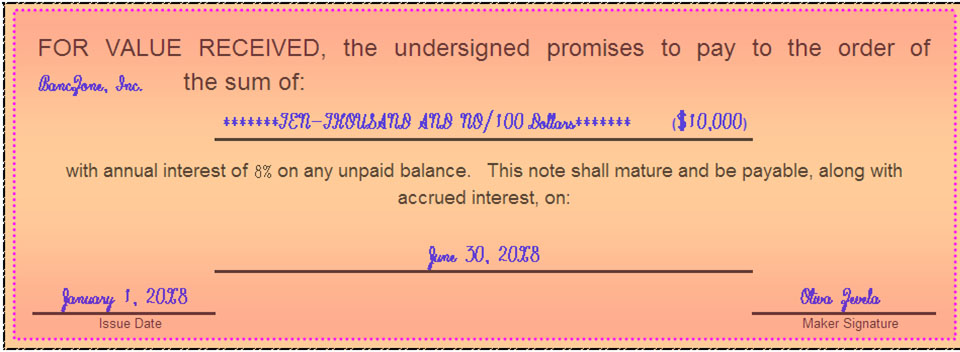

1. Promissory Note

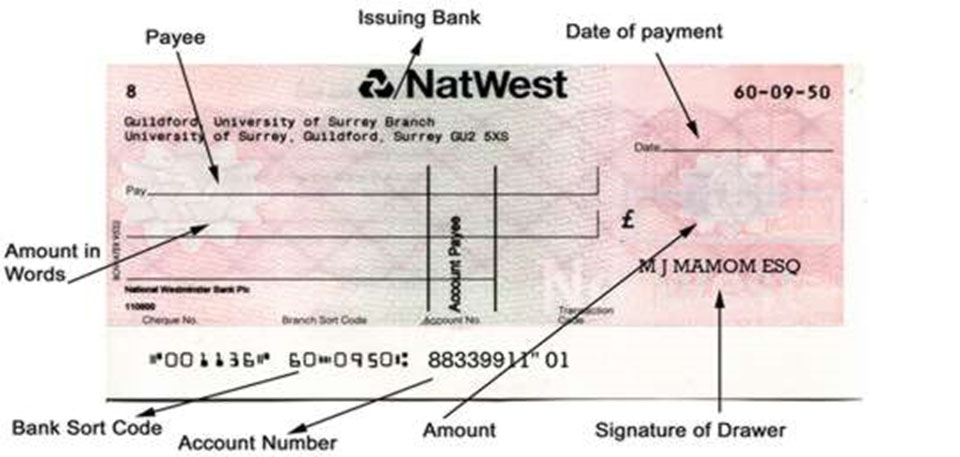

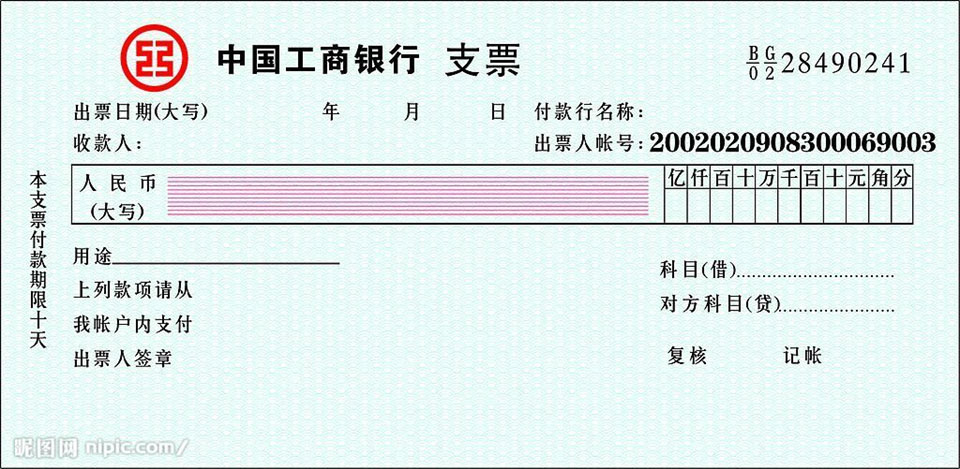

2 Check/Cheque

3. Bill of Exchange

An unconditional order in writing signed by one party (drawer) requesting a second party (drawee /payer) topay a stated sum of money to a third party (payee), ondemand or at a fixed or determinable future time.

contents of a draft/bill of exchange

1)“Bill of Exchange” or “Draft”

2) Unconditional order of payment

3) Fixed amount

4)Name of drawee/payer

5)Name of payee

6)Date of issuing

Drawer’s name and signature

sample:

BILLOF EXCHANGE

Drawn Under Bank of China, London

Irrevocable L/C No. 2003056 Dated January10, 2005ßPayble with interest 5.2 % Per annum

No. 20042 EXCHANGE for HKD236,000.00 Tianjin, China

February20, 2005 at 30days afterSight of this FIRST of Exchange (Second of Exchange being unpaid)

Pay to the order of Bankof China, Tianjin Branch thesum of HongkongDollarsTWOHUNDRED AND THIRTY-SIX THOUSAND ONLY

TO: BANKOF CHINA, HONGKONGßChinaMachinery & Equipment Import & Export Corp., Shanghai Branch(SIGNATURE)

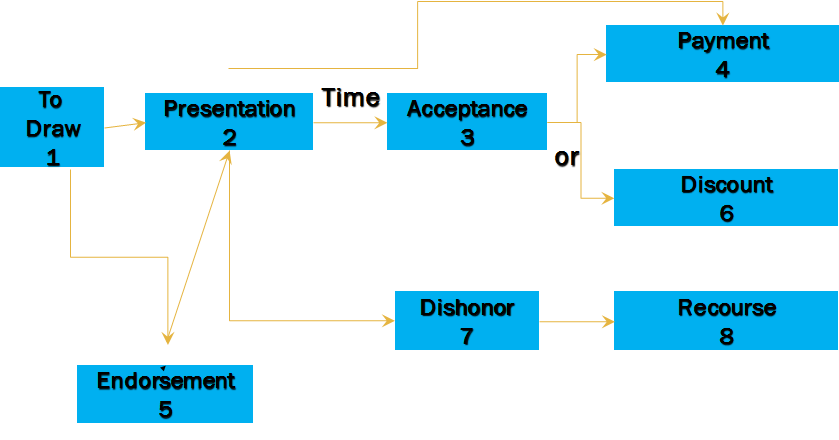

Classification:

Banker's Draft

Commercial Draft

Sight Draft (Demand Draft)

Time Draft (UsanceDraft)

Commercial Acceptance Draft

Banker’s Acceptance Draft

Clean Draft

Documentary Draft

flow chart of the drafts

Differences between draft andpromissory note, check

| 性质 | 当事人 | 付款时间 | |

| 汇票 | 无条件的书面支付命令 | 出票人/付款人/受款人 | 远期(需承兑)、即期 |

| 本票 | 无条件的书面支付命令 | 出票人/受款人 | 远期(不需承兑)、即期 |

| 支票 | 无条件的书面支付命令 | 出票人/付款人/受款人 | 即期 |

4 Payment Methods

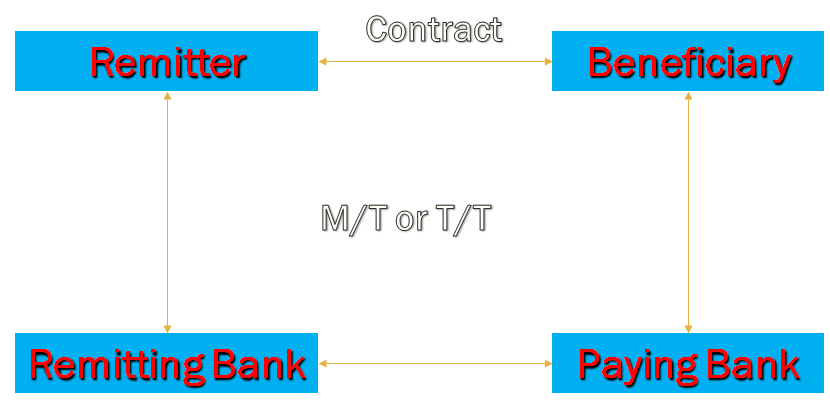

Remittance: transfer of funds from one party (payer) to another (payee) among different countries through banks.

Four Parties

Remitter

Beneficiary

Remitting Bank

Paying Bank

Types

of Remittance

MailTransfer (M/T) low service charge and slow speed

TelegraphicTransfer (T/T) faster payment with higher service charge

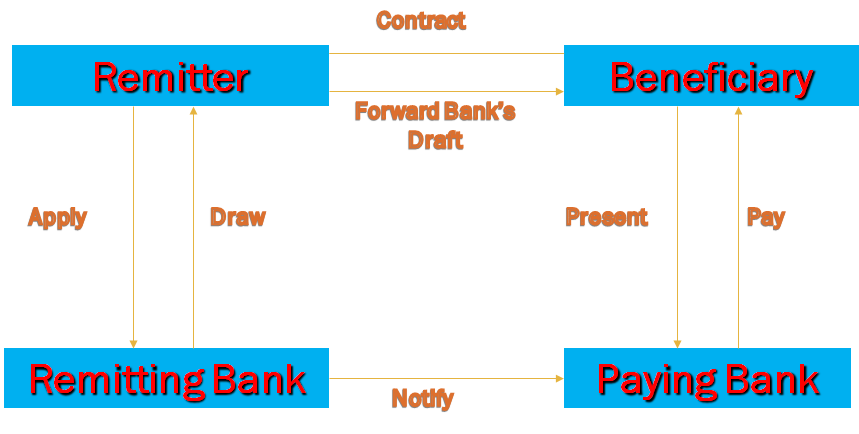

DemandDraft (D/D) flexible payment

The Process of Remittance –M/T orT/T

The Process of Remittance – D/D

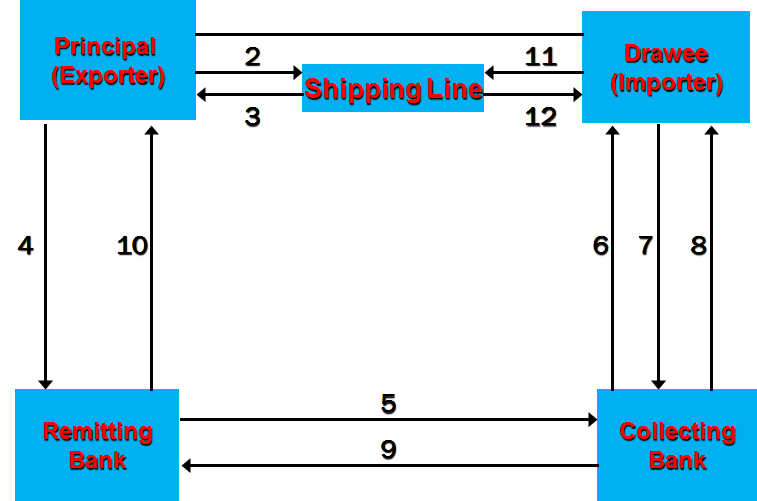

5 Collection

Adverseexchange (reverse remittance, to draw): the exporter takes the initiative togather the payment from the buyer.

Clean Collection

Documentary Collection

Documentary Collection is ameans of ensuring that goods (title documents) are handed over to the buyer (by a bank) only when the amount shown on a bill of exchange is paid or when thecustomer accepts the bill as a contract to pay by a specific date.

Four Parties

Principal

Remitting Bank

Collection Bank

Drawee

D/P Sight

“Upon first presentation the Buyersshall pay against documentary draft drawn by the Sellers at sight. The shippingdocuments are to be delivered against payment only.”

D/P after Sight

“The Buyers shall duly accept thedocumentary draft drawn by the Sellers at ××days sight upon first presentationand make payment on its maturity. The shipping documents are to bedelivered against payment only.

the flow chart of D/P (Documents against Payment)

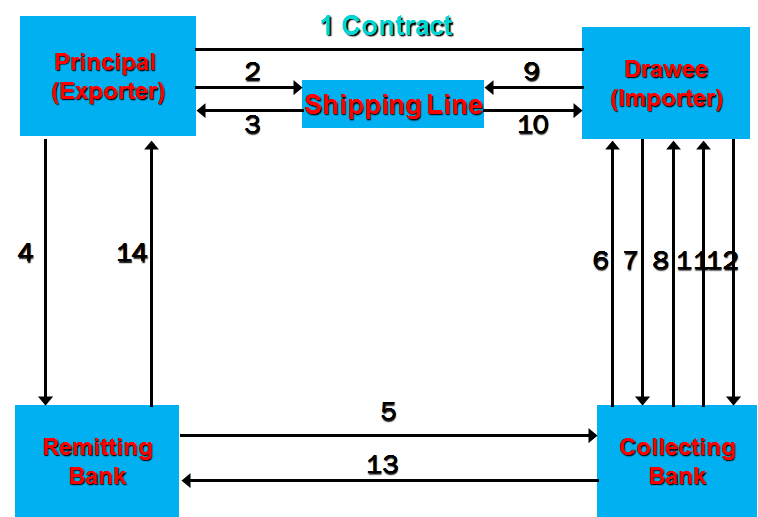

Sample Clause of D/A

The Buyers shall duly accept thedocumentary draft drawn by the Sellers at 45 days sight upon first presentationand make payment on its maturity.

2. The Buyers shall duly accept thedocumentary draft drawn by the Sellers upon presentation and make payment at 30days after date of B/L (draft). The shipping documents are to be deliveredagainst acceptance.

3. Payment by draft payable 120 daysafter cargo arrival, documents against acceptance.

the flow chart ofD/A (Documents against Acceptance)

Comparison of D/P and D/A

Similarities:

Collection,Commercial Credit, Adverse Exchange

Differences:

| Terms of Payment | Terms of Documents Releasing | time of Payment | Risks of Collection |

| D/P | payment | usance or sight | partial loss of income |

| D/A | acceptance | usance | loss of commodity and payment |