-

1 例题

-

2 自测题

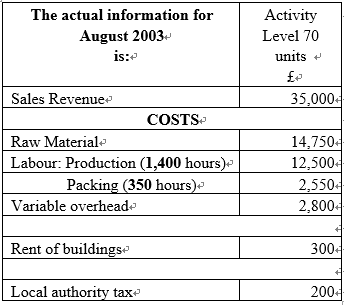

Davidson Limited

Davidson Limited produces trampolines. You are required to produce budgets for 3 activity levels as follows, for the month of August: 50 units, 70 units and 90units.

1. You are asked to produce budgets for the 3 activity levels in August 2003 identifying profit at each level of activity.

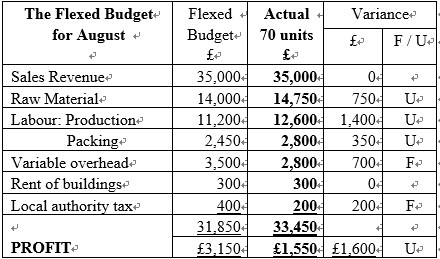

2 Prepare a comparison between the budgeted figures and actual figures at the relevant activity level.

3 As the Accountant, you are required to prepare a report for the Managing Director highlighting:

a. All variances that have occurred during August.

b. Recommendations for corrective action.

4 Draft a report to your colleagues, the Purchasing Manager and Production Manager, indicating actions they could take to ensure budget targets are met.

Answer

Q1

Q2

Q3-a

Direct material total variance = 70*200 -14750 = £750 U

Direct material quantity variance = 200 * (70-70)=0

Direct material price variance = 70* 200-14750 =£ 750 U

Production department

Direct labor total variance =(20*70) *8 -12600= =£1400U

Direct labor rate variance = £1400U

Direct labor efficiency variance = 0

Packing department

Direct labor total variance =(5*70) *7 -2800= =£350U

Direct labor rate variance = £350U

Direct labor efficiency variance = 0

Total overheads variance = 700+200 = £900 U

Q3-b Recommendations:

1. Attempt to source material at a cheaper price.

2. Investigate the use of lower grade /cheaper material

3. Investigate the use of lower grade /cheaper labour.

4. Investigate assumptions made in calculating overhead absorption rate of £60 pu.

Q4. Report

Colleagues

Sales activity and revenue were on target. However, August proved a very tough month for the control of costs. Consequently Profit was 53% below budget at £1,550. These disappointing figures require immediate attention.

It is vital that our colleagues in the Purchasing Department identify the rise inmaterial costs of over £10 per unit. We should investigate whether it is possible to:

· Source an alternative supplier offering the current grade at a lower price

· Identify if it would be possible to use a lower grade of material at a cheaper price, without compromising the quality of our product too severely

· Establish if it would be beneficial to negotiate a bulk order with the prospect of obtaining the material at a cheaper unit cost.

We have established that the number of hours it took to make the 70 units was exactly as budgeted. Even so our labour costs were much higher than anticipated. In total, labour costs were £1,750 above budget, an enormous 13%extra! It is likely that this increase in cost may have been caused by:

· Increase in the hourly rates

· Payment of a bonuses

· Overtime payments

Whatever the cause of the labour variances, we need to identify:

· Whether it would be possible to use alower grade of labour at a cheaper rate, without compromising the quality of our product, too severely?

· How to incorporate the rise in rates into future budgets

· How to obtain efficiency savings, working fewer hours to produce more units, without increasing rates.

Overheads require close scrutiny, as well. Our Accounting Department are, at present,trying to identify the principal causes for the favourable variances. One likely reason is that the anticipated increase in local authority taxes has not yet occurred.

To ensure we achieve the targets we have set, it is imperative that measures are taken promptly to prevent a recurrence.