Cargo transport modes and cargo insurance:

(1) Ocean Transport Cargo Insurance 海运险

(2) Cargo Insurance under Other Transport Modes 其他运输保险

• Overland Transportation Cargo Insurance

• International Air Freight Cargo Insurance

• Postal Parcel Transportation Insurance

陆路、空运、国际包裹

10.2.1 Ocean Transport Cargo Insurance

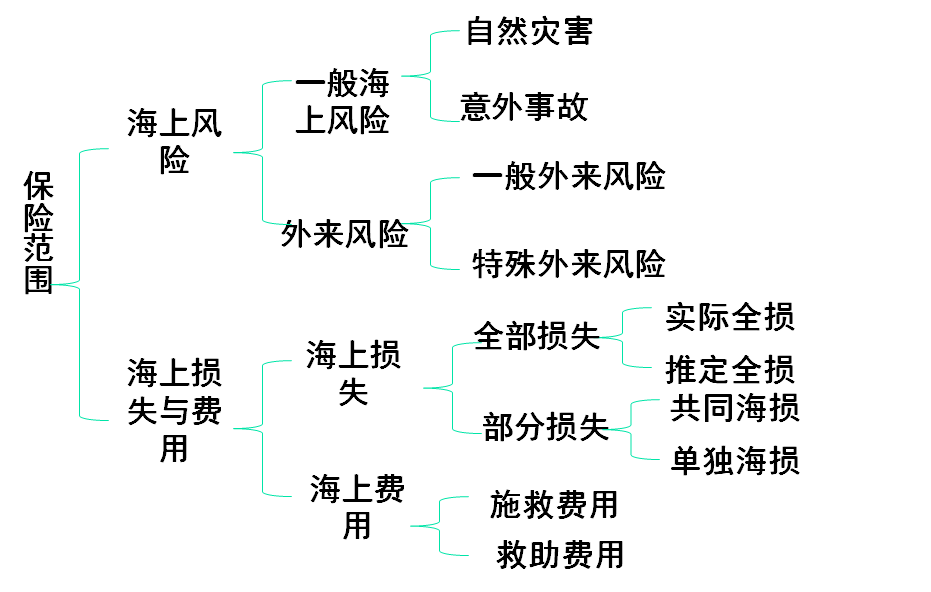

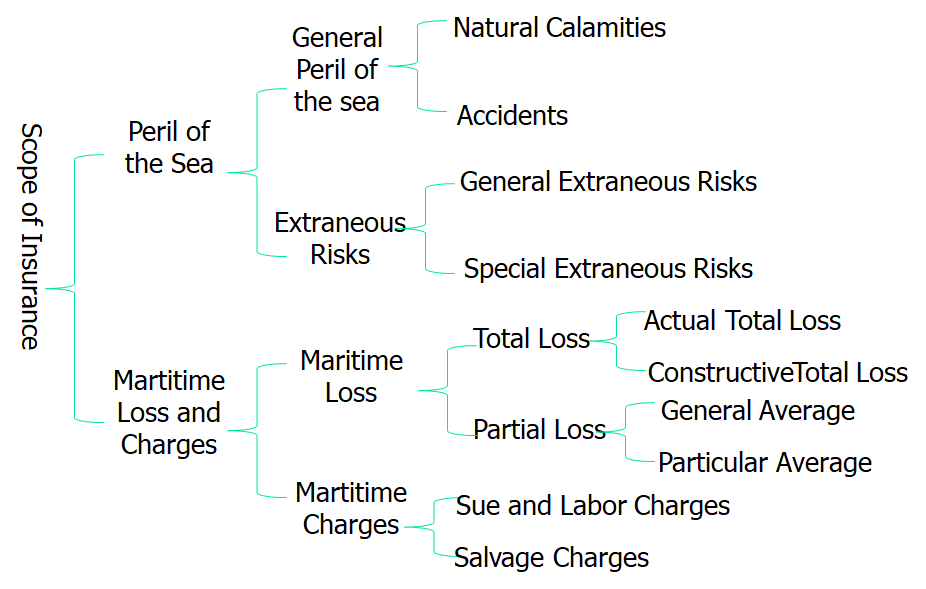

(1) Scope of Ocean Transport Cargo Insurance Coverage 海洋运输险的保险范围

(2) Insurance Covers in Ocean Transport Cargo 海洋运输险的险种

(1) Peril of the sea and Maritime Loss and Charges

(1) Peril of the Sea 海上风险

includes general perils and extraneous risks

• General perils of the sea, including natural calamities and accidents. 一般海上风险

• Natural Calamities are disasters as a result of natural changes. 自然灾害

• Accidents are the result of unforeseeable factors or force majeure. 意外事故

• Extraneous Risks, caused by reasons other than perils of the sea 外来风险

General extraneous risks are risks due to theft, rain, leakage, shortages, breakage, dampness, mildewing, heating, taint of odor, hooking and rusting. 一般外来风险

Special extraneous risks are risks such as war, hostilities, strikes, rejection of import or confiscation of goods, etc. 特殊外来风险

海上风险包括一般海上风险和外来风险

• 一般海上风险包括自然灾害和意外事故。

• 外来风险(Extraneous Risks),是指海上风险以外的其他外来原因所造成的风险,可分为一般外来风险和特殊外来风险。

(2) 海上损失与费用

• 海上损失:是指被保险的货物在运输过程中,由于发生海上风险导致保险标的直接或间接的损失。

• 海上费用:是指船只遭遇风险时为对被保险货物进行施救而产生的费用,包括施救费用和救助费用

(2) Maritime Loss and Charges 海上损失和费用

• Maritime loss: direct or indirect loss of insured cargo caused by perils of sea during the shipment. 海上损失

• Maritime Charges: expenses incurred for the rescue of the insured cargo when the ship meets risks, which include sue and labor charges and salvage charges. 海上费用

Maritime loss, including total loss and partial loss.

a. Total loss includes actual total loss and constructive total loss. 全部损失

b. Partial loss refers to partial loss of or damage to the object of insurance, which includes General Average (G.A.) and Particular Average. 部分损失

(2) 海上损失与费用

海上损失包括全损和部分损失.

a. 全损包括实际全损(actual total loss)和推定全损(constructive total loss).

b. 部分损失(Partial Loss),是指保险标的一部分毁损或灭失,部分损失可以分为共同海损(General Average (G.A.))和单独海损(Particular Average)。

Total loss includes actual total loss and constructive total loss.

Actual total loss means the insured goods are totally damaged, or have been lost or found valueless upon arrival. 实际全损

Constructive total loss occurs when the actual loss of the insured goods is unavoidable, or when the ship or the consignment has to be abandoned. 推定全损

全部损失(Total Loss),又称全损,全部损失分为实际全损和推定全损。

• 实际全损(Actual Total Loss),是指保险标的全部损坏或丢失,或到岸后已毫无价值。

• 推定全损(Constructive Total Loss),是指被保险的货物的实际全损已经不可避免,或者恢复、修复受损货物以及运送货物到原定目的地所花费的费用超过该货物运往目的地的货物价值。

Partial loss includes General Average (G.A.) and Particular Average. 部分损失包括共同海损和单独海损

General Average is the partial loss resulting from a deliberate act of the ship’s master. In this case, all beneficial parties will share the loss of the specific consignor. 共同海损

部分损失(Partial Loss),可以分为共同海损和单独海损。

共同海损(General Average,简称G.A.)是由于船主的故意行为而造成的部分海损,如将全部或部分货物抛入大海以挽救船只。在此情况下,所有因此受益的货主将共同承担特定发货人的损失。

The following premises have to be met to make it a G.A.:

• the vessel is indeed in calamity, which endangers the safety of the vessel and the cargo.

• G.A. sacrifice has to be caused by voluntary and conscious action of human being, rather than accidental loss due to perils of the sea.

• the sacrifice and expenses made in G.A. must be reasonable.

• the purpose of G.A. sacrifice and expenses caused is only to protect the safety of ship and cargo.

• loss must be directly resulted from General Average actions.

共同海损的成立,一般应具备以下几个条件:

第一,载货船舶必须确实遭遇危及货、船等共同安全的风险,载货船舶处在危难之中。

第二,共同海损牺牲必须是自愿的和有意识的行动所造成的。

第三,共同海损牺牲和费用的支出必须是合理的

第四,共同海损牺牲和费用支出的目的仅限于为保船、货等各方面的共同安全。

第五,损失必须是共同海损行为的直接结果。

Particular Average is the partial loss suffered by the party whose consignment is partially lost or damaged.单独海损

When the loss or damage occurs, no cargo of other parties has to be sacrificed to save the voyage.

部分损失(Partial Loss),可以分为共同海损和单独海损。

单独海损(Particular Average),是指被保险货物受损后,尚未达到全损程度,仅为部分损失,而这种部分损失不属于共同海损,由各受损者单独负担损失。例如,载货船舶在航行中遇到狂风巨浪,海水入舱造成部分货物受损。

Maritime Charges: expenses incurred for the rescue of the insured cargo when the ship meets risks, which include sue and labor charges and salvage charges. 海上费用包括施救费用和救助费用

Maritime Charges include sue and labor charges and salvage charges.

Sue and labor charges is the expenses paid to prevent loss expansion when the insured, the agent or employee tries to rescue insured cargo in the event of insurance covered natural calamities and accidents.施救费用

Salvage charges is the remuneration or reward payable by the saved party to savers who voluntarily and independently of contract render services to successfully rescue or save property at sea. 救助费用

海上费用(Maritime Charges),是指船只遭遇风险时为对被保险货物进行施救而产生的费用,包括施救费用和救助费用。

施救费用(Sue and Labor Charges),又称单独海损费用,是指当被保险货物遭受保险责任范围内的自然灾害和意外事故时,被保险人或其代理人或其受雇人等为抢救被保险货物,防止损失继续扩大所支付的费用。保险人对这种施救费用负责赔偿。

救助费用(Salvage Charges),是指被保险货物遭受承保范围内的灾害事故时,除保险人和被保险人以外的无契约关系的第三者采取救助措施,获救成功,依据国际上的法律,被救方应向救助的第三者支付的报酬。

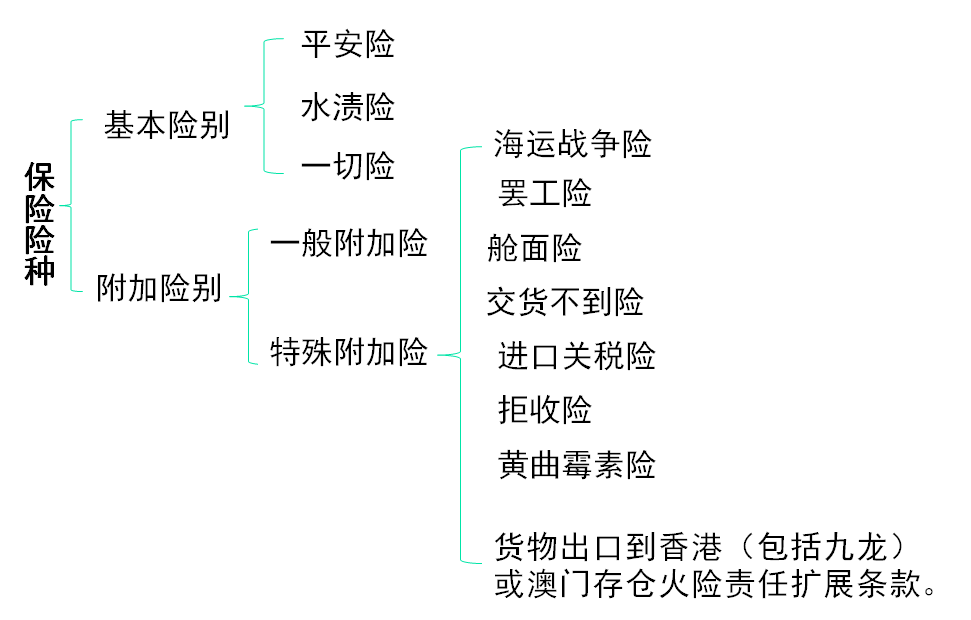

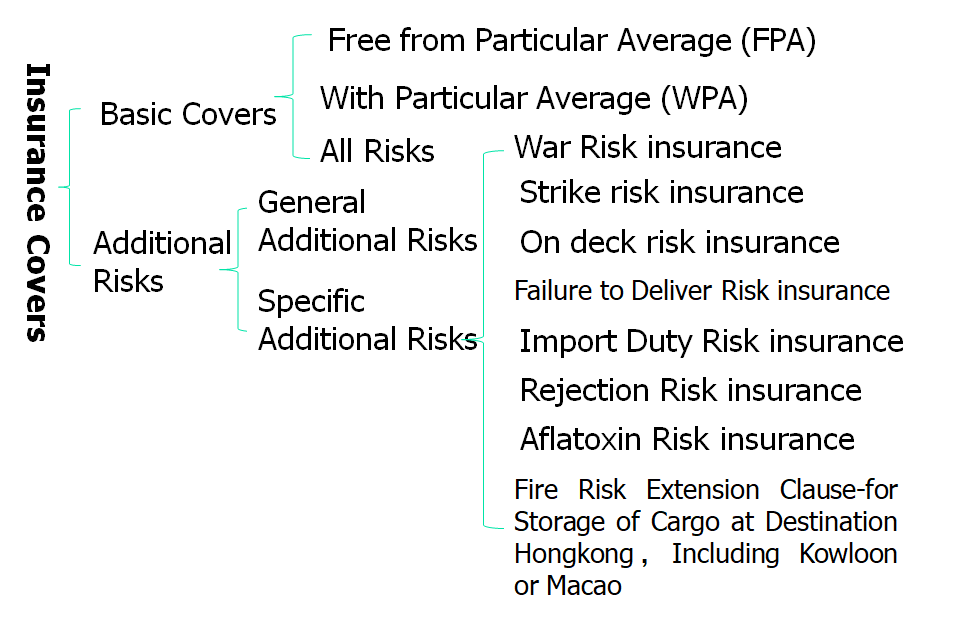

• Insurance covers define the obligation of the insurer to bear risks and loss.

• It is the basis on which the insurer and the insured perform their duties and calculate premium.

• the marine cargo insurance include basic covers and additional risks.

保险险别是保险人对风险和损失的承保责任范围,它是履行权利与义务的基础,也是缴付保险费多少的依据。分为基本险别和附加险别两大类。

(1) Basic Covers 基本险别

Basic covers are one that can be independently arranged, instead of being attached to other insurance covers. 基本险,又称主险,是可以独立投保,不必依附于其他险别项下的险别。

(2) Additional Risks 附加险别

Different from basic covers, additional coverage cannot be applied for independently, but has to be attached to at least one of the basic covers. 附加险别是对基本险别的补充和扩大。附加险不能单独投保,只能在投保一种基本险的基础上才能加保一种或数种附加险。

(1) Basic Covers include:

① Free from Particular Average (FPA)

This insurance covers the following loss except particular average loss:

• Total or Constructive Total Loss of the whole consignment hereby insured caused in the course of transit by natural calamities 自然灾害造成

• Total or Partial Loss caused by accidents to the carrying conveyance 意外事故造成

• Partial loss of the insured goods attributable to heavy weather, lightning and/or tsunami 意外事故前后又遭受自然灾害

• Partial or total loss consequent on falling of entire package or packages into sea during loading, transshipment or discharge. 装卸和转运过程中

• Reasonable cost incurred by the insured on salvaging the goods or averting or minimizing a loss recoverable under the Policy 施救费用

• Losses attributable to discharge of the insured goods at a port of distress following a sea peril as well as special charges arising from loading, warehousing and forwarding of the goods. 共同海险分担

• Sacrifice in and Contribution to General Average and Salvage Charges. 牺牲分担施救费用

• The loss of the ship owners is to be reimbursed by the Cargo Owner under the Contract of Affreightment Both to Blame Collision Clause. “船舶互撞条款”

(1) 基本险:

① 平安险(FPA)的保险范围包括:

被保险货物在运输途中由于恶劣气候、雷电、海啸、地震、洪水等自然灾害造成整批货物的全部损失或推定全损。

由于运输工具遭受搁浅、触礁、沉没、互撞、与流冰或其他物体碰撞以及失火、爆炸意外事故造成货物的全部或部分损失。

在运输工具已经发生搁浅、触礁、沉没、焚毁意外事故的情况下,货物在此前后又在海上遭受恶劣气候、雷电、海啸等自然灾害所造成的部分损失。

在装卸或转运时由于一件或数件货物落海造成的全部损失或部分损失。

① 平安险(FPA)的保险范围包括:

被保险人对遭受承保责任内危险的货物采取抢救、防止或减少货损的措施而支付的合理费用,但以不超过该批被救货物的保险金为限。

运输工具遭遇自然灾害或者意外事故,在中途港或者在避难港停靠,因此而引起的卸货、装货、存仓以及运送货物所产生的特别费用。

共同海损的牺牲、分摊和救助费用。

运输契约订有“船舶互撞条款”,根据该条款规定由货方偿还船方的损失。

② With Particular Average (WA/WPA) 水渍险

WPA covers wider risk than FPA, including particular average loss. 保险范围更广

This insurance also covers partial losses of the insured goods caused by heavy weather, lightning, tsunami, earthquake and/or flood. 包括自然灾害造成的损失

③ All Risks 一切险

This insurance covers most widely in these three basic covers. 范围最广

This insurance also covers all risks of loss of or damage to the insured goods, whether partial or total, arising from external causes in the course of transit. 一切外来原因

② 水渍险

水渍险的责任范围比平安险大, 包括单独海损。根据现行条款的规定,水渍险除承保平安险的全部责任外,还承保被保险货物由于恶劣气候、雷电、海啸、地震、洪水自然灾害所造成的部分损失。

③ 一切险

一切险是三个基本险中责任范围最大的险种,英文名称是“All Risks”。一切险除包括平安险和水渍险的各项责任外,还包括货物在运输途中由于一般外来原因所致的全部或部分损失。

(2) Additional Risk 附加险别

① General Additional Risks Coverage. It covers losses caused by general extraneous risks 一般附加险

② Special Additional Risks Coverage. Special Additional Risks Coverage deals with risks related to national administrative measure, regulations, and trade conventions, which is excluded from basic covers and is gained by additional insurance. 特殊附加险

附加险别是对基本险别的补充和扩大。附加险不能单独投保,只能在投保一种基本险的基础上才能加保一种或数种附加险,它投保的是外来风险引起的损失。按承保风险的不同,附加险又可分为一般附加险和特殊附加险。

① 一般附加险

一般附加险是承保由于一般外来风险所造成的损失,一般附加险有以下11种:偷窃提货不着险;淡水雨淋险;短量险;混杂、沾污险;渗漏险;碰损、破碎险;串味险;受潮受热险;钩损险;包装破裂险;锈损险。

由于一般附加险已包含在一切险的责任范围内,所以,如果已投保了一切险,就不需要再加保一般附加险。

(2) Additional Risk

② Special Additional Risks Coverage.

• War Risk insurance. 战争

• Strike risk insurance. 罢工

• On deck risk insurance. 仓面

• Failure to Deliver Risk insurance. 交货不到

• Import Duty Risk insurance. 进口关税

• Rejection Risk insurance. 拒收

• Aflatoxin Risk insurance. 黄曲霉素

• Fire Risk Extension Clause-for Storage of Cargo at Destination Hongkong, Including Kowloon or Macao.

② 特殊附加险

特别附加险所承保的风险大多与国家的行政措施、政策法令、航海贸易习惯有关,它并不包括在基本险中,必须另行加保才能获得保障。中国人民保险公司承保的特殊附加险有以下八种:海运战争险,罢工险,交货不到险,舱面险,进口关税险,拒收险,黄曲霉素险,货物出口到香港(包括九龙)或澳门存仓火险责任扩展条款。

(3) Modification to the Clauses of Basic Insurance Coverage 基本险别条款修改

International cargo insurance began adopting new insurance clauses since 1980’s. The original three basic coverages (i.e. FPA, WPA and All Risks) have been replaced by ICC (C), ICC (B), and ICC (A). The obligation scope involved has been modified as well, becoming more clear and explicit.

(3) Modification to the Clauses of Basic Insurance Coverage

1) ICC (A)

ICC (A) is basically the same to All Risks, except it regulates Clauses of Exclusions, meaning that the insurance doesn’t cover situation of unseaworthiness or uncargoworthiness, war, or strike. 与原来的一切险基本相同

(3) Modification to the Clauses of Basic Insurance Coverage

2) ICC (B)

It covers the total or partial losses caused by listed natural calamities and accidents, general average sacrifice, cargo being thrown or engulfed into sea, and pouring of water into vessel, lighter, shipping conveyance, container, large sea-chest, or storage places. 只承担自然灾害和意外事故

(3) Modification to the Clauses of Basic Insurance Coverage

3) ICC(C)

It only covers the loss caused by accidents (including total loss and partial loss),throwing goods overboard and general average sacrifice. 只承担意外事故

10.2.2 The Cargo Insurance under Other Transport Mode

(1) Overland Transportation Cargo Insurance 陆运险

1) Overland Transportation Risks 陆运险

① Total or partial loss of or damage to the insured goods caused in the course of transportation 自然灾害

② Reasonable cost incurred by the insured in salving the goods or averting or minimizing a loss recoverable. 抢救措施

2) Overland Transportation All Risks 陆运一切险

This insurance also covers all risks of loss of the insured goods, whether partial or total, arising from external causes in the course of transit. 外来原因保险

3) Overland Transportation Cargo War Risks

(2) International Air Freight Cargo Insurance 空运险

1) Air Transportation Risks 航空险

① Total or partial loss of the insured goods.

② Reasonable cost incurred by the insured in salving the goods or averting or minimizing a loss recoverable.

2) Air Transportation All Risks 航空一切险

It covers all risks of loss of or damage to the insured goods, whether partial or total, arising from external causes in the course of transit.

3) Air Transportation Cargo War Risks

(3) Postal Parcel Transportation Insurance

1) Parcel Post Risks 邮包险

• Natural calamities

• Grounding, stranding, sinking, collision, overturning, derailing, crashing or missing of the carrying conveyance

• Fire or explosion

• Reasonable cost incurred by the insured in salvaging the insured parcel or averting or minimizing a loss recoverable.

2) Parcel Post All Risks 邮包一切险

Parcel Post All Risks shall also indemnify total or partial loss of the insured parcel arising from external causes in the course of transit.

3) Parcel Post War Risks 邮包战争险