第一节 我国海上运输货物保险基本险

保险人承保货物在运输途中因海上自然灾害、意外事故或外来原因而导致的损失负补偿责任。保险条款包括:

一、平安险(Free from Particular Average)

平安险的责任范围:

1. Total or Constructive Total Loss caused by natural calamities-heavy weather, lightning, tsunami, earthquake and flood.

2. Total or Partial Loss caused by accidents -grounded, stranded, sunk or in collision with floating ice or other objects as fire or explosion.

3. Partial loss of the insured goods attributable to heavy weather, lightning and/or tsunami, where the conveyance has been grounded, stranded, sunk or burnt, irrespective of whether the event or events took place before or after such accidents.

4. Partial or total loss consequent on falling of entire package or packages into sea during loading, transshipment or discharge.

5. Reasonable cost incurred by the Insured in salvaging the goods or averting or minimizing a loss recoverable under the Policy, provided that such cost shall not exceed the sum Insured of the consignment so saved.

6. Losses attributable to discharge of the insured goods at a port of distress following a sea peril as well as special charges arising from loading, warehousing and forwarding of the goods at an intermediate port of call or refuge.

7. Sacrifice in and Contribution to General Average and Salvage Charges.

8. Such proportion of losses sustained by the ship-owners to be reimbursed by the Cargo Owner under the Contract of Affreightment "Both to Blame Collision" clause.

二、水渍险(With Particular Average)

水渍险的英文简称是W.A或W.P.A,英文原意是“负责单独海损的赔偿”。

Aside from the risks covered under F.P.A. Condition as above, this insurance also covers partial losses of the insured goods caused by natural calamities, such as heavy weather, lightning, tsunami, earthquake and/or flood.

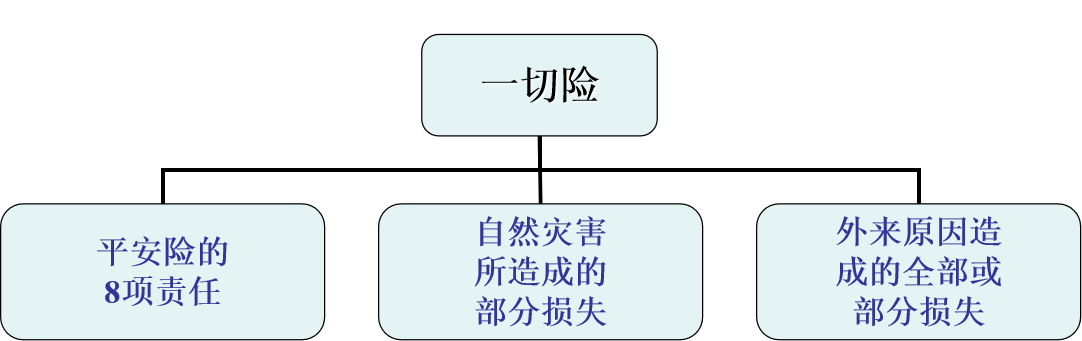

三、一切险(All Risks)

Aside from the risks covered under the F.P.A and W.A. Conditions as above, this insurance also covers all risks of loss of or damage to the insured goods whither partial or total, arising from external causes in the course of transit.)

一切险中的“外来原因” 一般附加险中的11种。

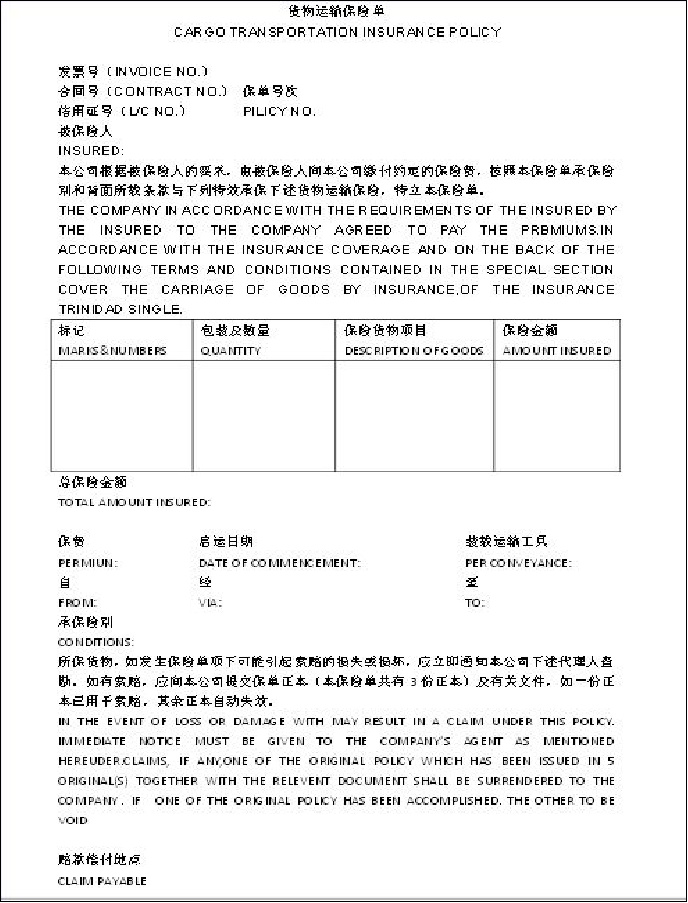

附:保险单(如图)

四、基本险除外责任(Risks Excluded)

除外责任是指保险人不承担的责任。

1. Loss or damage caused by the intentional act or fault of the Insured.

2. Loss or damage falling under the liability of the consignor.

3. Loss or damage arising from the inferior quality or shortage of the insured goods prior to the attachment of this insurance.

4. Loss or damage arising from normal loss, inherent vice or nature of the insured goods, loss of market and/or delay in transit and any expenses arising therefrom.

5.Risks and liabilities covered and excluded by the Ocean Marine Cargo War Risks Clauses and Strike, Riot and Civil Commotion Clauses of this company.

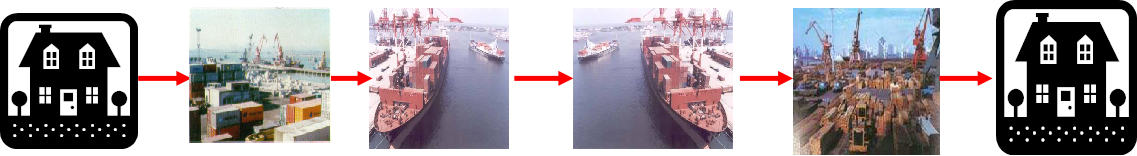

五、我国海上运输货物保险期限(Duration of Marine Cargo Insurance)

(一)正常运输情况下保险责任的起讫

保险期限均采用“仓至仓条款”(Warehouse to Warehouse Clause,简称W/W)。从货物运离保险单所载明起运港发货人的仓库时开始,一直到货物运抵保险单所载明的目的港收货人的仓库时为止。如下图:

1. CIF价格条件仓至仓,如图:

2. FOB价格条件船至仓,卖方投保陆运险。如图:

3. CFR价格条件船至仓,卖方投保陆运险。如图:

(二)非正常运输情况下保险责任的起讫

货物无法运往原定卸载港而在途中被迫卸货、重装或转运等。

1. 货物在非目的地出售,保险责任终止。被保险货物在卸载港全部卸离海轮满60天止。

2. 货物在上述60天期限内继续运往原目的地,保险责任按正常“仓至仓”条款。

Case study

国内某公司向银行申请开立信用证,以CIF条件向法国采购奶酪3公吨,价值3万美元,提单已经收到,但货轮到达目的港后却无货可提。经查,该轮在航行中因遇暴风雨袭击,奶酪被水浸泡,船方将其弃于海中。请问:被保险人在上述三种险中的哪一种能够进行索赔?

[案例分析]

如果法国方面保的是一切险,那可以向保险公司索赔。如果保的只是平安险或水渍险,保险公司可以拒赔。