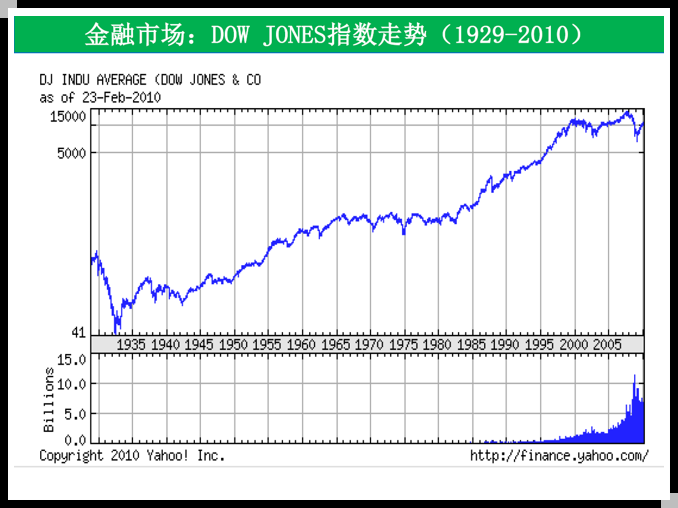

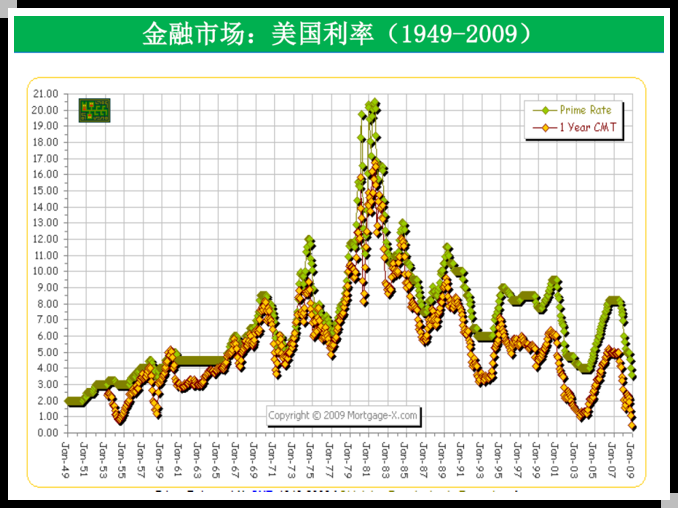

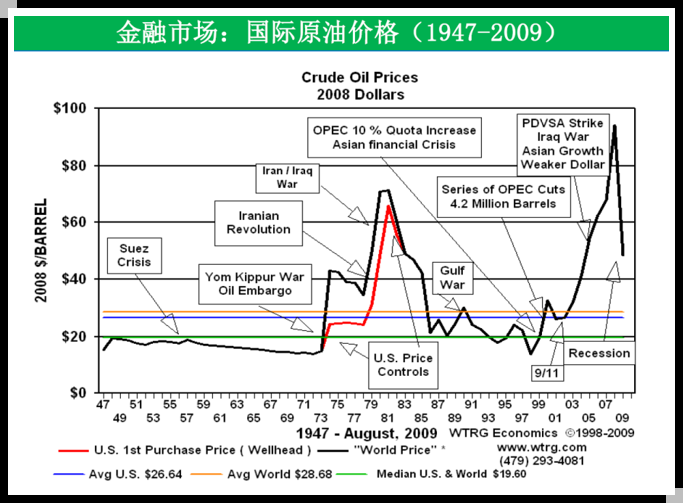

金融市场

金融市场

股票市场的价格指数

股票市场的价格指数

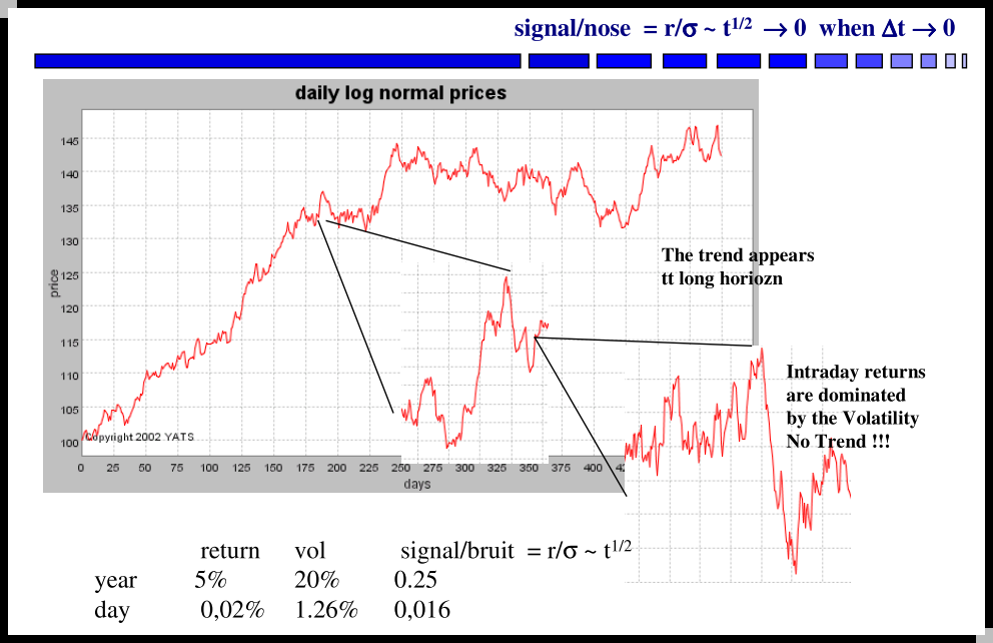

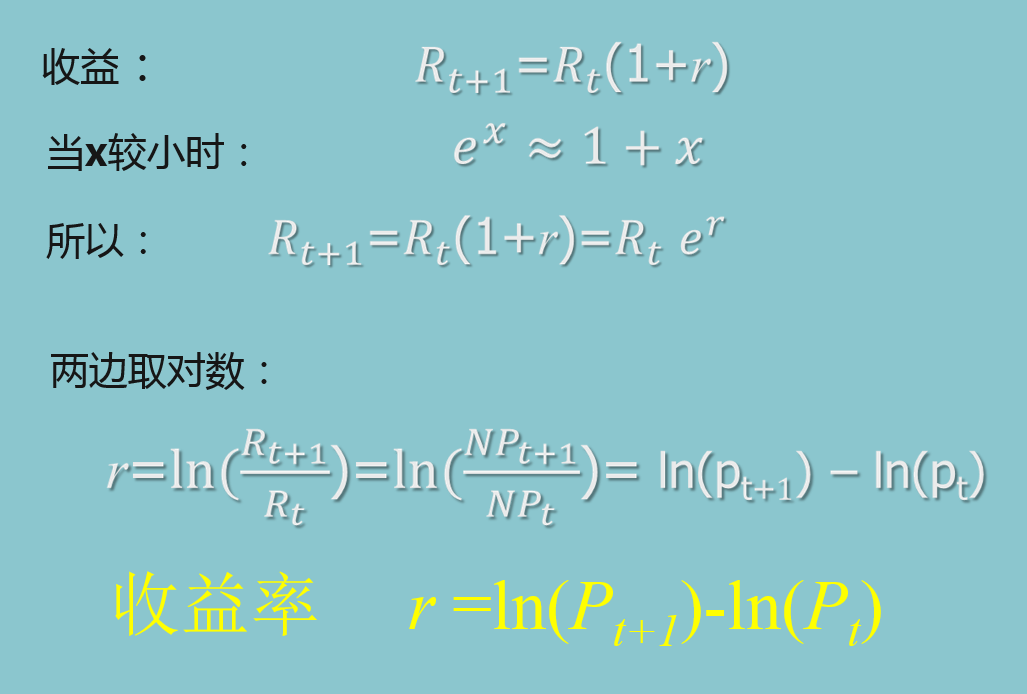

收益率

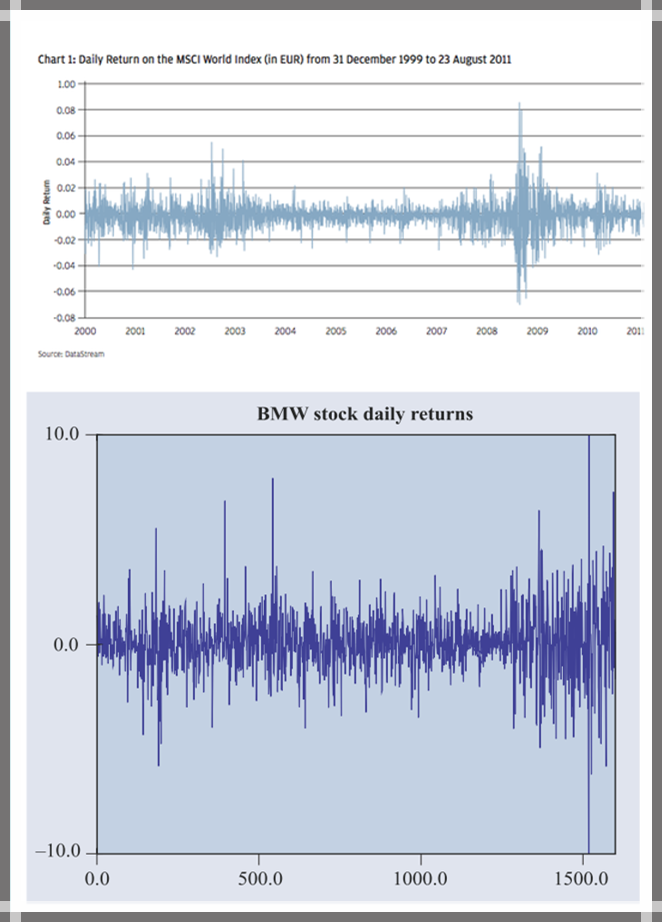

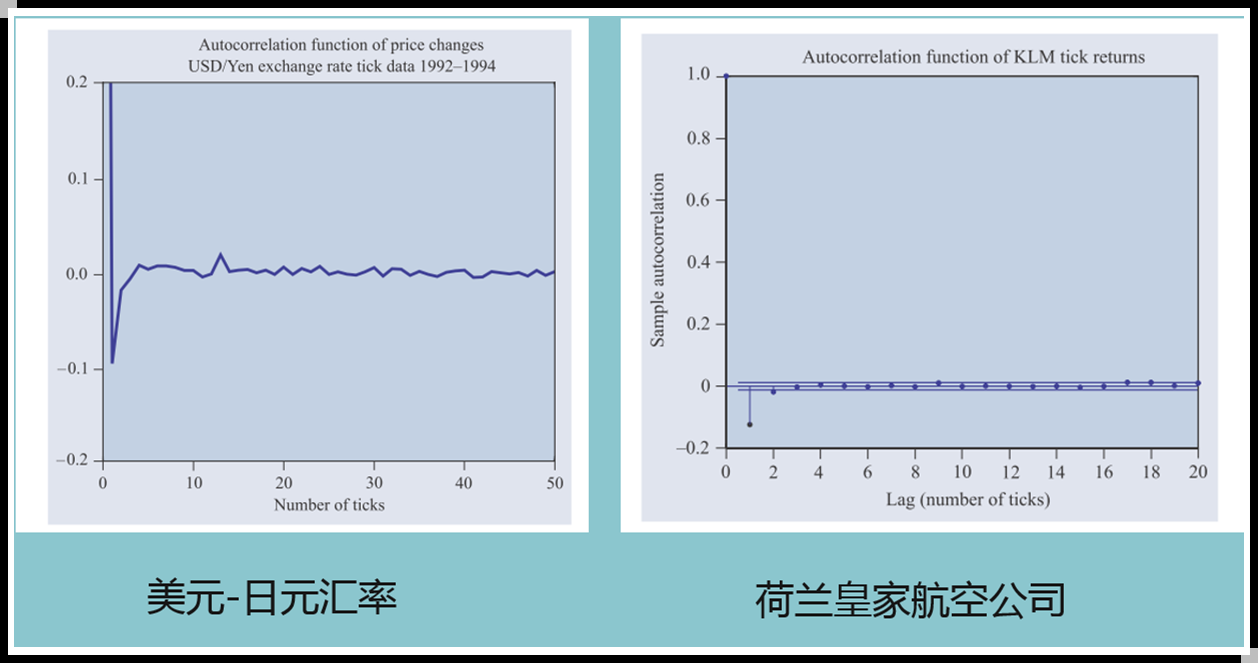

摩根斯坦利资本国际世界指数

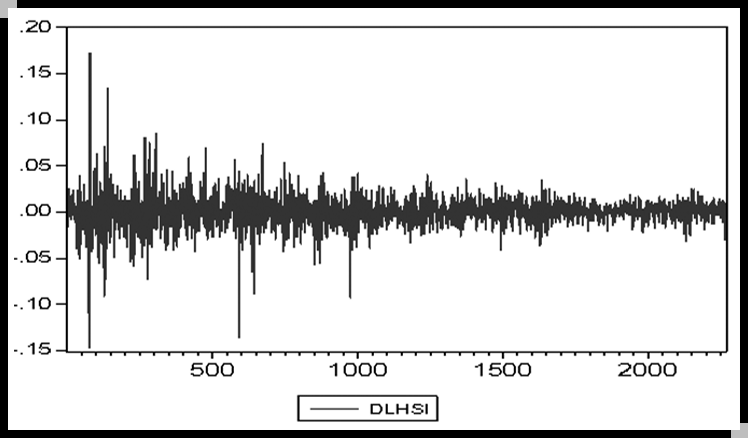

恒生期货现货收益率

金融市场的典型事实

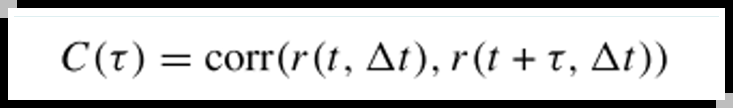

(linear) autocorrelations of asset returns are often insignificant, except for very small intraday time scales ( 20 minutes) for which microstructure effects come into play.

时间序列的自相关是指时间序列的前后数据之间存在着相互的影响。如果证券价格的变动对其后价格变动有某种影响,那么在价格变动的时间序列上就表现出某种自相关关系。

收益率不存在自相关性

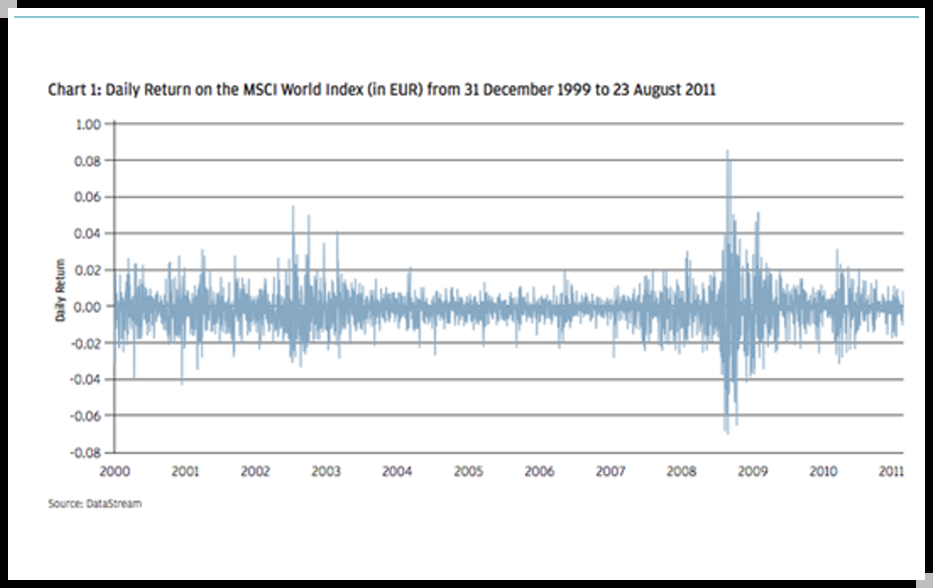

different measures of volatility display a positive autocorrelation over several days, which quantifies the fact that high-volatility events tend to cluster in time.

Slow decay of autocorrelation in absolute returns: the autocorrelation function of absolute returns decays slowly as a function of the time lag, roughly as a power law with an exponentβ∈[0.2-0.4]. This is sometimes interpreted as a sign of long-range dependence.

以收益率的绝对值为例:金融资产价格的变化往往是大的波动后跟随大的波动,小的波动后跟随小的波动,也就是它的波动具有正相关性

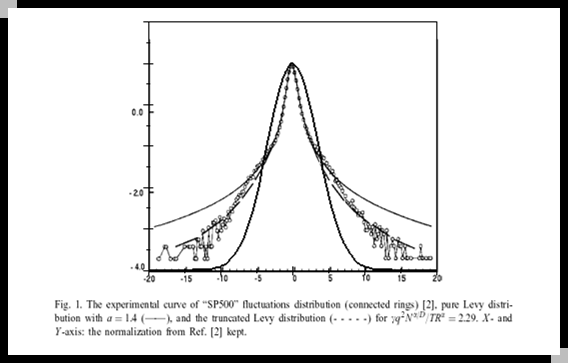

he (unconditional) distribution of returns seems to display a power-law or Pareto-like tail。

尖峰胖尾分布

one observes large drawdowns in stock prices and stock index values but not equally large upward movements .

most measures of volatility of an asset are negatively correlated with the returns of that asset.

trading volume is correlated with all measures of volatility.

我们如何认识与理解金融市场?